Awesome NBA Amex 20K Offer

BBVA Compass issues the NBA American Express credit card. For a limited time they have doubled the normal offer on the card from 10K to 20K. There are quite a few interesting things that you may not know about this card, so I thought it might be a good time to take a look at why I am planning on adding it to my wallet soon.

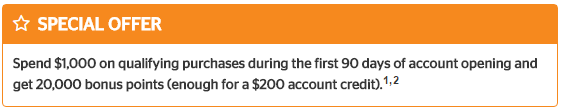

The Offer

The normal offer on this card gives 10,000 bonus points ($100) after $500 in spend during the first 3 months. For a limited time that offer has been doubled to 20,000 bonus points ($200) after $1,000 in spend during the first 3 months.

Direct Application Link (Non-affiliate)

Card Features

- 2x points at gas stations.

- 2x points at supermarkets.

- 3x points on transactions for qualifying NBA tickets, NBA in-stadium transactions, and NBAStore.com transactions.

- 5x points on ALL PURCHASES, including non NBA related items, during the NBA All-Star Weekend and two weeks of the NBA finals.

- No annual fee

Why I Am Applying for This Card

- A $200 bonus is fantastic on a no annual fee card.

- BBVA Compass is a smaller bank and I don’t already have a card with them.

- This card earns 5% everywhere on NBA All Star Weekend and during the NBA Finals. (5% EVERYWHERE!)

- This card is eligible for Amex Offers if you sync it with Twitter or another social network.

Potential Drawbacks

- BBVA Compass is known to give low credit limits.

- During past 5% windows they were quick to lockup cards with a large amount of purchases citing fraud alerts.

Analysis

The way I see it, this card gives me access to Amex Offers with no annual fee and comes with a $200 sign-up bonus. The fact that it earns 5% everywhere for two+ weeks a year is just icing on the cake. (And sweet icing at that.) My plan is to pickup this card very soon and do some spending on it so it’ll be primed and ready come NBA All Star Weekend in February.

Conclusion

I really think this is a great deal on quite a few levels as mentioned above. Given the combination of Amex Offers, high sign-up bonus, no annual fee and 5% opportunities it is a card I think would be good for a lot of people. I almost applied before last year’s NBA Finals, but their website broke and I gave up. Now it is time to add it to my wallet. The only thing I need to decide is which team to customize it to! Actually, I have already made that decision.

[…] there was the NBA Amex card where the $200 bonus and Amex Offers are nice, but my real plan is to take advantage of its 5X everywhere earnings during NBA All Star Weekend […]

[…] today I wrote about my experience getting the NBA Amex card with its 20K ($200) bonus and no annual fee. That card has some amazing benefits like 5X everywhere earnings during specific time periods, but […]

[…] 20K Offer on a No Annual Fee Card that has Amex Offers, 5% Cashback on Certain Days & More. I&#… […]

Is this an everday AMEX? i.e. how do I determine what 20,000 points can be redeemed/transferred to?

No this is a 3rd party card. It earns points from BBVA not American Express.

Do you guys know which credit bureau they pull from?

Everything I’ve found is 100% experian. Shawn posted about a database in the past which is here: creditboards.com/forums/index.php?app=creditpulls

The fine print is NOT encouraging:

Superstores and wholesale clubs are excluded from bonus categories. Purchases made through a third-party payment account or on an online marketplace (with multiple retailers) will not earn additional points. A purchase may not earn additional points if the merchant submits the purchase using a mobile or wireless card reader or if you use a mobile or digital wallet to make the purchase.

I believe that pertains to the bonus categories like supermarkets. It really comes down to how Amex codes the transactions. For example, neither superstores nor wholesale clubs count as grocery stores on any American Express card. The language above is pretty standard.

I think every purchase during the 5% period counts. I’m pretty confident this is the case but take it as just my opinion.

In my experiences and from what I’ve read, they actually give much higher limits than other banks.

I’ve had mine for a while now and over the NBA Finals I bought $12,000 in AGC. Took a while for them to manually give me the 5% but months later they did in fact give it to me despite the post date being outside of the promo period.

Yeah, they definitely do whatever they can to slow down any recycling of your limit and in some cases account freezing. A quick call though and a rep will unfreeze it and let you be on your way with more purchases. In most cases I never felt like the rep was interrogating me. In fact you got the impression they deal with it a lot and they were preemptively wanting to let me be on my spending way and get off the phone.

I’m currently doing their $50 promo on my existing card and I just signed my wife up today. Her’s went into the 7-10 day pending, just like mine did when I applied, so I’m not too worried about it. I’m hoping to get an email in a few days with the approval response.

Also, contrary to what seems to be popular belief, you CAN set up automatic payments. It’s a bit of a pain but it’s doable and worth the effort, as it only takes one time to miss a payment and screw up your credit.

Is there a min to how much you need for a statement credit? Like do you need $25 in points or could I do $5.60 if I wanted to?

See my answer above, but the normal minimum is 2,500 points or $25. They do have an app that allows smaller redemptions.

Are these points membership rewards?

Nope, just points that are effectively used towards cash back at 1:1 ratio. Hence 20,000 points is $200. IIRC you can redeem them for other things but there’s really no point when the best option is a statement credit redemption. Or in the case of the new BBVA Wallet app you can even redeem your points against a purchase so that you are redeeming them in real time.

Compass Bank is actually upping their game lately and while their service is still very fragmented between their bank and credit card department I’m excited to see where this all goes.

Thanks for stepping in and answering Anthony!

So it is not count towards the 4 cards limit on Amex, right?

It’s a third party card which don’t go against your limit of 4 credit cards. Costco and SPG are two of the notable exceptions to Amex cards that count against your limit.

You’ll be able to load Serve and you’ll get the 1% cash back as well. So if you link this card you’ll get $10 in cash back and meet your minimum spending right off the bat.

Wow. That’s awesome. Imagining loading serve during all-star week!

Just clicked your link to sign up and the bonus is only 10000 points for $500 spend in 3 months.?? What gives?? And, does it give Amex Membership Rewards points that will go into my Amex Platnum to increase my Amex points or????

The front page says 20,000 but apparently they haven’t updated all of the pages. You can call the bank if you want to confirm. Others have called and have been told everyone will get 20K, but I understand your concern. BTW that is a direct link to the bank’s website and is not an affiliate link. Thanks!

Is $25K a low credit limit? Cuz thats the highest in my wallet to date.

5x on Serve loads? Minimum point redemption?

Minimum point redemption is 2,500 although they have an app you can download that sometimes allows you to redeem real time for your purchases. http://www.doctorofcredit.com/bbva-launches-real-time-redemption-50-for-1k-spend-offer/

Yeah I used the BBVA wallet app to redeem the $2.80 in points I had towards a purchase as part of the $50 promo I’m in the midst of completing 🙂

5x for Amex Serve loads?

Could be but that is a financial transaction and may not earn the bonus. I have heard that this card does work for making online Serve loads though without a cash advance.

It works great for Serve loads. I use it monthly on a Serve account I manage.

I’m still hanging on to my MC loads on Softcard, but this is good to know!

One other benefit that probably get’s swept under the rug is that by showing monthly usage of the card, when the time comes to hammer the promotional window we’re more likely to not have the system put a freeze on our account. Call it a hunch but that’s what I believe will be true.

But what can you redeem for these points? Is it just cash back?

Yes each point is worth $.01.