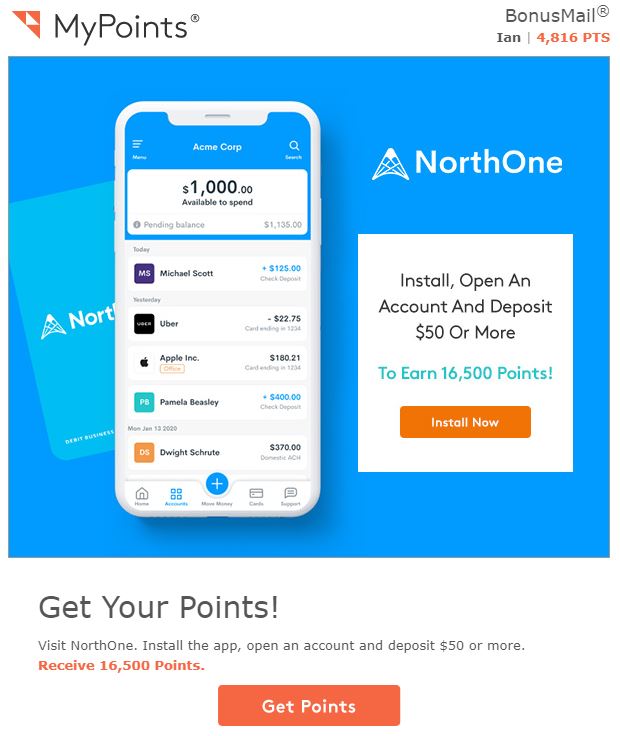

MyPoints NorthOne Bank Offer

I’ve used MyPoints for several years, and while I haven’t earned a ton of points, I do like to keep tabs on their offers as lucrative ones come around from time to time. One of the ones that caught my eye this morning in my email inbox was the MyPoints NorthOne Bank Offer.

Anything that offers over 10,000 points is typically worth looking into, as we’re talking about $60+ on the table. Depending on what’s being offered, you can sometimes receive whatever product you’re buying essentially for free, or even make some money. In this case, it appears that you can make some free money by simply opening an account.

Offer Details

The MyPoints NorthOne Bank offer is for 16,500 points for simply opening an account and depositing at least $50.

Details of the offer:

- Points will appear as Pending for 32 days

- Must enter valid sign-up information, including credit card information to earn Points

- Must sign-up and deposit $50 or more

- Offer may only be redeemed once (1) per user

NorthOne Bank Account Details:

- NorthOne charges a flat fee of $10 per month for an account

Link to offer

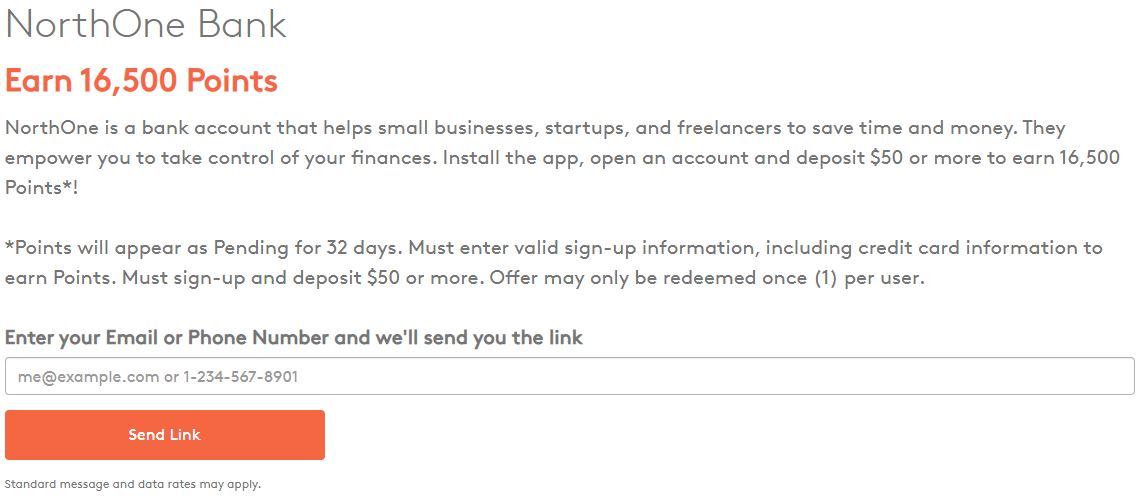

To take advantage of the offer, you need to visit the link and then submit your phone number or email. I entered my phone number and was promptly texted a link to download the NorthOne app.

My Experience With the Offer

NorthOne Bank is meant as a business account for small businesses, startups, and freelancers. Given my little side hustle, I’m a perfect fit. You do need to enter business information, but for a sole proprietorship, this is SSN, business name, and business address.

The sign-up process through the app is quick and painless. It took me less than five minutes to set up the account, including submitting my debit card information to pull the initial $50 deposit. NorthOne Bank approved my account within minutes of submitting the application.

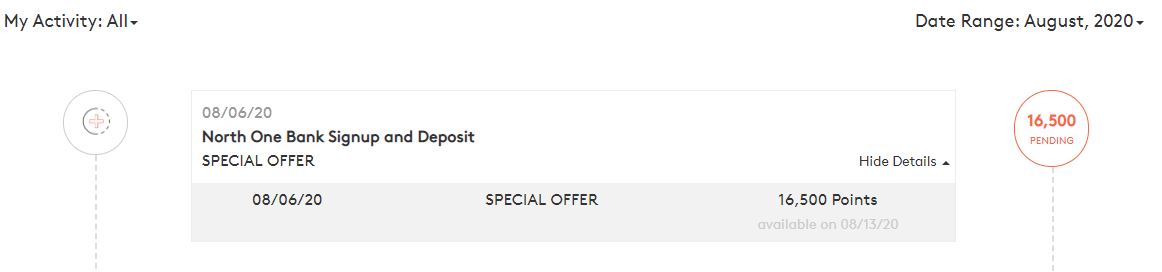

I didn’t expect the MyPoints to track for a couple days, but as soon as I logged back in, the points were showing as pending!

Value of the MyPoints NorthOne Bank Offer

The 16,500 MyPoints earned are enough to redeem for a $100 prepaid Visa card with a handful left over. You can also redeem for $100 gift cards with many other retailers. I like to redeem my points for United miles, and I can use 13,900 MyPoints for 5,000 miles.

Since the points don’t post for 32 days, you’ll end up paying 1, maybe 2, monthly fees for your new NorthOne account. Deducting this from the bonus value, you’re left with a profit of $80 or $90. Not bad for a few minutes of work.

Conclusion

The MyPoints NorthOne Bank offer is a quick, easy deal if you’re looking for some MyPoints. You can use the bonus toward a $100 Visa card, or any of the gift card or other redemptions available through MyPoints. I like to use my MyPoints for United miles, which I value at 2.0 cents each, which is what I’ll be doing once the points post from the offer.

United points posted to my Mileage Plus account only 15 days after opening the NorthOne acct. No mention of early termination fees so transferring out my $50 & closing today before any $10 monthly fees.

Doctor of Credit also reports a 12k Swagbucks deal for those not wanting United miles.

Was able to transfer my points to United 8.14, very quick turnaround!

Got denied for the account due to “the inability to verify your identity based on the information you provided, missing or incorrect documentation, a particularly high risk type of business, limited time in business, a prohibited type of business or information provided from 3rd party vendors”

3 years as a business, great correct, not high risk, provided accurate info…

I see someone said ‘hard pull’ so I wonder if it’s because I keep my credit reports frozen.

Not real pleased, however, I just found out North One did a hard pull.

Oh no! I never saw a notification for it. I’m so sorry. Normally these hit right away to my email. I would have noted that as an issue. It’s been forever since I’ve had a bank hard pull credit for an account.

Took 7 minutes, thanks Ian! Love quick lucrative deals like this.

(btw the $50 debit purchase is with Radius Bank)