Mlife Rewards Mastercard Review

Back in 2016 Mlife rebranded to Mlife Rewards, debuted a new website and launched their co-branded credit card. Here is our review of the Mlife Mastercard updated for 2020!

Mlife Rewards Mastercard Benefits

Unlike some of the larger hotel credit cards, the Mlife Rewards Mastercard is issued by First Bankcard®, a division of First National Bank of Omaha. This no annual fee card doesn’t have a ton of benefits, but it could be good for a loyal Mlife member.

Here are the benefits you get as an Mlife Rewards Mastercard cardholder:

- Automatic Upgrade to Pearl Level Status (Free parking, buffet line pass, 10% bonus on points and express comps.)

- Priority Hotel Check-in at M life Resorts

- No Annual Fee

- No Foreign Transaction Fees

Mlife Rewards Mastercard Earnings

This card earns points in the Mlife Rewards program. The points can be used for Express Comps on property as well as for FREEPLAY. Note you also earn tier credits as well. Here is how you will earn when spending with the Mlife Rewards Mastercard:

- 3X points and tier credits per $1 spent at MLife Rewards destinations worldwide.

- 2X points and tier credits per $1 spent on gas station and supermarket purchases.

- 1X points and tier credits per $1 spent everwhere else.

Pay Up! Increased Vegas Resort Fees Pass $50 & How to Avoid Them in 2020!

Mlife Rewards Mastercard Sign-Up Bonus

While not as big as you will find with some other hotel cards, the Mlife Rewards Mastercard does have a sign-up bonus. Here is the current offer:

- 10,000 points ($100) when you spend $1,000 in the first 3 billing cycles.

The application link along with the full details of the card can be found here.

Mlife Rewards Mastercard Review & Analysis

Unfortunately the Mlife Rewards Mastercard isn’t going to win any huge award for innovation, but it could be good for someone enveloped in the Mlife ecosystem. One big drawback with this card are the points. When you spend on this card the points earned are worth $.01 each, but they can only be used for Express Comps or FREEPLAY. This means you are tied to spending your earning at Mlife properties.

One other thing to consider is opportunity cost. With this card you are earning less than you would with a straight 2%+ cashback no annual fee card that gives you actual cash. There is the benefit of also earning tier credits, which could be nice to top off your status, but I think this will only appeal to a very select few. Just know your use for this card if you decide to get it.

A Much Better Alternative

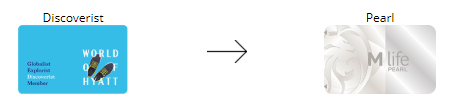

For many, the allure of free parking and Pearl status will be a reason to consider the Mlife Rewards Mastercard, but remember that the World of Hyatt Credit Card from Chase gives you Discoverist status which can currently be matched to the same Pearl status you would receive from holding this card. Yes, the Hyatt card has an annual fee, but it comes with a MUCH more valuable sign-up bonus and perks like free nights and more. I highly recommend checking it out, because it is a much more robust offering.

Mlife Rewards Mastercard Review – Bottom Line

The Mlife Rewards Mastercard has been around awhile, but the company doesn’t seem to want to make any changes. That is unfortunate since it is a truly niche card, but I suspect enough people are signing up just to get the free parking. For most people a different travel rewards credit card or the World of Hyatt Credit Card are probably better options.

Do you agree with our Mlife Rewards Mastercard review? Do you have this card and elite status with Mlife? Share your thoughts below!

Bullshit Company…..I payed off my card the amount the computer said I owed.2 weeks early ..Then they declared I had a late payment of $17.00 …because of interest …THEY DID NOT SEND A BILL FOR THAT AMOUNT OR I WOULD HAVE PAYED IT!! NOT A SINGLE LATE PAYMENT AND ALWAYS 2 WEEKS EARLY AND ONE FUCK UP ON THERE PART AND THEY TOOK MY BALANCE FROM $2800 TO $900.

This card sucks. I received it in the mail yesterday and activated it. Today I ordered some flowers in the morning via phone and gave them my cc number. Amount was approx $200. In the afternoon I went to Nordstrom to buy some shoes and the transaction was declined twice. Amount was approx $800. My CL is over $10K. Would be a good card if it worked! So much for reaping the rewards of 10K points if spending $1K. Useless to me.

Getting my neighbors MLife Rewards Because The wrong address Is on the The card.

Their customer care says it’s his problem and they won’t fix it.

How good does your credit score has to be mines 625…just wondering?

Just tried to apply for a credit limit increase

They asked for 2 years of taxes

2 w2s

Snapshot of current bank statement

Can’t imagine how they would ask for that info…thought I was applying for a Mortgage!

Wow that is crazy.

Yep, they just asked for copy of ID, SS Card and Utility Bill that needs to be NOTARIZED and sent back before I can use the card. Wish they would have told me that in the first place or I wouldn’t have bothered. Now trying to cancel the card and they won’t since they have requested these documents. I don’t understand. Been an Mlife member for years and have excellent credit. You’d think that would count for something.

I thought they were good until recently I missed one payment, only by an oversight, and now they are calling my job and a missed 30 day payment. I told the representative it was a mere oversight and they would receive a payment the following week. I asked them to remove my work number and use my home number for contacting. I was told it was being removed immediately only to receive a call the very next day asking for a payment. At this point, I am upset. Not only am I at my place of business, but harassing me daily will not get the payment any sooner than the day that I stated, on a recorded line. My recommendation is DO NOT, apply for this card, BUT, if you do, make sure you do not miss a payment. If you do, they will not listen to your explanation. They only want their payment. Bottom line.

Update since this article was written in 2016 – Hyatt match has changed with the Hyatt Visa Signature card. You now become automatically a “Discoverist” which is the “lower” tier Platinum and matches to MLIFE as a “Pearl” not Gold status, which is a huge deal. Just sayin..

Thanks Lou. I just fully updated the article for 2019 including the Hyatt portions!

I have been waiting to see comps and tier increase after 4 months and many dollars, I have no credit showing. A trip to LV is scheduled soon. Any suggestions?

I think it would be better it cardholder’s received waived resort fees, that would make it worth it in my opinion and I would then consider applying for the card. I frequent Vegas quite often but the current benefits are not enough just yet to have me apply.

I also play the myVegas slots through FB. Have recieved a handful of buffet (esp the 2 for 1 deals) and a few comped rooms on week nights so they are worth it.

As far as how many Points you get for purchases, ect I think they are a bit low for what you get in return, and I do expect them to have a Premier card at some point that I would be interested in.

I got this card to try it out for a year. I go to Vegas 2-3 times a year. I easily got the 10,000 points bonus in the first month, plus some other expenses and got 12,757 points. I converted those to express comps and its $127.57. I stayed at the MGM Grand for 3 nights and put everything on my card and expect that to be around 7 to 8000 worth of point, since everything is 3x at mgm properties. So after converting those i expect to have over $200 of express comps. Now if I do my math right and put enough of this card (along with my SWA card for free flights) I should be able to pay for flights and rooms every time I go, which to me is a win. But we will see how the dust settles when it is all said and done.

i think if you:

1. already play myVegas games and are collecting points for freebies

2. will be spending a week or more in Vegas each year

then it’s totally worth it. With the card you’ll get more points towards your myVegas games and save money on parking. 7 x $15 = $105 for parking alone. That’s if you only go to one casino a day. Given that the majority of the properties on the strip are part of the Mlife group and given that utilizing most of the rewards in myVegas (buffets and other foods, shows and other entertainment), means you are going to those same hotels/casinos (and therefore have to park somewhere) it seems like the way to go to me.

This is the worst bank ever to get a credit card from.

The customer service is horrendous. The credit limits

are ridiculously low. The rewards are terrible. Look

elsewhere and save yourself some time and money.

I rather deal with the bank then mlife they treat their loyal customers like shit they lie right to your face then start taking your free play away then they stop inviting you to their slot tournaments then they push you right out the door this is aftrer you been going there for years

Can you spend your way to Hyatt Diamond with this card via Statud match from Mlife?

No the highest you can match from Mlife is Hyatt Platinum. http://www.mgmresorts.com/hyatt/

You forget the other benefits:

1. Issued by FNBO, one of the suckiest credit card companies around;

2. Laughably low credit limits;

3. Stone Age application approval process;

4. CSRs known to be not playing with a full deck.

MGM should be ashamed of themselves.

I have had to called the customer service line a couple of times, and althugh I am glad they are in the US, they are the most untrained an unproffesional I have ever dealt with.

I applied about 2 years ago and used over $7,000 in charges. Not one point was earned. Always paying on time except for one late 6 months ago and I had overlooked that. Six months later they close my account. What was more interesting was that I had a zero balance last year, told them that I would be going to Italy and they said okay, they will make the notes that I can use it because of no fees. The first time I went to use it, it was declined. I kept it because we stay at Mirage and Mandalay Bay a lot for free parking, but not anymore. Just awful everything.

Amazing. It took them this long for M Life to match Total Rewards with a co-branded cc, and this is what they come up with. This is so obviously rewards designed by a committee of accountants, just like everything at MGM these days.

There is nothing here to move the needle. The committee of accountants threw us just enough to make the bare minimum of competitiveness. A few Express Comps? Free parking? This isn’t enough to attract even the Las Vegas locals.

It is so obvious MGM is a company just living off the fumes of what Kerkorian created.

The TR card is much better IMO

Do I hear a collective yawn?