Email Offer to Increase Credit Limit from Citi without Hard Pull

I received an interesting email offer to increase my credit limit on a Citi card, and the part that was interesting is that there would be no hard pull / inquiry on my credit report. That’s what drew me in, so here’s the offer I got. Maybe you can find the same in your email.

The Email

The subject of the email was:

Please read: Ryan, we kindly encourage you to view this credit limit information…

And this was for my Citi Double Cash Card.

The email body mentioned that I could “request”, which I found a bit odd. I was targeted, but I still had to take action and could be rejected. The deadline in the email says May 5, 2022.

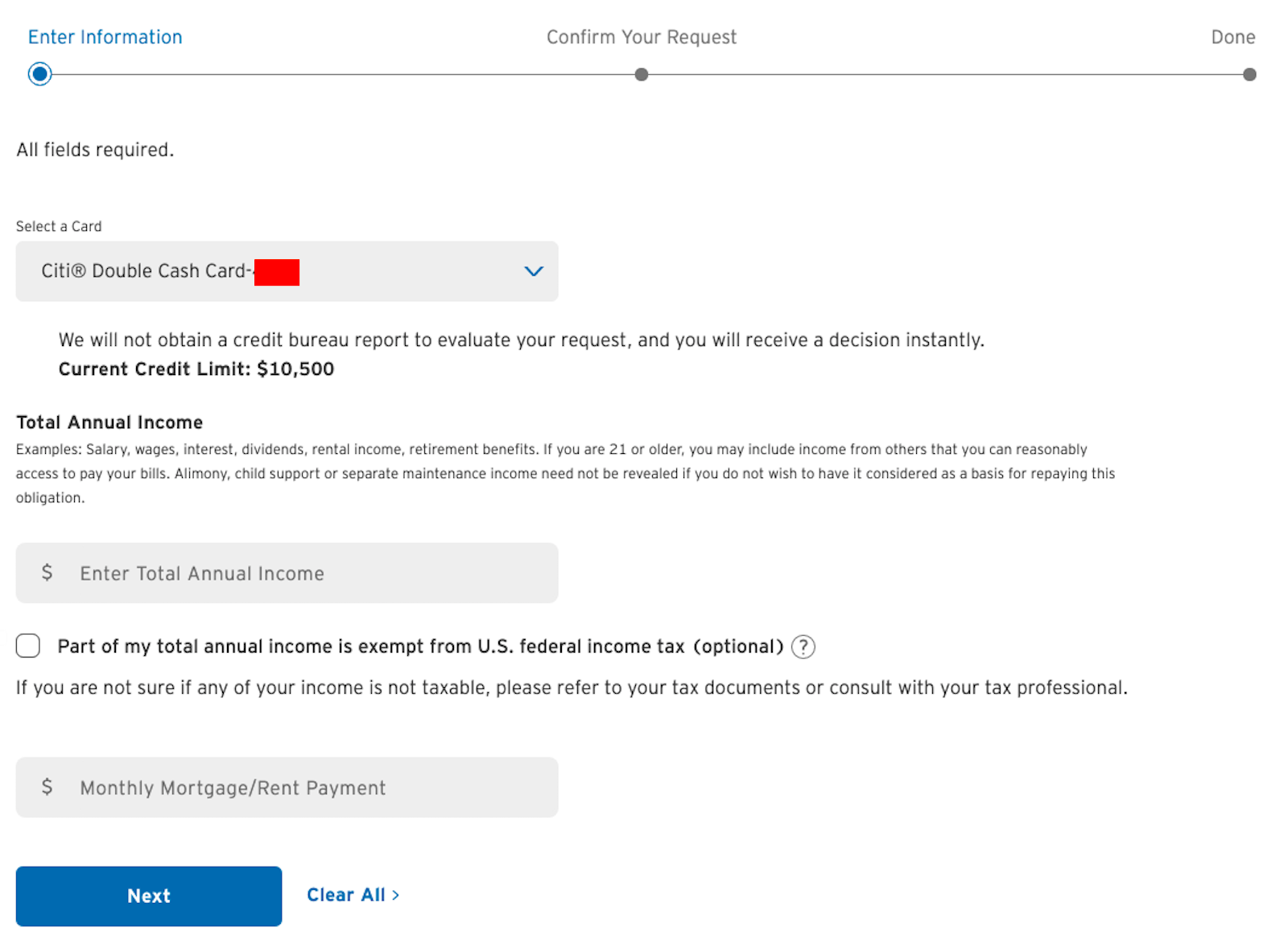

The link in the email (here) took me to this page.

I filled out my income and rent information, went to a “check your info, then submit” type of page.

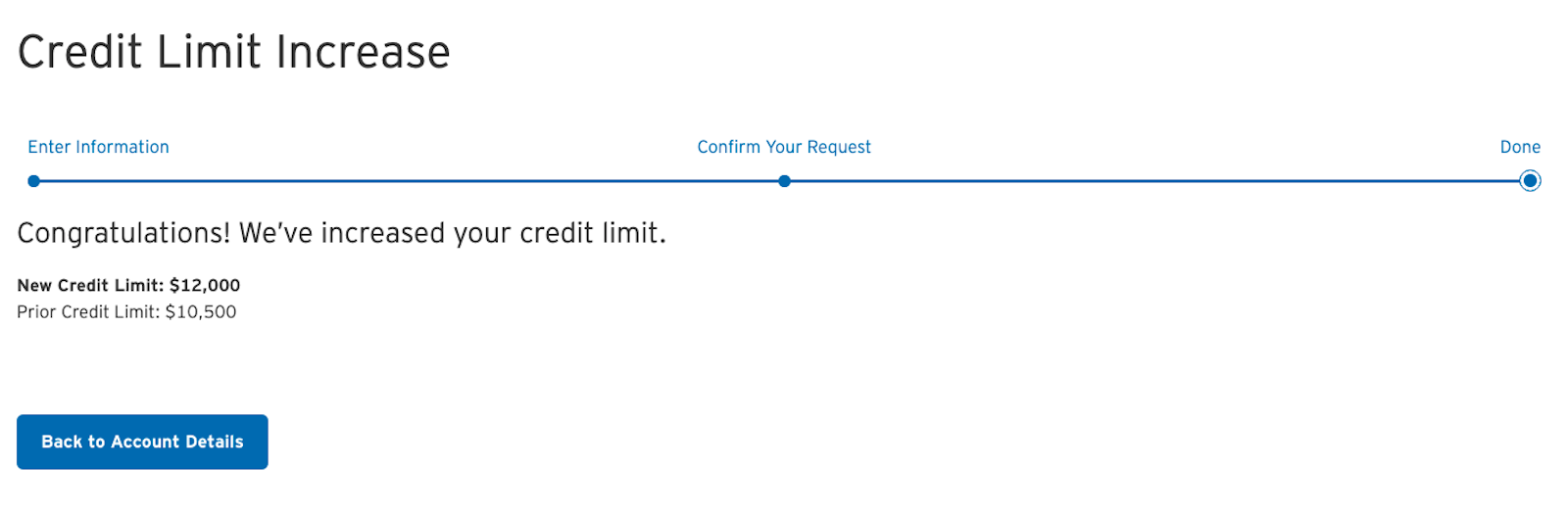

In the end, my application was approved. I got an increase of $1,500 on my Double Cash Card — not much, but it could help boost my credit score a few points.

RELATED: How Your Credit Score is Calculated

What Makes This Offer Unique

Typically, Citi will pull your credit report when requesting a credit limit increase. They’ve gotten better about telling you in advance whether they’re going to do a hard pull or not. Since Citi reached out to me and promised no hard pull when requesting the credit limit increase, I was interested in the offer.

I made sure to check the terms before proceeding. If there had been a hard pull in the process, I wouldn’t have gone forward.

You can read more about credit limits and how to request an increase here. We break down the policies by bank, how to request an increase, and whether you’re likely to get an inquiry on your credit report or not.

Since my initial c.l has been decreasing substantially with every subsequent application (13.5, 8.8, 4.9), I feel like I don’t want a cli, as it will almost surely lead to either an insufficient cl to begin my next card with, or an outright denial. Citi does not allow cl reallocation afaik, so maybe I would be best to close the older citi (not even close to my oldest ) card before going for premier again

J – correct, they don’t allow shifting credit. However, you can take from an open card to create what you need for a new card during reconsideration call. Citi may even do this automatically when reviewing an application.

I got the offer on my Premier, to go from 4K to 6K (still not enough to use the card for a big trip, but whatever). I accepted, got the increase, and keep getting the same offer (4 to 6) by email every other week. Okay, Citi – you’re not triggering a lot of trust here…

I would not use this card for a big trip anyway due to the lack of trip delay insurance, baggage, rental car etc. Better to use csp/csr for at least some peace of mind, despite (maybe) giving up a point or 2 per dollar imho

Thanks due to this I searched my email for “citi” which came back with an email stating my credit limit was automatically increased a few days ago.

[…] This was published by Miles to Memories, to read the complete post please visit https://milestomemories.com/email-offer-credit-limit-increase-citi/. […]

Thanks for posting the link. I didn’t receive the offer but it worked for me. Was able to get a $2K increase on my Double Cash and finally got my limit above $20K.

I’m guessing that this offer is giving them more and different information than they could get directly from the bureaus themselves. It is also Citibank’s data, not sharing with Chase / Amex. If it turns out they don’t like your information, then their options are greater than if you’d never responded. That’s why they don’t just increase it without notification or getting more updated information from you, as I’ve seen other Chase cards do in the past.

“Checking credit”, even when much better, can hurt that product’s price. I just renewed my homeowners, where they check credit every two years. It is much better than it was during the last check, and so I suggested they do so. My very knowledgeable agent and the inruance company’s people themselves said that if they re-checked, it would almost certainly mean I’d be paying more, not less, even with a better rating. YMMV, since Florida’s real estate market is hot, building (and repair) costs are through the roof: 🙂 — So, rates are rising substantially, and many insurance companies are pulling out of Florida… Now, if we had only locked down tight for Covid in Florida, we wouldn’t have all the new residents that are now raising our rates! (And valuations.)