Morgan Stanley Platinum Card 125K Welcome Bonus

The Platinum Card from American Express exclusively for Morgan Stanley is one of three Amex Platinum cards available to consumers. Now this version has an improved welcome bonus of 125,000 membership Rewards points. To make it even better, the spending requirement is only $6,000 and I don’t see any lifetime language in the terms.

The Morgan Stanley Platinum card is a bit different from the other Platinum cards, as it gets you one free authorized user, and lest you redeem points for 1 cent each. You can read all about the card here, and check out the details of the offer below.

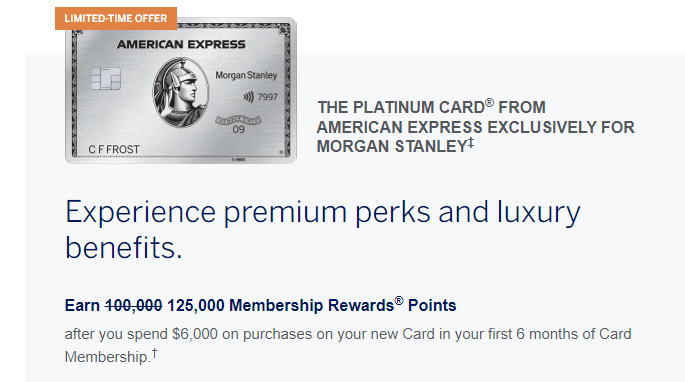

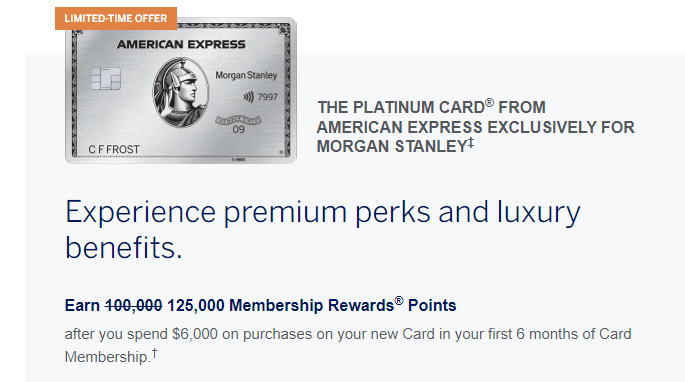

The Offer

- Earn 125,000 Membership Rewards® Points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership.

- Annual Fee: $695

- Add one Additional Platinum Card for no additional annual fee. After the first Card, each Additional Platinum Card is $195. There is no annual fee for Companion Platinum Cards.

- Offer expires on 11/8/23.

- DIRECT LINK

Card Highlights

- Earn

- 5X MR points on airfare booked directly with airlines or through Amex Travel

- 5X MR points on eligible hotels booked through Amex Travel

- $200 in annual Uber savings ($15 in Uber Cash for U.S. rides every month plus a bonus $20 in December)

- $200 annual Airline Fee Credit

- $200 Hotel Credit for prepaid bookings at Fine Hotels + Resorts(R) or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel.

- $100 in statement credits annually for purchases at Saks Fifth Avenue or Saks.com. That’s up to $50 on a semi-annual basis. Enrollment required.

- $240 Digital Entertainment Credit ($20/month) on eligible purchases or subscriptions: The Disney Bundle, Disney+, ESPN+, Hulu, Peacock, Audible, SiriusXM and The New York Times.

- Receive one Global Entry ($100) statement credit or one TSA Precheck ($85) statement credit

- $189 CLEAR Credit annually.

- Access to over 1,400+ airport lounges, including The Centurion lounge, Delta Sky Clubs, Airspace Lounges and Priority Pass Select membership

- Walmart+ Monthly Membership Credit ($12.95/month)

American Express Membership Rewards points are worth 1 cent each when they’re redeemed into an eligible Morgan Stanley account.

Conclusion

With Morgan Stanley ending the Access Investing account, it is now harder to waive the annual fee on the Morgan Stanley Platinum Card. But even when paying the annual fee, this is a great deal and an option to get yet another bonus.

The bonus is better than what’s available on the Amex Platinum Card, and you can add one free Platinum authorized user. You then get all the perks of Amex Platinum such as Uber credits, Walmart+, entertainment credits, $200 airline credit, $200 hotel credit, CLEAR and Global Entry credits and more.

The card also lets you redeem your Membership Rewards points at a value of 1 cent each. But the Schwab Platinum Card is a better option at 1.1 cents, and you can also get that same 1 cent value through the free Amex Business Checking account.

Increased Offer! - Chase Sapphire Preferred® Card 75K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Been eyeing the Morgan Stanley as our long term keeper card due to the free AU for P2. But the stars never aligned due to 5/24 slots and other SUBs we were working on. Then I saw the platinum family language appear on the vanilla and Schwab platinum applications, and got worried the triple dip platinum SUB ship may have sailed. So I was super happy to see the 125K offer without platinum family language, and applied immediately. A couple years ago, I never thought I’d have even one credit card with an annual fee above $100, but now that I’m deeply entrenched in the hobby, I have not one but two platinum cards. RIP.