Chase Hyatt Credit Card Review

Overview

The Hyatt credit card is one of a number of competitive travel rewards cards issued by Chase. Unlike hotel cards for some other chains, this card has a number of unique features and a valuable sign up bonus, making it incredibly competitive in the marketplace.

Product Features

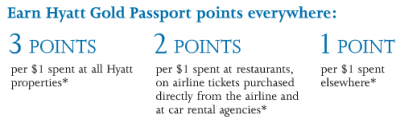

The Chase Hyatt credit card earns points on a three tiered system:

- 1 point per dollar spent on everyday purchases.

- 2 points per dollar spent at restaurants, on plane tickets purchased directly from airlines and at car rental agencies.

- 3 points per dollar spent at Hyatt properties.

CLICK HERE to compare this and other hotel rewards credit cards

Other product features:

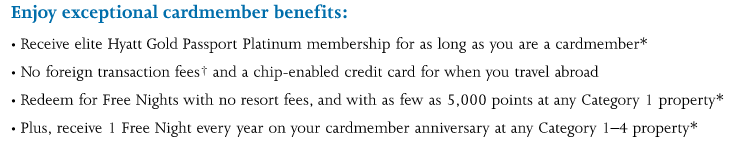

- World of Hyatt Discoverist status

- No foreign transaction fees and a chip enabled card.

- Annual free night certificate for use at any category 1-4 property.

Best Offer/Sign Up Bonus

The public offer for the Chase Hyatt credit card gives 40,000 World of Hyatt points after spending $2,000 during the first three months. You can also get an additional 5,000 bonus points for adding an authorized user. The offer has been slightly devalued since it used to offer 2 free nights at ANY Hyatt, however it is still quite lucrative.

CLICK HERE to compare this and other hotel rewards credit cards

Annual & Other Fees

The Chase Hyatt credit card has a $75 annual fee which is waived the first year. Additionally there are balance transfer & cash advance fees of 3% or $5, whichever is more. You can find the full list of card fees here.

Our Chase Hyatt Credit Card Review

The Chase Hyatt credit card is a really solid credit card product. Considering the sign up bonus is good for anywhere from 1-8 nights depending on the property category, you can live it up in luxury or spread your bonus out to get the most value.

I like this card because it doesn’t carry a foreign transaction fee and thus can be used at any Hyatt without incurring fees. I never will understand why some hotel credit cards have foreign transaction fees, which means I am paying a premium to earn points at foreign properties.

As for spending, I personally wouldn’t use the Chase Hyatt credit card for my normal purchases, considering I can earn Chase Ultimate Rewards points at the same level with a product like Sapphire Reserve. Chase Ultimate Rewards points are flexible and can be transferred 1:1 over to Hyatt. I normally use a 2% cashback (or better) card for everyday spending unless I am working on minimum spend for a sign-up bonus or have an amazing retention offer.

Since Chase issues so many premium cards, it can be difficult to decide which ones to get. At some point you will hit a cap as to the number of their products you can hold at once, but this is a card I am happy to have because of the annual free night. The Discoverist is a nice added benefit as well.

CLICK HERE to compare this and other hotel rewards credit cards

Conclusion

The Chase Hyatt credit card is a solid product with a solid sign-up bonus. While I personally don’t use the card for everyday spend, the up to 45K bonus, 3x points earned at Hyatt properties, Discoverist status and the annual free night make it a compelling product to get and keep.

[…] Related: Chase Hyatt Visa Review […]

[…] Related: Chase Hyatt Visa Review […]

[…] Related: Chase Hyatt Visa Review […]

[…] to Memories has more information on getting that Chase Hyatt card offer along with his review of the Chase Hyatt […]

[…] by creating a dummy booking. You can find the step by step instructions along with my full review here. (No affiliate […]

[…] lets look at the Hyatt card (my review) which has a sign up bonus of 2 free nights […]

Nice write-up. Thanks for the review.

So would this be one of the 4-6 Chase cards you would choose to keep on an ongoing basis (given that the annual fee isn’t too bad compared to the annual benefit)? Or maybe would it be one that you sign up for (get the nice sign-up bonus) and then potentially close when you have to choose a card to close to get approved for a new Chase card?

There’s no business version of this card, correct? Can you remind/enlighten me. How frequently (based upon your experience or what you’ve read/heard from others) can you apply for a Chase credit card? (realizing that how often SHOULD you apply is a more personal question!) And does the frequency allowed depend on personal versus business cards?

Thanks again! Hopefully my questions and your answers are helpful to more people than just me. 🙂