Disclosure: Some offers mentioned in this post have expired.

How To Get Approved For The Charles Schwab Amex Platinum Card

Mark posted previously that he couldn’t apply for the Schwab Amex Platinum Card, due to the American Express pop-up message. My wife even had this same problem back in December 2019, the month after I was approved. I applied for and was instantly approved for the Charles Schwab version of the American Express Platinum Card in November 2019. Since this is a lesser-discussed version of a great card, here’s how the application went and how to apply.

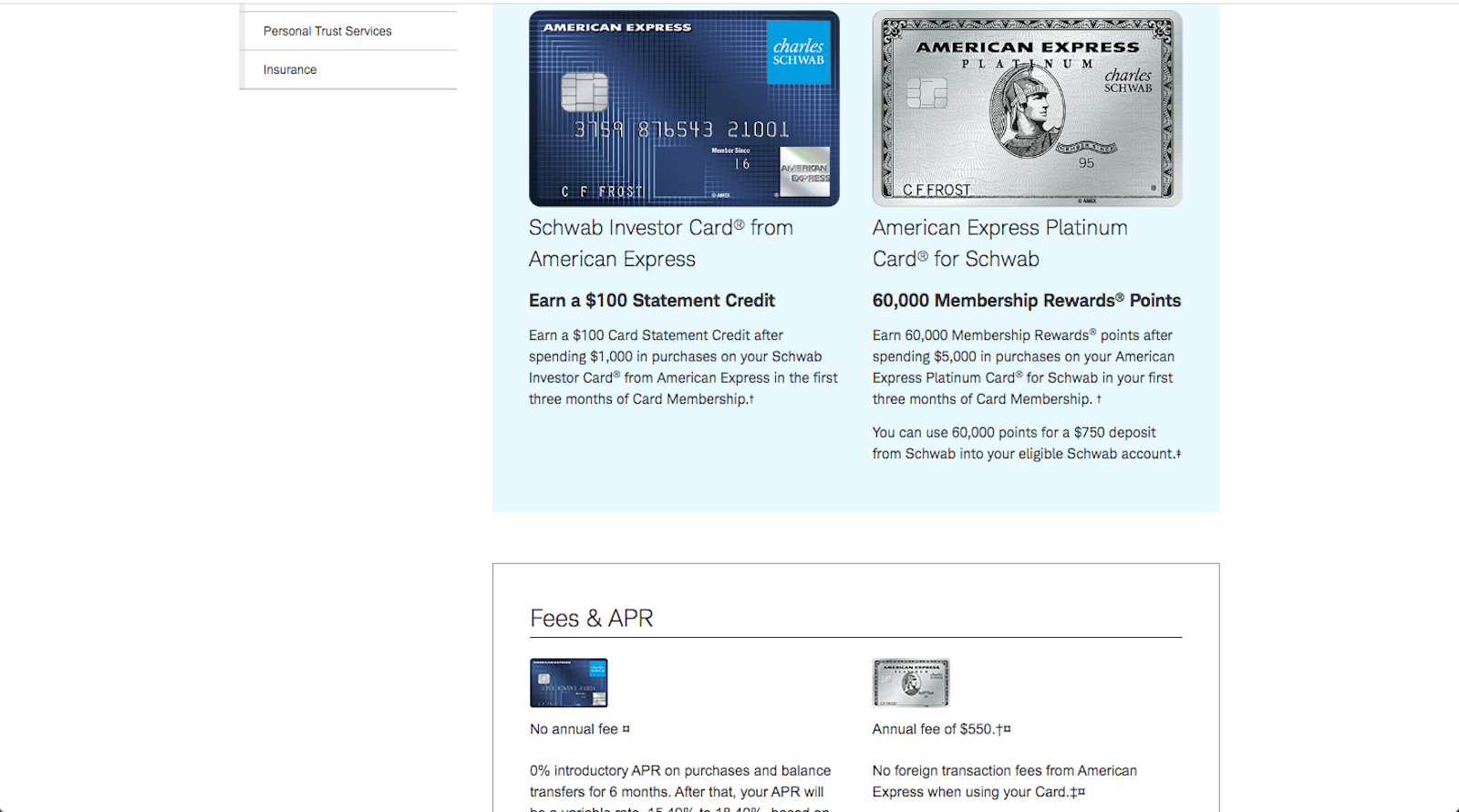

What is the Schwab Amex Platinum Card?

The Charles Schwab version of the Platinum Card from American Express has all of the same benefits. You can read about those here. It has an additional benefit that the standard version of the card doesn’t have: withdraw your Membership Rewards points at 1.25 cents per point. They’ll deposit into your Schwab checking account as cash.

Additionally, there’s one more HUGE perk to this card: another opportunity for a welcome offer bonus from American Express. If you aren’t aware, American Express has “once in a lifetime” restrictions on most welcome offers you’ll see when signing up for a credit card. If you’ve had that card in the past and received the welcome offer, you can’t get it again. That restriction is only for the same card, though.

Yes, this is a Platinum card, but it’s considered a different product from the regular Platinum card. Now, you can get the welcome offer bonus on this card, even if you’ve had it on the standard Platinum Card. There’s also the other way around: I got this card while holding out for a better welcome offer from the regular American Express Platinum Card. The current public offer is 60,000 points. With once in a lifetime language restricting me to only getting this offer one time, I’m hoping to come across one of those 100,000 points offers.

Key Benefits of the Schwab Amex Platinum Card

All versions of the Platinum card (there used to be 4, but some are not open to new customers now) come with some great benefits:

- Priority Pass annual membership with unlimited visits plus 2 guests per visit

- Access to American Express and Centurion lounges

- Access to Delta lounges when flying on Delta

- $15 monthly credits for Uber (includes Uber Eats!) and $20 in December

- $200 annual airline credit toward your preferred airline

- 5x points earning on bookings through AmexTravel.com or flights directly from the airline

- Fee credit for your application for Global Entry or TSA Pre-Check

- $100 annual credit for shopping at Saks Fifth Avenue

- Car rental and travel insurance perks

- It is the only card that allows you to cash in Membership Rewards points for cash at a rate of $0.0125 a piece

- Annual appreciation bonus from Schwab of $100-$200 depending on how much is in your account, minimum $250k to qualify

My Schwab Amex Platinum Card Application

To be eligible to apply for this card, you must have a Charles Schwab brokerage account. There is no need to put much money in the brokerage account, and the checking account normally comes with a $100 new account offer. As of July 2020, the brokerage account no longer requires a hard pull.

The checking account is worth getting for most, and having the ATM card from that checking account is fantastic. I don’t use it as my primary card, since USAA has been great to me for 10 years, but it’s worth looking at the Schwab checking account independently of the Platinum Card application. That is if you don’t have a SoFi Money account at least.

Step 1 – Brokerage and Checking Accounts

You’ll need to become eligible to apply for the Schwab Amex Platinum Card first. To be eligible, apply here for checking and brokerage accounts. Depending on how much money you fund the accounts with (and park it there for a year to not lose the bonus), you can earn up to $500 cash as a welcome offer.

Scroll all the way down for the account type you want after clicking on ‘apply’. You want Schwab Bank High Yield Investor Checking® Account linked to Brokerage Account. Fill out all of the information, then the site will lead you through the process of opening a checking account linked to a brokerage account. Expect a hard pull on your credit report.

Fund the accounts via bank transfer. Funding via credit card isn’t an option. You don’t need to put much in there. You can later close the brokerage account after opening the Schwab Amex Platinum Card. However, if you do that, you lose the ability to cash out your Membership Rewards points to Schwab.

Step 2 – Schwab Amex Platinum Card

Once you fund your accounts, you’re eligible to apply. I gave it 3 business days to be sure everything was working and ready to go. However, you should be able to apply instantly. You can apply here for the Schwab Amex Platinum Card. The standard welcome offer is 60,000 Membership Rewards after spending $5,000 within 90 days.

There are even targeted offers of 100,000 points on this card. The annual fee is the same $550 as other versions of the Platinum Card. You get all of the standard perks above PLUS the cash out option I mentioned.

Step 3 – Activating & Managing The Card

Activating and using the Schwab Amex Platinum Card is just like any other card from American Express. I manage it in my AmericanExpress.com portal just like my other cards. I can see my statements and benefits there, just like normal.

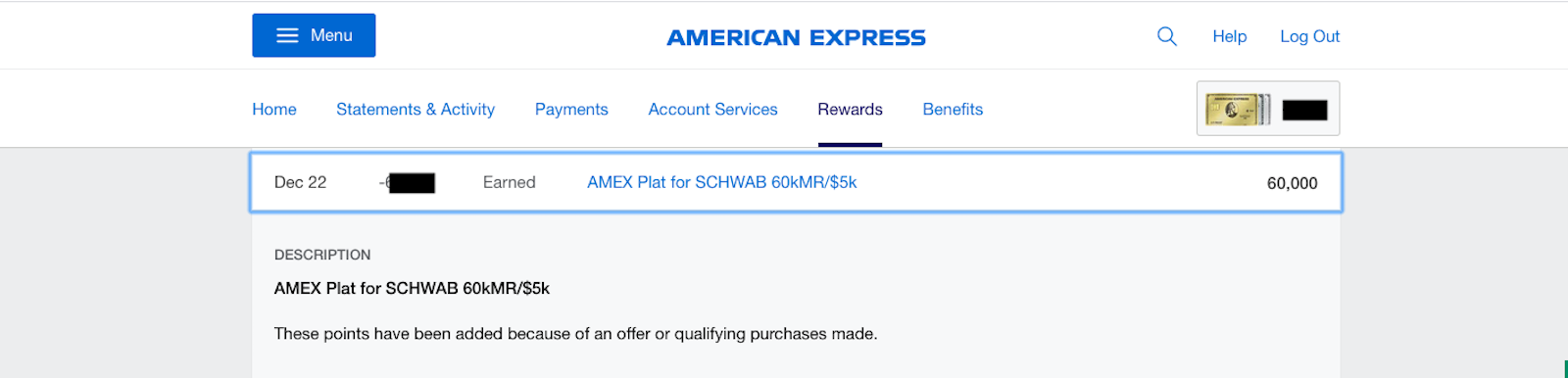

Step 4 – Receiving The Welcome Offer Bonus Points

After I’d met my spending requirements, the points posted as normal. They went into my Membership Rewards portal on the Amex site just like normal. Except for the relationship with Charles Schwab and the brokerage account requirements, this card functions just like any other card from American Express. The bills, points, benefits, Amex chat, and everything else function just like any other card.

Final Thoughts

The Platinum Card from American Express card is a love it or hate it card. Ian talked about why it’s not worth the fee for him. For me, the benefits outweigh the costs. It depends on your situation. If you’re looking to get the card, though, here’s here’s how to apply for the Schwab Amex Platinum Card. Maybe you’ve had the welcome offer bonus on the regular version. Maybe you’re like me and holding out for more points before applying for that one. If you’re curious about the ins and outs of this lesser-discussed version, here’s how it went for me. Good luck!

All information about American Express cards in this post has been collected independently by Miles to Memories. Some offers mentioned in this post have expired.

Do I need the checking account or just the brokerage account?

No, the checking account is not required.

According to DoC

https://www.doctorofcredit.com/schwab-brokerage-removes-hard-pulls-for-new-checking-brokerage-customers/

No more hard pull.

Thanks for the reminder. I updated it.

The link to the Schwab site it not working.

Thanks. It’s fixed now.

Are MR points earned in the past from other cards eligible to be deposited at 1.25 cents?

I can’t personally confirm, but I’ve seen people say elsewhere that this is possible. Don’t have first-hand knowledge and don’t want to claim I do, so that’s the best answer I can give you.

Tim – confirmed. Our writer Benjy has personally done this. That’s better than “I read somewhere”.

I believe Charles Schwab hard pull your credit report when you apply for checking/brokerage account. The reward points bonus will add to your present account? By the way anyone wants to apply Schwab checking account, you should ask someone refer you, you may get $100 bonus

Yes, there is a hard pull, as mentioned in the article. The reward points – you mean your Amex MR? Yes, they go in the same spot as my other MR. This was shown in screen shots above.

Your forgot the perk of a yearly credit depending on how much money you have with Charles Schwab. It’s a nice little credit to offset the annual fee.

Since it’s not specifically a perk of the card (which is what the article is about) I didn’t include it. Also, I’ll never qualify for it, so I didn’t want to make myself feel bad 🙂