Fidelity Launches Fidelity Rewards+ with $75 Bonus and Up to 3% Cashback

Fidelity Investments announced the launch of the Fidelity Rewards+ program, designed to give eligible Fidelity Wealth Management customers exclusive opportunities to earn and save more.

This is not a rewards program for everyone. To be eligible, customers must have a minimum $250,000 invested through Fidelity® Wealth Services, Fidelity® Strategic Disciplines, or a combination of both.

Signup Bonus

$75 Bonus – Early enrollees will receive a one-time bonus of a $75 statement credit when they use the Fidelity Rewards Visa Signature Card to make any purchase amount on Amazon.com by Sept. 30, 2020.

Fidelity Rewards+

Fidelity Rewards+ features no-cost enrollment, automatic renewal with qualifying assets, and automatic upgrades to higher benefit tiers. It includes:

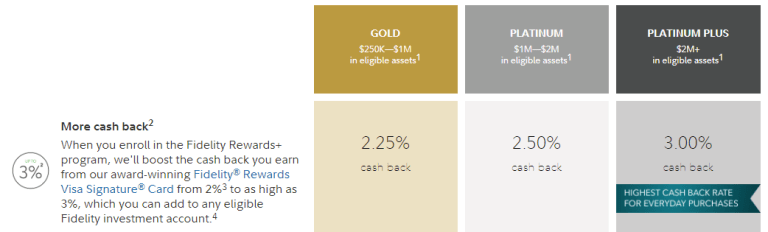

- Up to 3% Cash Back on Everyday Purchases – Fidelity offers the Fidelity® Rewards Visa Signature® Card with no annual fee, which earns cardholders unlimited 2% cash back on everyday purchases. Fidelity Rewards+ members can earn up to an additional 1% for a total of 3% cash back on everyday purchases that can be added to any eligible Fidelity investment account.

The rewards program includes three levels of benefits based on assets – Gold, Platinum, and Platinum Plus. Once customers are enrolled in the program, if their eligible assets increase to the next level, Fidelity will boost the rewards automatically. Customers can learn more and check their eligibility and program status at Fidelity Rewards+.

Yeah, I was excited until I saw the details. Uh, no thanks. 🙁

They will give me back a percentage of the additional fees I pay them? This is almost as good as paying 20% more for a hotel room’s “double points” room rate to get 5% back in point value.

Fidelity Wealth Management is fee-based. You’ll need to pay over $1000 annually in fees to earn these higher rates. This is not a card for the masses.

I got all excited until I saw that to qualify you have to not only meet the high tier requirement ($2M+ for the 3%), but those assets have to be under an advisory fee based program. No thank you, unless you’re already this type of customer.