Hyatt Mlife Status Match Changes

The news this morning has been dominated by Hyatt’s announcement of a brand new loyalty program to launch on March 1. I posted this morning about the program and have kept that post up to date as we have learned more. You can find the full details here.

As the day has progressed, two more significant pieces of news have come out that I know will be of interest to many of you. Along with the new program, Hyatt is downgrading Mlife reciprocal status and at the same time is making changes to how elite status works with their co-branded Chase credit card.

Mlife Downgrade

With the new World of Hyatt loyalty program comes changes to their Mlife partnership. Specifically elite status matches between the programs are being throttled.

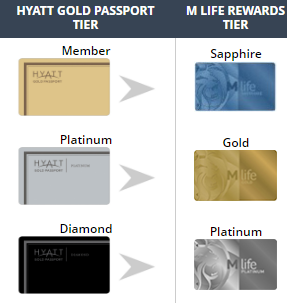

Currently Hyatt elite members are matched to Mlife as follows:

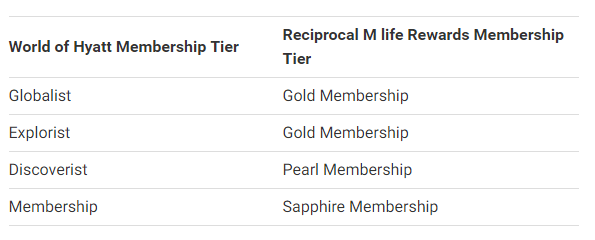

While I suppose the good news is that status matches will continue, unfotunately the highest level you will be able to obtain within Mlife through the match will be Gold. Here is how matches will look once the new program launches as reported by View from the Wing:

Currently Hyatt Platinum (which can be obtained through the credit card) gets you Mlife Gold. Under the new program, the equivalent status (Discoverist) will only earn Pearl status. Top-tier elites also take a hit since both Explorist and Globalist members will top out at Gold status.

The main differences between Gold and Platinum Mlife status are slightly better room upgrades (although I almost never see this) and priority check-in, valet, etc. Since Mlife is still largely based on your play, taking a hit on status isn’t huge although I will miss some of the priority benefits that Mlife Platinum has given me.

Credit Card Changes

View from the Wing is also reporting a few changes to the way the credit card deals with elite status. Specifically there are three changes, with one of them being somewhat interesting.

- The card will come with Discoverist (lowest tier) status.

- $50K spend each calendar year will earn Explorist status through the following year.

- Cardmembers who have the card by March 1 will earn a 5% bonus on base points earned for in-hotel spend through February 28, 2018.

Overall, the Discoverist status isn’t a surprise, but the ability to earn Explorist status with $50K in spend is a decent development I think. We are losing the ability to earn 10 nights towards status with $40K in spend though, so those who were hoping to get to top-tier via that method are out of luck it seems.

Conclusion

As I wrote in this morning’s post, I think the changes coming to Hyatt are mostly negative for those of us who seek to maximize everything. With that said, they are clearly going after high value customers and this very well may be a good thing for their business in the long term. Overall I am sad about the overall changes including the Mlife devaluation, but the added ability to get a decent level status through spend is a nice one.

What are your thoughts about all of these changes? Let us know in the comments!

[…] reader earned Diamond status via a status match from MGM, which he got from a Hyatt status match. His tier score is nowhere near reaching Diamond status again. And while Diamond status with […]

[…] you can gain Mlife status. I have never found that partnership to be quite even and it is being devalued later this year, but it is better than […]

Do you know if I would receive Breakfast if I am a Hyatt Diamond member staying at Luxor?

No you only receive your match Mlife benefits. No Mlife tiers give free breakfast unfortunately.

Current year statuses expire on 2/28/2017. Does this mean everyone will be given a status based on the new criteria on 3/1/2017? If so, we have 2 months left to put in enough nights to meet the new qualifying criteria.

Looks like those who have 25 stays but less than 30 nights will be hit the hardest.

As someone with no skin in the game on the loyalty side, but someone who enjoys staying in Hyatt properties, I must say this is an epic failure in terms of marketing. I applaud them for trying to be a bit different than the usual loyalty programs, but from the naming of tiers, to the significant changes in benefits, to the credit card downgrades which make the card worthless, this is reminding me of the New Coke debacle.

Thanks for updating with this. It gave me the kick in the butt I needed to call and match to Mlife Platinum while I still can. Been meaning to do it and just hadn’t called. Not sure I’ll have a trip to Vegas in the next year to take advantage of it, but I’d rather have the ability than not. Thanks!

Looking at the loss of benefits posted earlier (no more 2pm checkout or premium internet) for Hyatt credit card holders means it really has no value for me anymore. I’ll be dropping the card when it comes up for renewal.

The Hyatt news this morning was disheartening, but this is a real punch in the gut for me. I’ve been “maximizing” the Hyatt/Mlife partnership since it was announced and leveraged some amazing benefits (upgrades and fees), so the loss of Hyatt Diamond matching to Mlife Platinum will be painful.

Seriously – as a millennial I cannot stand this new program. The logo is terrible. Maybe they were going for retro? Whatever the intent, it is horrible. This Globalist, Discoverist, etc. is even worse. I can’t decide which I hate more – the naming of tiers or logos.

I don’t want to be called a “Globalist”… To me it comes off as douchy and arrogant. To be honest, I didn’t even like it when United went from “1K” to “Premier 1K”. Still prefer just “1K”. Keep it simple, Hyatt.

I’d even rather have level 1, 2, 3, and 4. I’d rather be a 4 than a Globalist.

Shawn, great coverage today, much appreciated. Hyatt’s credit card is about to become by far the least compelling among itself, Marriott/SPG, IHG and Hilton. Hilton gives Gold w/ a $95/year card. Marriott gives it with $10k spend on the RC Visa, which is $150/year if you use the travel credits (and less w/ other bennies accounted for). so here, Hyatt wants $50k spend for its 2nd highest status??? Which appears to be less beneficial than both Marriott and Hilton Gold? I just don’t get it.

While I travel a great deal and have been a Diamond for many years. I enjoy the “My Hyatt Concierge” service and consider it one of the best perks of any program out there.

Having said that, these are a bit much. The monikers their now going to use are pretty tacky. The credit card which has been a nice perk as well seems be destined for a downgrade. Let’s see the numbers on how many people dump that card. Frankly this opens the door for us that have the Sapphire Reserve to “pull ” it out more!

The M Life downgrade is so so as I stay in Vegas three times a year and frankly have not seen any real advantages but then I am not a gambler.