My Results After Requesting an Offer Match from Chase

Chase recently released a new and improved offer for their Marriott Business card. With the new offer I would get 5,000 less points but the $99 annual fee is waived. Since 5,000 Marriott points are worth around $30 that is a great deal! Too bad I recently signed up for the Marriott Business card during my epic app-o-rama where I went 1 for 5.

No problem, I thought, Chase has been really good at matching offers in the past…or so I thought.

If you are interested in the better offer you can get more details in DDG’s article!

Contacting Chase

Since I like to work smarter, not harder (a life motto right there folks!) I decided to contact Chase via secure message. I have had luck in the past contacting them via SM for offer match requests.

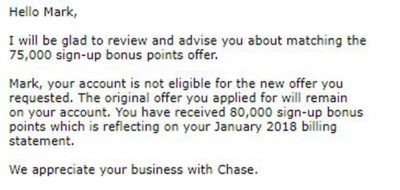

They responded with in a few hours, which was faster than expected. I eagerly opened the message and was met with complete and utter failure.

Here is Chase’s response:

Timing may have been working against me here. I signed up for the card a little over a month ago and completed the $3,000 in minimum spend a week or two ago. The real kicker is I just earned my bonus when my statement closed last night :(.

Conclusion

I imagine the fact that my statement had just closed, issuing me the bonus Marriott points, worked against me. Although, Chase just may not be matching this offer at this point in time.

That is where you come in, my beautiful & amazing readers. I give you a call to arms…has anyone been able to get this offer matched after recently applying for the Marriott business card? Let me know in the comments section!

[…] Chase’s Response to Matching the Improved Marriott Business Credit Card Offer […]

Off topic – On the Marriott personal card – if I cancel within 30 days of the fee posting, I get the fee refunded, correct? How does the fee get refunded to me if I have a zero balance when I close? TIA!

Yes you would get a refund – it would just be a negative balance on the old account and you can ask for the check mailed for the amount. Or cancel before the payment is due and don’t pay it. Just give yourself like a week for the credit to go through.

Thanks! My free night certificate is already in my Marriott account. That won’t be clawed back, will it?

In the past they haven’t.

Same results here. Approved for the “old” offer 2 days before the new offer came out. I’ve been denied twice today and have one more request in. Not hopeful.

Patrick – I respect your persistence – best of luck! 🙂

Strike 3!!

🙁

This is because the offer is smaller – 75,000 points versus 80,000 points. Chase will match a higher offer, but not a lower one. The detail that the annual fee is waived is not registering on their algorithms.

Makes sense Jenny. Kind of sad but still makes sense – thanks!

Marriott business card subject to 5/24?

Nope…the personal card is but not the biz version

Thanks for posting this. I got the same response and I was wondering if I should HUCA, but this makes me think this really is the party line, so I’ll just let it go. Thanks again for the very helpful post!

Thanks for reading Kevin!

My husband and I were just approved for this card in the PAST WEEK. We don’t even have the cards in hand yet. Sent SM’s on both accounts. Denied.

Wow – surprising. I have to imagine them losing the card in the near future has something to do with it

My wife was approved for this card at 80k w/ $99 AF 11 days ago. We just received and activated the card and sent an SM asking to convert to the 75k w/ no AF offer. Denied 🙁

I am starting to think Chase wants that AF $ before they lose the card in a few months

Exact same situation. Got the same lame response. I called in and the agent wanted to help, but apparently had to open a ticket. I expect that will again be denied. But also, Chase Secure Message is the worst.

If you get a positive report from the open ticket let us know….I will have to call in then!

if it makes you feel better, i got the same response and haven’t completed the spend yet or had a statement cut.

That is surprising to me…Chase is usually pretty good about matching.