I Accidentally Opened a Credit Card — Now What?

Have you ever heard someone say “I accidentally opened a credit card”? It’s not common, but it happens. Maybe there was some serious pressure from a store clerk, you signed up, and now you regret it. That’s not “accidental”, though. That’s buyer’s regret. In rare circumstances, it is possible to open a credit card by accident–not knowing you’re opening a credit card. How does this happen? Let’s take a look at what happened to my mom.

Credit Cards as Revolving Credit

In order to avoid accidentally opening a credit card, it’s important to know what constitutes a credit card, as opposed to other types of credit. There are 4 main types of credit:

- Charge cards / Open credit: You can borrow in nearly limitless amounts, but you must pay the balance in full every month. The most common example of this is a charge card, like the Amex Platinum or Amex Gold cards.

- Service credit: You get services before you pay for them, and companies do this with the assumption you’re going to pay (there’s probably a contract). This covers things like your utility bills.

- Installment credit: You borrow a certain amount at the beginning, and then you have a monthly payment to make until the whole thing is paid off. This is probably what you think of when you think of a “loan”. You pay it back in installments — monthly payments.

- Revolving credit: Revolving credit…revolves. You can go up to a certain amount but no more. However, you don’t have the same payment every month, because you can borrow more or less each month. This is where credit cards come in.

So…How Do You Accidentally Open a Credit Card?

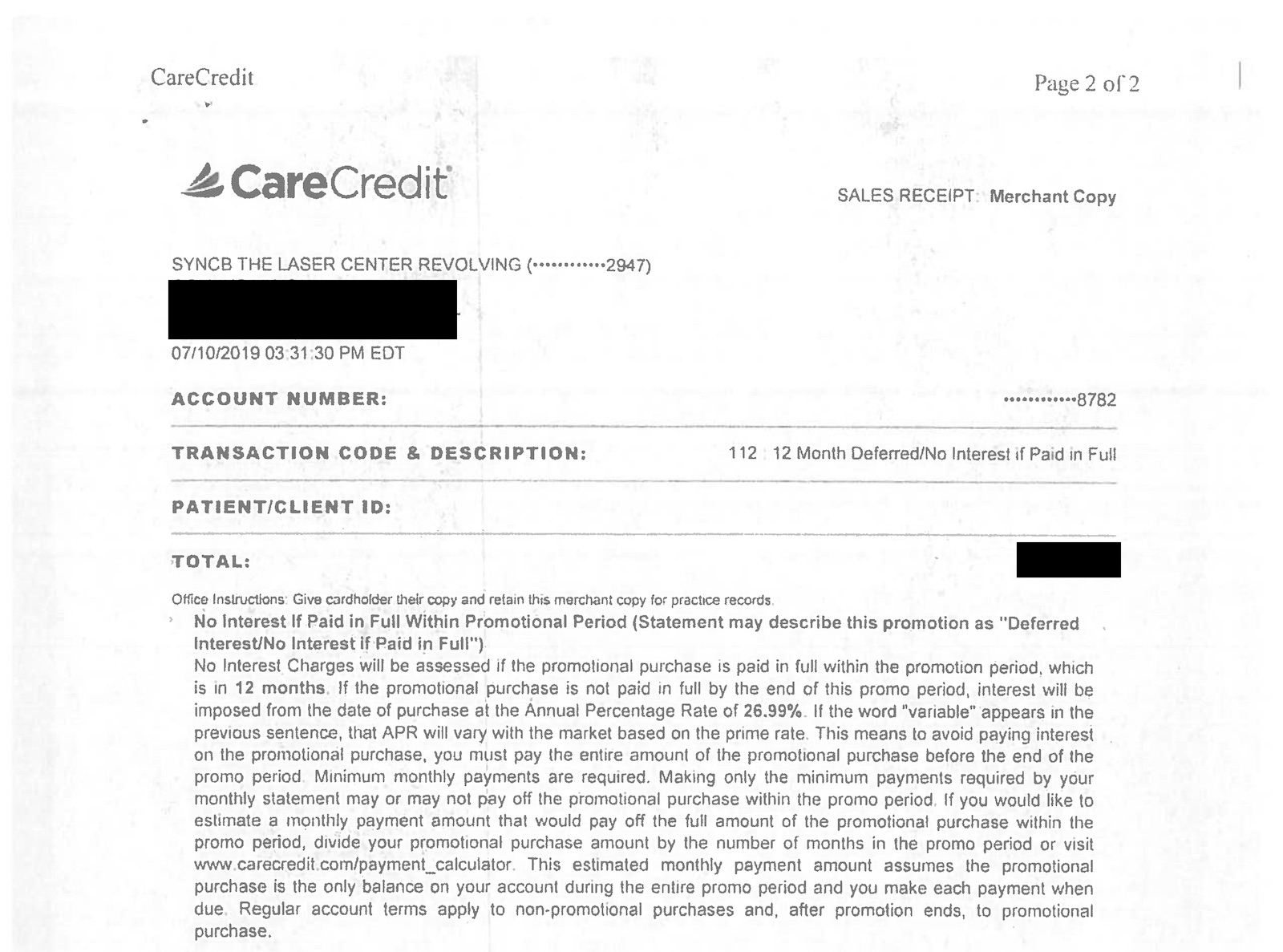

In July, my mom was visiting the eye doctor and needed some services beyond what her health insurance would cover. When talking to the administration team, they offered her financing. The payment terms included “no interest if paid in full in 12 months”. That was much better than paying interest by putting the charges on her credit card.

The doctor’s office outlined information about the payment terms, the length, the monthly payment — all of your normal loan stuff. Nowhere in the documentation does it say this is a credit card. I’ve looked through it. My mom was quite surprised when she received a credit card in the mail a few weeks later. So, how did she wind with a credit card by accident? That one key word: revolving.

This doctor’s office farms out their financing to a company called CareCredit, which covers medical financing of all types. The credit terms spell out the rates, penalties, etc. but don’t say the words “credit card”. There’s just that word “revolving” at the top. If you go to CareCredit’s website and look at their “how it works” information, you will find the words “credit card”.

If you are taking out a loan and see “revolving” as the type of account, that’s a credit card. Unsure about what’s happening? Go to the website of the company providing the financing and search for “credit card” on the website.

The most common places I’ve seen this happen are small businesses that contract out their financing. Doctors’ offices, rent-to-own furniture shops, even payment plans when buying home appliances — these are the places leading to people saying, “I accidentally opened a credit card…now what?”

Now What?

Does this really matter? It depends on who you ask. Are you trying to keep your inquiries down on your credit report before applying for your next credit card? Are you trying to keep the number of new accounts down?

What if you’re under 5/24 and just went over it because of this?

That’s the biggest reason this matters. My mom was 4/24 and had been waiting to get a Southwest card and earn the Southwest Airlines Companion Pass. Now, it really matters if you accidentally open a credit card. She’s not only ineligible for Chase cards now being at 5/24, but she can’t get the Companion Pass she’d been planning for all year and built her application strategy around for 2019.

Unfortunately, if you’re in this situation, there’s nothing you can do. You signed a contract, and I didn’t find any reports of people saying, “I didn’t mean to open this, let’s cancel it.” While major credit card issuers typically have a “before first use” policy of canceling the card, I didn’t see that in the terms for my mom’s card. The “now what?” is “nothing”.

Final Thoughts

I’ve seen people say “I accidentally opened a credit card” a few times in this hobby. The only way to avoid this is to read through loan terms carefully and watch for “revolving” as the type of credit account you’re being issued. If that’s in there, you’re getting a credit card. The financing company might not make it very clear that this is a credit card, and that may or may not be intentional.

If you don’t want a credit card from this account, you need to consider other options. If this business doesn’t offer any other types of credit (installment is what you probably wanted), your choices are now using your credit card (and maybe paying interest if you don’t pay everything that first month) or opening their new credit card that you didn’t really want. Consider your options as to what’s best for you in your situation.

[…] I Accidentally Opened a Credit Card – Now What? […]

[…] from Miles to Memories wrote a cautionary tale about the dangers of unknowingly opening a credit card. While it might not be a big deal for some people, if it puts you over a limit, like Chase’s […]

Related, but not the same. I always ask those people that ask “would you like a 5% discount on today’s purchase?” at the checkout how much my credit pull should be worth and most don’t even know what a credit pull is or that they have any value over just getting their card. I’ve also asked those hawking Chase cards (United Airlines) how this affects my 5/24 status. It’s fun to see them stammer through a response.

The actually useful laws are always about 12 years behind. By that time, these crooks are on to other games.

Synchrony strikes again – same thing happened to me yrs ago at the eye dr for a procedure I ended up not having to do but would have exceeded insurance claims. The office prompted me to get “pre-approval” in the event another specialist gave the green light. I had never heard of Synchrony or Care Credit at the time so also had no idea it was a credit card. The credit line eventually fell off on its own from non-use. Certainly made me more careful going forward, but I still wince when I see it on my credit report.

My mom ordered some clothes over the phone when a new never-heard-of card landed in her mailbox a week later. I filed a complaint with the credit bureaus, & it was removed.

1st world problems. You can’t have interest free financing AND your free companion pass

My parent did that…. I was trying to get them to go below 5/24 and I guess my father was offered one of those “would you like 5% discount on today’s purchase?” at the checkout and talked to into it. 🙁

on other time, during my early early years playing this came… I accidentally submitted duplicate applications for BofA Alaska personal card. Both went in pending and I realized I got approved for both after checking the status only. I called right away to cancel one… “sorry I accidentally did this, can you cancel it???”

Don’t ask me what I was thinking. I was a beginner. Good old days.