Miles & Points New Year’s Resolutions

I am not one for New Year’s resolutions or yearly goals etc. Most of the time people say they are going to do them and then quit after only a few weeks. Gyms make bank in January from sign ups and then continue to bill you for months until you get over your shame and go in and cancel. There is a reason they don’t let you do it over the phone! Having said that, here I am writing a New Year’s resolutions post. I think when it comes to miles & points it may be a bit different though. Because when it is your hobby, or something you already love, I think you are more likely to follow through on it. Plus I will have to update you all on it which will keep me honest and on my game. So here are my miles and points new year’s resolutions. Share yours with me below.

Update 12/24/22: I figured it would be fun to go through these one by one and say how I did. New stuff will be bolded below.

Create $15,000 In Income

I am coming out of the gates swinging for the fences. My first goal is to create $15,000 in income this year from miles, points, reselling and bank bonuses. I will keep track of this throughout the year and only count things that occur in 2022. So no easy way out of cashing in points I had stored up over the years. Not that I could anyway, more on that next.

My plan will be to chase welcome, spending, referral and authorized user offers to hit a chunk of this goal. I will mix in some bank, investment and Swagbucks bonuses to help out too. The last bit of the goal will come from my regular spending activities and any reselling I do for a profit.

Update 12/24

So this went way better than expected. I surpassed this in the first few months of the year and am on my way to doubling it. I’ll update everyone on my numbers next week.

Rebuild My Transferrable Currencies

Last year I burned my points empire to the ground, mainly as a motivation tool. The money ended up coming in handy for some travel along the way though. I did this once again at the end of 2021 for some projects we have going on around the house. That means I have some goose eggs sitting in my transferrable currency accounts right now. I had built them back up to early 2021 levels before burning them to the ground once again. I seem to be in a rinse and repeat cycle right now.

My goal is to get a little nest egg in the Membership Rewards and Ultimate Rewards programs. I am shooting for the 150K-200K level in each. The rest I will use towards goal number one. This will be tougher than normal because I don’t have a lot of welcome offers available to me in either program any more. But I shall prevail! I should have enough points in my airline and hotel loyalty accounts, plus free night certificates etc., to get by for the next year or two without needing any transferrable currencies.

Update 12/24

This was going swimmingly until my wife’s 40th birthday trip crushed my balances a bit and then my birthday trip took them down another notch. I should end up with around 300K Membership Rewards with another 200K or so posting in early 2023. The Ultimate Rewards will end up right around the 200K level.

Leave The Country

It has been a while since I have been outside the US. Since before the pandemic kicked off. I have had plenty of false starts over the last few years but haven’t been able to make it work. With the constant changes in testing requirements, quarantines and the like this may be my most difficult goal. I am hopeful after this Omicron fueled spike it will burn out some and the summer / fall will look completely different.

Update 12/24

I did this not only once, but twice. I knew Mexico City was already in the works for a meet up but switching my wife’s Hawaii trip to Europe got me the double dip.

Fly Alaska Airlines Or JetBlue

This came up in our MtM Diamond Group live slack chat last night. I have never flown Alaska Airlines or JetBlue. These are two airlines that have a cult like following and I haven’t made it on either. The route maps out of Detroit are pretty bad and that is the main reason why it has never happened. I may have to fly to Boston just to go to McDonald’s with Joe or something 😁.

Update 12/24

I wasn’t sure if I would hit this one or not since I didn’t have any concrete plans with it. Luckily my buddy picked Seattle for his 40th Birthday so I was able to fly Alaska Airlines on the way out there. I shared my thoughts on their first class product on the podcast.

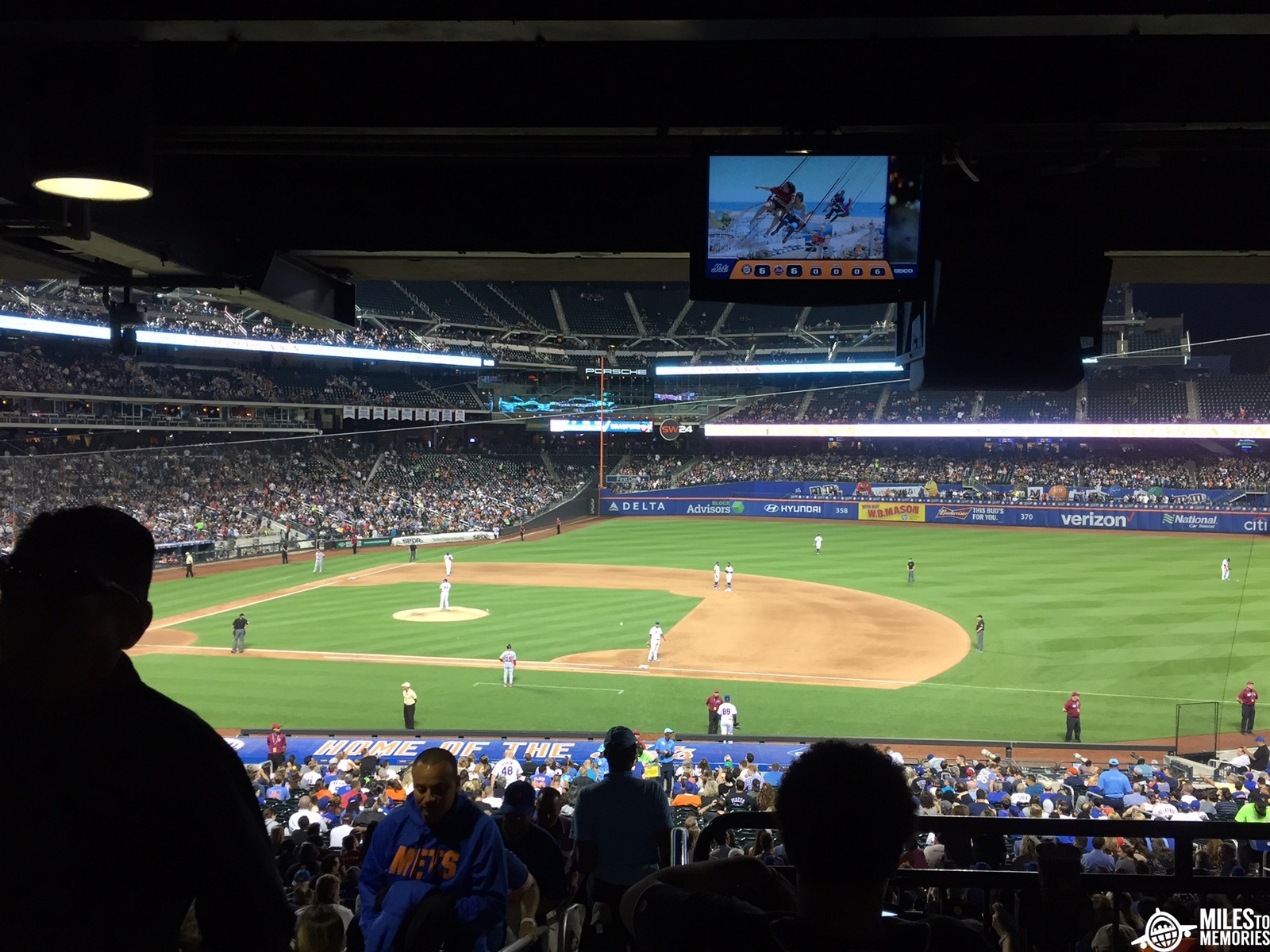

Knock Off At Least 3 Ball Parks

Another thing that has been kicked to the wayside is my goal of seeing every baseball stadium. It wasn’t really an option much of 2020 and I had a lot of other stuff going on in 2021 and couldn’t make any trips work out. This will be a focus in 2022 and I am hopeful I can knock off at least 3 MLB ball parks this year.

Update 12/24

This one is a loss for sure. I was only able to knock off the previously mentioned Mariners park in Seattle. We just never had enough time to get another trip put together and knock more off.

Finally Give Up On Capital One

My final goal of 2022 will be to finally give up on Capital One. I have tried to get a card with them once or twice every single year for the past 6-7 years. No more! It stops here. I pledge to make 2022 the year I give up on this impossible task.

Update 12/24

Ope! Yeah, so about that. I was good up until like October when I grabbed the Spark Travel Elite card offer. Luckily the banker helped me get over that Capital One hurdle.

Miles & Points New Year’s Resolutions – Final Thoughts

That does it for my miles & points New Year’s resolutions list. Hopefully I can go a 6 for 6 although my main focus will likely be on the top two on the list. What are your miles, points or travel related goals this year? Let me know in the comments below.

Update 12/24

Overall I think I came out a winner. The only one I think I really missed on was the ballparks but that was probably the least important one to me. You could throw in Capital One too but since it was an approval I don’t think it really counts.

How did you do with your goals? Let me know in the comments!

Booked 3 first class international trips for 2 people! We’ve done ANA and we’ve got Qatar on the A380 and Etihad on the 777 coming up in the next 4 months. Might be our last chance to find two F seats with saver availability with airlines tightening things up!

Awesome – great finds!

My 2023:

> Design trips to have DFW as our one-stop when flying, the Cap1 lounge rocks.

> Organize records. If something happens I’d like my family to find, and benefit from my efforts.

> Expand into AMEX Charge cards, now that I hit the 5-chare card wall.

From 2023,

> Accomplished. Hit Platinum Pro, very worthwhile: Learn and earn, including status, with the new AA program, shifting spend to AA cards and shopping portal; beat the man at his own game.

> Missed, but didn’t need their routes anyway. Earn status with Spirit via BOA MC spend leveraging the 6-month earning extension so I can burn those miles in 2022-2023 at their highest benefit tier.

> Missed, but went SW. Chase Aeroplan cards for P2 (soon) and P1 when I come out of 7/24 in November to 4/24.

> Missed. Close bank bonus accounts opened in 2020, consolidate, and go for some new bank bonuses.

I like the attempt to connect through DFW. Hear nothing but great things about that lounge

I was at the Cap 1 lounge on a Sunday at 8am. Not crowded, great service. I paid my way into the lounge. Then I went to the Priority Pass lounge at DFW, terminal D, which was a disaster. Very crowded, terrible food.

I had a client flying Lufthansa Business class from DFW, so Cap 1 lounge was the contract lounge. At 4pm on a weekday they said the lounge was crowded.

Mark, looking back, what was your SUB total for 2022?

To be honest I have no idea. I never tally it all up.

It’s too bad you can’t use or get a Capital One card. Especially their business cards like the spark 2% cashback card everywhere all the time. It wasn’t too long ago they were giving a $2000 bonus to get the card and because I was cycling my $30,000 plus credit limit several times a month they offered me an $88,000 credit limit which I gladly took.

Haven’t been able to in like 6 or 7 years unfortunately. Missed out on some good offers for sure.

Planning to spend 10 months outside the USA, visiting 10 plus countries for as close to a month each as possible including five totally new destination. Only doing a week each in Seychelles and Mauritius, anything more would be a bit much.

Been to all 30 stadiums, plus many that aren’t around anymore. What’s your favorite? Least favorite? I love Pittsburgh, San Francisco and Dodger Stadium. Can’t stand Oakland.

If you can’t get Venture X, time to throw in the towel.

Awesome – sounds like it should be an amazing year. Favorite so far is surprisingly Cleveland. I think it has had the most diverse food options, good sight lines etc. And I have always thought downtown Cleveland was underrated. Dodger stadium I didn’t get to explore a ton since it was with the Arby’s trip but I liked what I saw. I was let down by Pittsburgh. Beautiful park but the food options were among the worst I have seen. Great for a game if you care about the teams playing but for just visiting it didn’t live up to my high expectations. The new Yankee Stadium is probably the worst. Feels very corporate. Citi Field wasn’t a ton better either imo.

ESPN once did a round up of all the parks including food options. Unfortunately out of date now but hopefully they will update it one of these days. I read the reviews before doing my ballpark pilgrimage. I’ve done 31 including Montreal but they keep opening new parks so I guess I’ll just have to keep visiting! 🙂

Gives us a reason to check out new places at least 🙂

I want to take advantage of the Staples and Office Max visa gift card deals with Chase Ink this year.

That is a great one every year 🙂

I’ve flown Alaska several times…there’s a lot to like about them, mainly their service. Their planes, the 738/739 are okay but nothing to write home about. Like you, I’m looking for fly Jet Blue for the first time, more specifically I’d like to experience their Mint product.

Strange enough I want to focus more on Citi and less on Amex and Chase this year. MR points come really easy and my only real use for them is transferring to Delta as I don’t take many international flights. I’ve stashed enough Hyatt points which is my only use I have for UR.

I was approved about a week ago for the Citi Premier which will round out my set of Citi cards that I plan to focus on this year to build a hefty stash or TYP or the ability to cash out at 1cpp. My set up now is the Prestige, Premier, Double Cash, Rewards+, and the Custom Cash. Those should allow for me to do some reason TYP stashing.

Here’s to looking forward to a fruitful 2022!

Citi has a pretty good lineup for earning for sure. The premier is tough to beat at the $95 price point too. I think there are many ThankYou points in your future Heavy 🙂

1. Take a 10 day anniversary trip internationally, funded exclusively with points and miles

2. Max out spend on Chase Ink Cash, Amex Gold, and 3X Chase Freedoms

3. Points-flow flights and lodging for my triathlon race calendar (~5 events per year)

4. Get approved for a Venture X between me or P2

5. Get approved for WoH credit card and earn the free night while maximizing the 2X intro offer

6. Earn Hilton Aspire free night.

Some good goals right there Nathan. If you can get the double Venture X approvals I will be pretty jealous haha 🙂

Thanks for the list. I need to come up with something too, otherwise I just seem to wander with no real plans / or goals in mind.

We like to visit MLB ballparks as well. We are from the St Louis area so we like to see the Cardinals play. We seen them in 6 stadiums so far and have done a couple ballpark tours too. I find it to be a fun bucket list to work through!

Awesome Becky, I find it gives you a reason to check out new cities / areas that you probably wouldn’t have otherwise. What I like most about doing it at least.

Thanks for making us think. Off-beat, but applicable to my situation given I have bank in most other programs and like to have a lot of ready-to-go leverage in all programs:

> Learn and earn, including status, with the new AA program, shifting spend to AA cards and shopping portal; beat the man at his own game.

> Earn status with Spirit via BOA MC spend leveraging the 6-month earning extension so I can burn those miles in 2022-2023 at their highest benefit tier.

> Chase Aeroplan cards for P2 (soon) and P1 when I come out of 7/24 in November to 4/24.

> Close bank bonus accounts opened in 2020, consolidate, and go for some new bank bonuses.

Ah closing bank accounts – how I loathe it too haha. I think a lot of people are going to go after the AA program this year. Will be interesting to see if they adjust or are happy selling their miles along the way.

Yeah I am with you on B6! I’ve yet to fly them, Spirit, or Hawaiian and then if this counts, Avelo or Breeze. But I don’t really have much interest in flying Spirit. So I’ll stick with Jetblue! But I think my goal too is to just use my Hilton Diamond status but since I’ll have it till 2024, that will be something I will focus on next year. And I hope to also use my Hyatt and Flying Blue status but I definitely won’t qualify.

Spirit out of Vegas has a pretty solid route map so you will get there sooner or later. Use some Amex credit on the Big Front Seat and it isn’t too bad 🙂

Good idea! I’ll definitely look at that next time we fly!

I feel you on Capital one Mark, I got the venture one from them two years ago and have been denied on the venture and venture x two years in a row. I won’t waste another inquiry on them and most likely will close the venture one.

I was able to get a Venture and a Spark for me and the wife years ago no problem but now everything is an auto denial. Even when she was under 5/24 etc. It is crazy really