Hyatt Credit Card Best Offer

The Hyatt credit card is one of the better overall values on the market if it is used properly. An old method of getting a better offer on the card has resurfaced, so I thought it was a good time to go over the options currently available.

The Hyatt Credit Card Evolution

- Way back when, the Hyatt credit card came with two free nights and the $75 annual fee waived. Diamond members even got those two free nights in a Suite. The Diamond benefit went away unfortunately, but not before I enjoyed an $1,800 per night suite at the Park Hyatt Tokyo!

- While the public offer on the card was 2 free nights, you used to be able to also get a $50 statement credit on the Hyatt website. This has been around off and on. (See below.)

- Over a year ago, Chase started offering 5,000 bonus points for adding an authorized user on the card. At one point, a 2 free night, $50 credit, 5,000 bonus point and no first year annual fee offer came around. This was the best ever off on the card and it only lasted a few months.

- Recently Chase began eliminating the first year annual fee waiver. The $75 fee is now charged up front.

Where We Are Today

Update: According to data points on Doctor of Credit, the $50 statement credit offer is also coming with 5K points for adding an authorized user, despite it seemingly not being in the terms. That clearly is the better deal!

Today, we have two versions of the Hyatt credit card offer:

- 2 free nights after $2K spend in 3 months + 5,000 points for adding an authorized user. $75 annual fee NOT waived. Direct Link

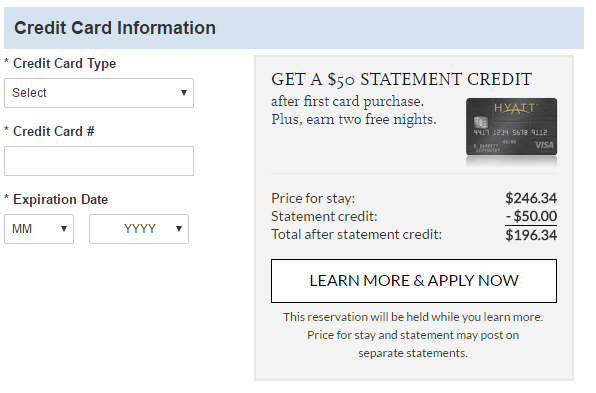

- 2 free nights after $2K spend in 3 months + $50 statement credit after first purchase. $75 annual fee NOT waived.

The 2nd offer has recently come back to my attention since it has come and gone from the Hyatt website. It has now returned (I’m not sure how long ago it came back) and you can find it by creating a dummy booking and going to the final confirmation screen where you input your credit card information. It will look like this:

$50 or 5,000 Points?

Basically, the question becomes whether you should take a $50 statement credit or 5,000 points for adding an authorized user. While conventional wisdom says that Hyatt points are worth more than $.01 each and thus you should take the points, unfortunately you have to add someone to your account to do that.

In the world of 5/24 and other bank tightening, being an authorized user or AU on someone’s account isn’t always the best idea. For example, my wife and I often used to be AUs on each other’s account, but rarely are anymore. Chase counts AU accounts towards 5/24 and other banks evaluate them as new accounts when determining whether they should give you new credit. For these reasons I think the $50 is both simpler, easier and better for most people.

Conclusion

It is nice to have options and I am glad that the $50 credit is back, especially now that you have to pay $75 up front. With the credit you are essentially purchasing 2 free nights at any Hyatt for a $25 first year fee (plus the opportunity cost of $2K in spend), which is quite a deal in my opinion. Yes, I wish we could go back to the good old days of the very best offer on this card, but unfortunately those days seem to be behind us.

I’ve had a Hyatt card for 5 years, but I think this would be a good time to (1) cancel the card (annual fee due on current statement) and (2) re-apply for a new Hyatt card with the $50 statement credit. My question is: How much time should I allow between steps (1) and (2)? Does Chase want to see a minimum interval between ownership of the same product? I know Citi want 2 years, but as far as I know Chase only cares about the interval between bonuses. Any insights would be appreciated.

You are correct the bonus rules apply to the interval between bonuses. I personally have done this exact thing after closing a card for 3 months although I know some people who applied sooner. Those data points are old though.

I would wait if you can so you have a reason to justify your new app, especially if you have a lot of other new accounts.

[…] The Evolution of the Hyatt Credit Card, the Best Current Offer and How to Get it. Nice summary laid out. This credit card would buzz A LOT more in the blogosphere if there was an affiliate link for it. Still so ridiculous of some Titan bloggers who blog about this program and then can’t even get themselves to lay out the direct link to their readers, so pathetic! […]

The old best ever deal was still available at the start of sept. They ‘enhanced’ it to the latest no-waiver version around 9/9.

Wow somehow I missed that. I maintain the FM Best Offers list and the link we had died awhile back. Either way as you say the recent enhancements with the annual fee hurt.

It was available thru the booking process. I had checked in August with no luck, but it re-appeared again early sept. I combined it with a csr, tho Hyatt is still pending for me. Waiting it out for now

I will be cancelling this card when my renewal is due. Now that I have the Sapphire Reserve it is no longer worth the annual fee. I did not realize the first year annual fee is no longer waived and the initial spend for the two free nights has increased from $1,000 to $2,000. Disappointing.

Thanks Andy…appreciate the idea! Will most likely make my 10 year old daughter my AU for all my cards! 🙂

Our 17-month-old son is the AU for all our Chase cards.

Yes a lot of people do this.