Issues with No-Fee Amex Hilton Aspire Offer?

A couple of days ago, we wrote about a bonus of 150,000 Hilton points for the Aspire card. What was special about this offer was that it also waived the annual fee for the first year. This is a huge deal, as the fee is $450. But we warned that there’s also some risk involved. The offer is no longer available, but many people have applied already.

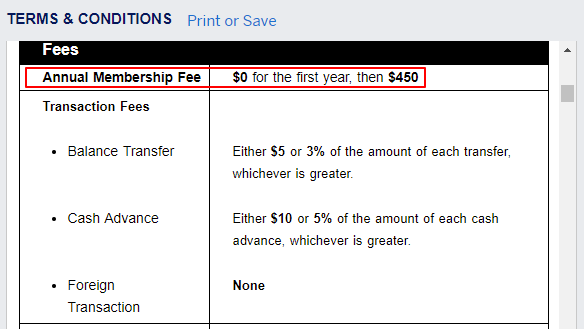

Some American Express reps are denying that there was such an offer even though it was on the documents during application. “Annual Membership Fee $0 for the first year, then $450”. You can see the screenshot below which we also posted in the original article.

There is some speculation that the offer was intended for military people but I doubt that is likely. American Express pulled down all Aspire links quickly so I think it was just a glitch. I’m sure they will try to make people pay the annual fee for the first year, but hopefully you have screenshots showing the waived annual fee. You can also use our image above.

Conclusion

Hopefully Amex honors the offer they provided. But, if it comes to fighting Amex over the annual fee, you have to decide for yourself if it’s worth it. Yes it is a lot of money to pay, $450. But it is also possible that it can jeopardize your account or future offers.

We are not attorneys but we think there would be legal precedent that they would need to honor it if you can show it in writing. Contact your legal professional to be sure it is an option though.

Let us know if you applied, and what you plan to do if they do not waived the annual fee.

My bonus miles still hasn’t posted and it’s been 2 months. My past experience with other Hilton cards is they bonus post as soon as spending is met. Not sure if there is something with this no fee card

Have had the Aspire for over a year, you all who got it for the $0 AF made out like bandits! Good for you.

Of course screen shots can be modified to look however you want. In addition to screen shots I would document blogs, etc. showing others had the same offer.

received the card today and the card agreement says 0 dollar first year

Glad to hear that Alan!

I got my card and cardmember agreement today via UPS. It says $0 AF for first year.

Mine and my wife’s too. Never rely on phone representative.

Awesome!

Applied on Monday, got the card today and the agreement does say $0 for the first year. Not seeing any fee post in the account

Usually it doesn’t post till around the time the first statement posts. Glad to see the paperwork says no fee. Let us know if it is still good to go after the first statement if you can…would be much appreciated Mowogo!

I would think their denial in the face of printed (screenshotted) evidence would make a complaint to the CFPB worthwhile.

CFPB has lost a lot of their power. Even with evidence people haven’t been able to get anywhere with them for a few years. I know they helped me out big time with the 100K leaked Platinum offer a while back but they can’t do much anymore.

I received the card in the mail today. Cardmember agreement says $0.

My card has already been added to my online account and the cardmember agreement tied to it shows $0 first year.