PayPal Overcharged Me

My wife was recently approached about buying some Little Caesars Pizza Kits for a family friend’s fundraising sale. We decided to purchase some crazy bread from them and I chose to PayPal her the money. I decided to pay her with a credit card, even with the fee, to work on some minimum spend I needed to get done. It turns out PayPal overcharged me and I wonder if this is a widespread issue.

Details On The Billing

The package of crazy bread cost $18. PayPal said the credit card fee would be 82 cents. My Paypal balance was sitting at $14.02. It was left over from my Kindle Fire sales and I had not gotten around to transferring it to my bank yet.

I decided not to transfer the $14.02 before sending the money. This is usually done before making a purchase to ensure no PayPal funds are used. I do this before all eBay purchases but I thought that was more of an eBay rule then it was a PayPal rule. Paypal had recently changed their policy when paying for shipping so I thought this would be more in line with that.

I honestly don’t remember being notified that they would use my PayPal balance first when making the payment. They could have warned me and I just missed it. I assumed, since I chose credit card payment and agreed to the fee, that they would leave my PayPal balance alone.

Later in the day I was looking at my credit card transactions online and noticed the charge on the card was for only $4.80. I immediately realized that they had used my PayPal balance first but thought “no big deal”. I went to PayPal to look at the details just to confirm my assumptions and that is when I realized they had over billed me.

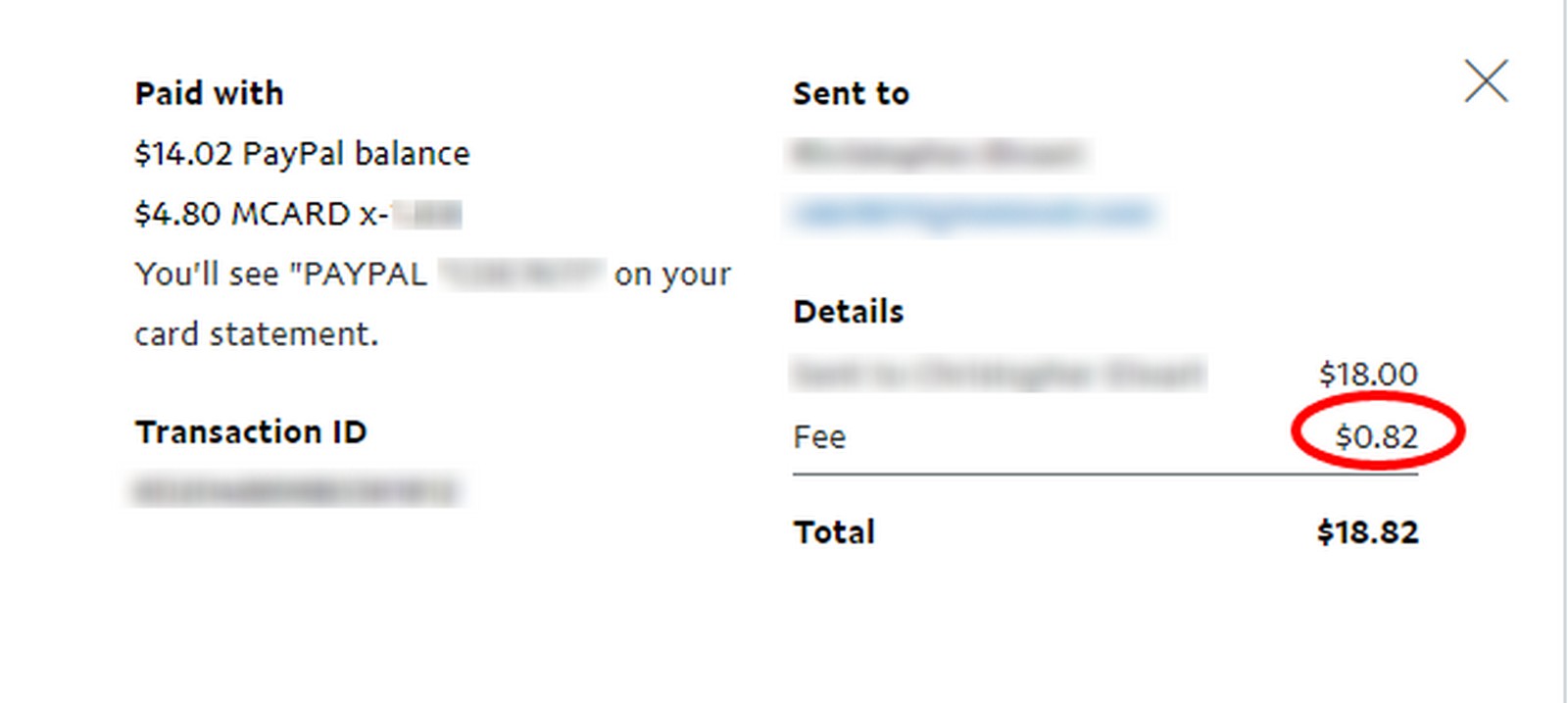

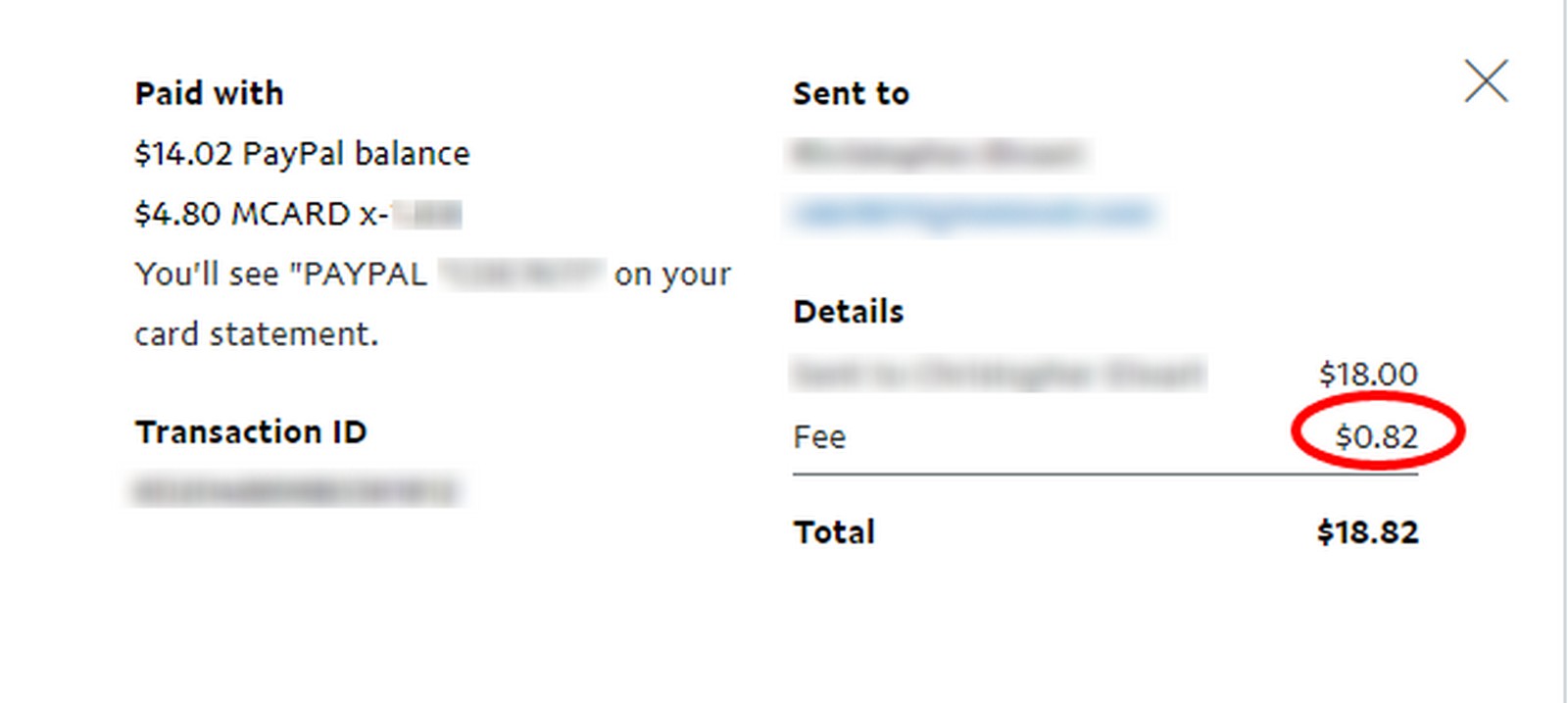

Proof of the Over-Billing

When I had originally picked credit card payment I was told that the fee was 82 cents. I was surprised when I looked at the detailed billing info and noticed I was still billed 82 cents in fees. Even though only $3.98 was technically billed to the credit card before the fee, not the full $18.

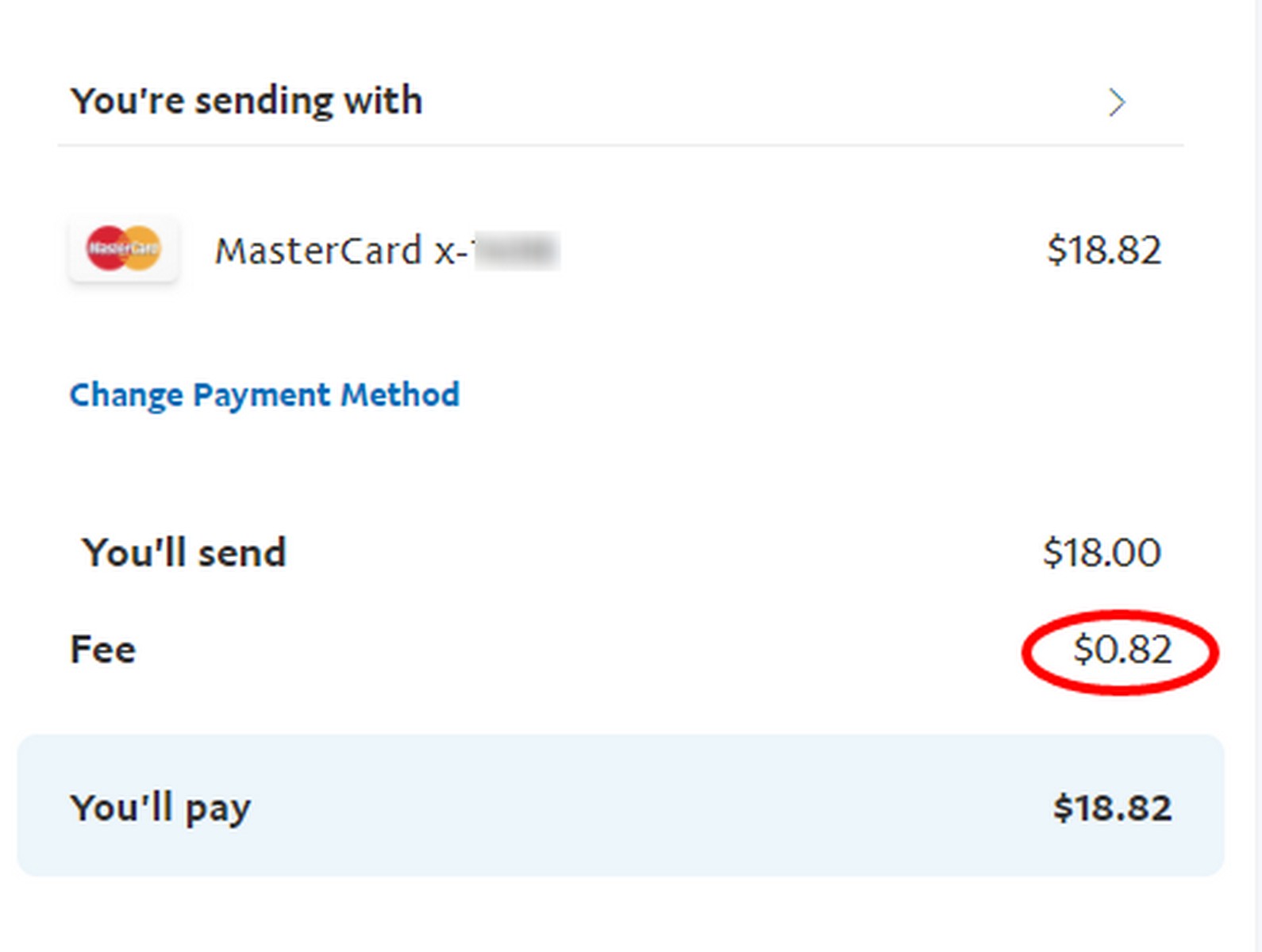

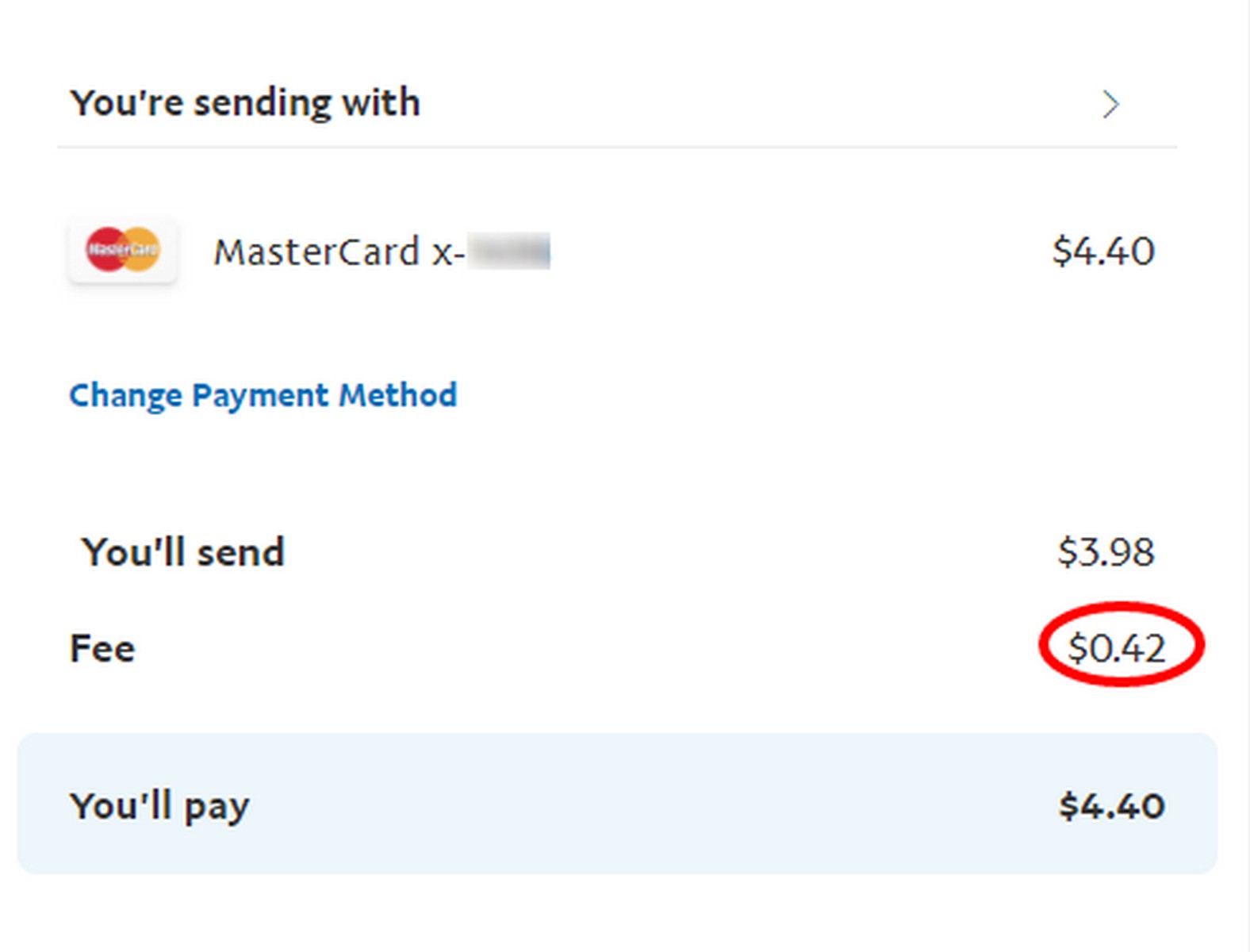

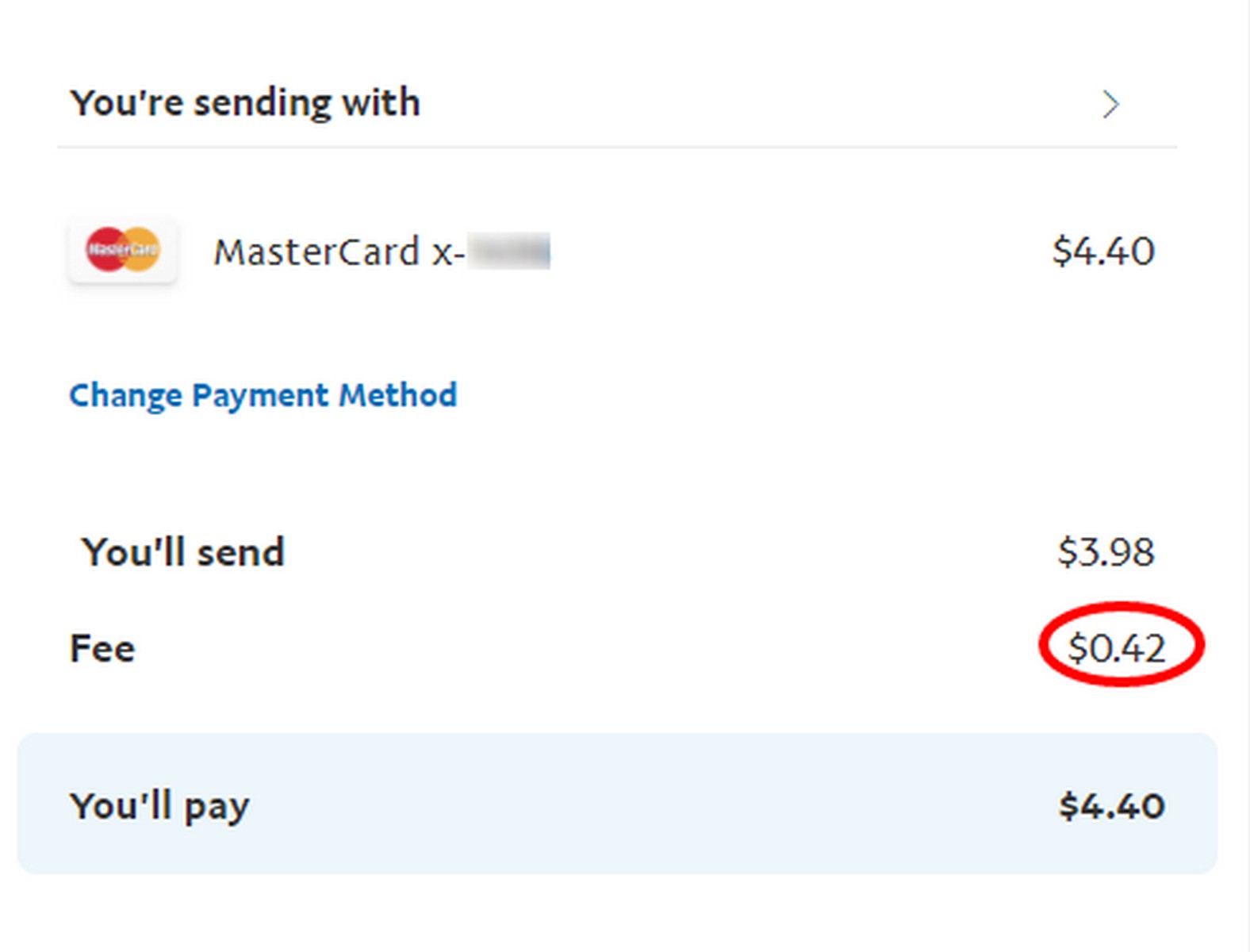

Just to ensure I wasn’t going crazy I set up a test payment for $18 to see what it is supposed to bill using a credit card.

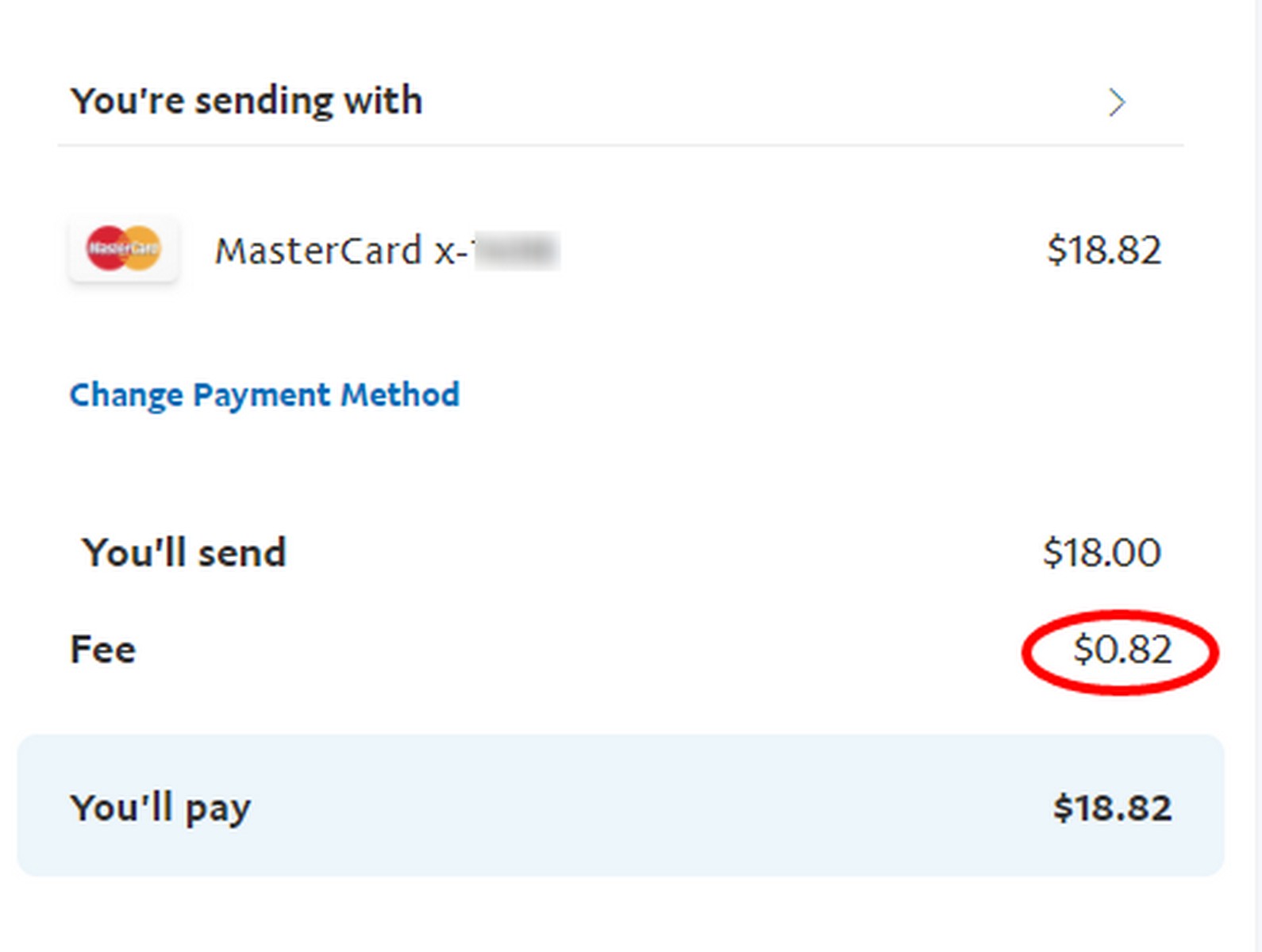

As you can see the fee is the same – 82 cents. I then did a test payment for $3.98, which is the amount that was left over after using my $14.02 PayPal balance.

As you can see the fee should have been changed to 42 cents since my PayPal balance covered the first $14.02 of the bill. Paypal overcharged me by 40 cents.

Conclusion

Now 40 cents is not a big deal in any way but it is surprising that PayPal, a technology based payment company, would have what seems to be a system glitch like this. PayPal does over 5 million transactions per day and how many of them have this glitch? 40 cents is not a lot of money but if you do it a couple million times per year that can add up pretty quickly. And what if I had made a larger purchase with a bigger PayPal balance? The overcharge amount would have been much higher.

I guess the lesson learned is to transfer all of your money out of your PayPal account before making any transaction with them. Hopefully PayPal is alerted to this issue and makes the proper corrections. I would not be surprised to see a class action lawsuit sometime in the future if this is as wide spread as I think it may be.

Has this ever happened to you? Let us know in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Im late to the party too. A recent purchase I made where the merchant price was E90.90 and the Paypal receipt sent to me also stated E90.90, however they requested E94.58 from my linked account and got it. Ive started looking back at a few more transactions, Receipt says E77.50 but they billed my account E80.75. My bank seems to think that they are doing some shady maths with currency conversion but when I check Paypal’s receipts, they have done the conversion on the receipt and given me the correct total in Euros eg E90.90 yet they seem to have done a different conversion and requested the E94.58 from my bank. Sinilarly, another transaction cost E119.99, Paypal receipt said 119.99 but they requested E124.45 from my bank. Im shocked!

I know I’m a bit late to the party, but I received a refund from a purchase I made using PayPal credit, their 6 month interest free purchase agreement. First, I did not receive the full amount which I paid it was $5.00 short, not a big amount but I’m still getting charged. Secondly, PayPal took the refund off my total balance not the original purchase. This purchase remains in my account accruing interest until my 6 months interest free is up. I have called PayPal and was told I was charged a fee for a refund which no one can answer as to why and I keep getting the promise that this purchase will be removed from my account, which hasn’t. I have no other option but to keep calling every week until my refund issue is resolved, but as you say how many others are being charged these unexplained fees and aren’t necessarily noticing these charges. My guess is they think no is noticing this and they are making a fortune in fake fees.

What a mess – hopefully you are able to get it straightened out Susan.

I believe that there may be an intentional strategy to overcharge. On this month’s bank statement, I was overcharged by pennies on more than an half-dozen E-bay transactions! When I called E-bay, they pointed the finger at PayPal. When I called PayPal, the system disconnected. When I called the Bank, they said that they’d immediately issue a refund because it would cost them more to go after PayPal! The bank writes if off as simply “the cost of doing business,” and that is exactly one of the strategies PayPal is counting on… that, and witless customers who are willing to dismiss statement discrepancies amounting to only a few cents (less than a U.S. dime) per transaction. Imagine how much they are raking in on the hundreds of thousands of transactions that are overcharged by “just a few pennies!” This has got to stop! Class-action anyone?

That is crazy and disturbing to hear that they would do it so often on your account.

I have been overcharged on paypal once again. A friend who I had loaned money to paid me back on Paypal. She had borrowed 180€ and paid me back that amount. Paypal charged me 9€ on the transaction. And after 18 emails they send me only the same disclaimer of charging 2% on the transaction. This is well above the 2%. Is there any legal facitity where I can sue them. I really have had it with this dishonest and thieving company. Needless to say I will be closing my account. I have found a new cheaper more honest company called Lydia if anyone is interested.

Smalls claims court would be an option but probably not worth the time/effort and I am not sure if that would work since you are not in the US. Did you friend pay the money with a Credit Card? I don’t know why they would charge you a fee for getting money unless your account is set up as a business account.

I’ve also noticed when issuing returns to customers through paypal they sometimes will take a few extra cents out of my account.

Interesting

[…] PayPal Overcharged Me – Are They Doing it to Others Too? […]

I just bought something on Ebay through paypal and shipped from Canada. I have free forex on my cards, but they charged me in USD at a rate of 1.22 CAD/USD, even after showing how much it would cost in USD at the proper exchange rate of 1.18 CAD/USD, and after showing the true cost in CAD in the checkout. I filed a cfpb complaint and I’m waiting for resolution to get my $7 back.

Shady all around!

Kudos on the great post but if I were you, I would have consulted with a class action law firm and taken credit for this finding/investigation. This is YOUR finding. This may or may not be intentional on Paypal’s part but it doesn’t matter – their dev/QA teams should have caught this or someone in their business should have. Either way, you don’t want to be just part of the class, you want to be a representative plaintiff.

A related story: last year, there was this period where Paypal would refuse to use the payment method I specified. Now this was back in the day where Paypal would automatically use any PP balance you had (I was aware of that). But even if I cleared out the balance, and then checked out and specified to pay with a credit card for a purchase, it would then… use the wrong payment method. More specifically, the cheapest payment method for them.

Eg first it used a bank account instead of the credit card I specified. Then I deleted that bank account. Then it used a different bank account (I had two linked). I removed all bank accounts. Then it used the PP Extras MC rather than my chosen Amex. Then I closed my PP Extras MC. Then PP would still try and charge it…. and hence error as it was closed. Only when it was fully removed and there was just one payment method left, would PP actually use that one.

Given the shadiness of the company, could it be intentional that some users’ payment methods default to the ones cheapest for Paypal rather than convenient for the user?

PayPal is definitely a hassle to deal with sometimes. Unfortunately eBay makes using them a necessity. I also hate the continuous verification loops you get buying from PPDG sometimes….drives me insane.

[…] PayPal Overcharged Me – Are They Doing it to Others Too? by Miles to Memories. I’ve never noticed PayPal doing this, but I’ve also never looked for it either. Please report any datapoints you have over on that post. […]

This instantly reminded WF overcharging customers (for weight of the containers) from last year. They were fined for these “tricks”

Interesting – I didn’t hear about that

Agreed that this is the exact type of situation class action lawsuits were designed for. Each individual transaction is not worth pursuing, but there are literally millions of such transactions. You should call a lawyer and be the lead plaintiff now!! The lead plaintiff usually gets a nice bonus as part of whatever settlement that comes out of this.

and as always, if they have to pay the judgement, its their customers that will foot the bill eventually.

You are given a choice of using the credit card, but at the bottom of the payment screen there is a check box that you also need to uncheck that allows the PayPal balance to be applied.

Good info – thanks Pam. I will make sure to pay more attention next time! Even if it is missed they should not be overcharging when they use your balance for a large chunk of it.

Of course if you transferred the balance out first you would have still paid the same 82 cents, so you wouldn’t save anything. You’d just keep them from maybe profiting from the miscalculation.

It wouldn’t have saved me money but I would have gotten the spend on my credit card which was the point of using it in the first place. I also am not a fan of giving money to a company’s bottom line just for the heck of it 🙂

This is prime class action material here.

That is what I was thinking…I highly doubt I was a one off.

What really irks me is when both ebay and paypal take a percentage of what my customers pay me for shipping fees.

Good point!

yeh, that adds up.

on my paypal account there is a choice of where the money comes from. yours is different?

There is a choice and I chose to pay with a credit card. They sent the money but decided to use my PayPal balance first and then paid the rest with the credit card. But, they still charged me the full fee for the payment as if I paid the whole thing with a credit card which is wrong.

Being a buyer and seller on ebay for 15 years, this is why I have always kept 2 separate paypal accounts – one for receiving money and one for paying money. This garbage of always taking money from your balance first has been going on for years and is just a way for paypal to try to make more money.

That is a great idea….too bad it would even come to that though. It seems like it should have been fixed a long time ago.

Not anymore. Now you can have Paypal balance and still use your credit card, starting recently.