New Chase ‘Cash-like Transaction’ Definition

Most credit cards let you get cash or “cash equivalents”. But using your credit cards for such transaction results in a “cash advance,” which comes with fees and higher interest rate than regular purchases. The exact definition for these cash equivalents, or cash-like transactions, varies from one bank to the other.

Some things like withdrawing money at an ATM or buying money orders are a common example of cash-like transactions. But some others are more in the grey area. Now Chase has updated the definition of what constitutes a “cash-like transaction”. The issuer notified cardholders this morning with an email titled “Important information regarding changes to your Chase account.” Let’s see what this update includes, and how it could affect you.

Chase Cash-like Transactions

The updated Card Agreement includes changes to the minimum payment calculations and amendments to the Interest-Free Period and Cash-like Transactions. All changes take effect 4/16/2021 (at least for me, but this could vary by account).

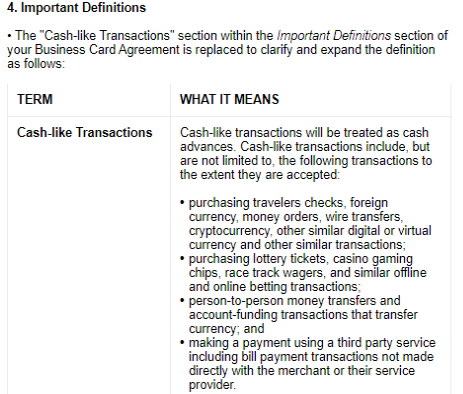

Regarding “Cash-like Transactions”, the Card Agreement has been updated to clarify and expand the definition as follows:

- Cash-like transactions will be treated as cash advances. Cash-like transactions include, but are not limited to, the following transactions to the extent they are accepted:

- purchasing travelers checks, foreign currency, money orders, wire transfers, cryptocurrency, other similar digital or virtual currency and other similar transactions;

- purchasing lottery tickets, casino gaming chips, race track wagers, and similar offline and online betting transactions;

- person-to-person money transfers and account-funding transactions that transfer currency; and

- making a payment using a third party service including bill payment transactions not made directly with the merchant or their service provider.

Here’s a screenshot of the email I received for my Chase Ink Business Cash card:

What It Means

The short version is that no one knows for sure. And then there’s also the issue of whether it will be enforced or not. But there are some possible scenarios where this could be troubling.

“Account-funding transactions” for example could put a stop to funding new bank accounts with a Chase credit card. That’s often an option when opening an account online. Bill payments through a third party and not directly with the merchant, could mean that services like Plastiq and PayPal Key will now code as cash advance as well. Then there’s things like lottery tickets and online betting, which has become very popular rceently.

Again, we will not know this for sure, until and if these new updates are implemented.

Conclusion

The optimist in me would say that these updated agreements don’t always translate into action. But I would still be careful making any large purchases that could be treated as cash advance after the the April date when these changes take effect.

If you want to make sure that you are not charged a cash advance fee, a good way to avoid it is by setting your cash advance limit to $0. That way your card will be declined if you are attempting a cash-like transaction.

Let us know what you think about these updates and how they could affect you.

Does this mean that donations to charity on their website are now Cash Advances? And person-to-person payments via Venmo or PayPal are also Cash Advances? If so, time to change cards.

Venmo and PayPal will be cash advance (had already started to change for some cards). Not sure on Charity, I would imagine not.

Seems to me that “cash-like transactions” includes transactions made through services, such as PayPal and Apple Pay. I use Apple Pay frequently when shopping online due to its simplicity as compared to finding my wallet and digging around for my credit card. PenFed did this last year, which took effect in March 2020. Just another way to make a killing off us.

I got 3 letters in the USPS mail today about this, my ink plus said the changes take effect 3/28; my United said 3/29; and my freedom said 4/2

Following

I used to pay my electric bill via a 3rd party service that charges a $3.50 fee each month…..Western Union, which contracts with Florida Power and Light as the only way you can use a credit card. Same thing when paying my $900 per quarter HOA fee……it is done thru a 3rd party system which allows you to use a credit card. I never used a 3rd party to pay my mortgage for a small charge, but lots of people do. This will affect them as well. Some people do the same thing with car payments. This policy looks like it will stop these type of activities if they will now be “cash advances” and not receive any points or miles. Guess will need to use Barclays, Citi or other banks for these purposes. What do you guys think? Do you think I understand this correctly?

Seems like a smart move by Chase to help cut down on mfg. spending but we’ll see.

Got one notice and that is only on my one Business card. I am wondering if this is limited to the Biz cards only as a trial run?

Does Chase allow you to set your cash advance limit to zero? They told me the lowest number was $20 which seems ok to me to avoid problems.