Why You Should Consider Plastiq for Your Small Business

Many of our readers use Plastiq to pay bills with their credit cards that they normally can’t. People use Plastiq to pay their rent, car payments, their mortgage and plenty of other bills. They do it because it makes payments hassle free but more importantly it collects those all important miles & points! But what about for small businesses? There are many reasons that using Plastiq for your small business makes sense and I wanted to share some of those with you.

Note: Plastiq is running a $5K fee-free dollar sign-up promo for small businesses through August 31, 2019. Learn More!

What is Plastiq?

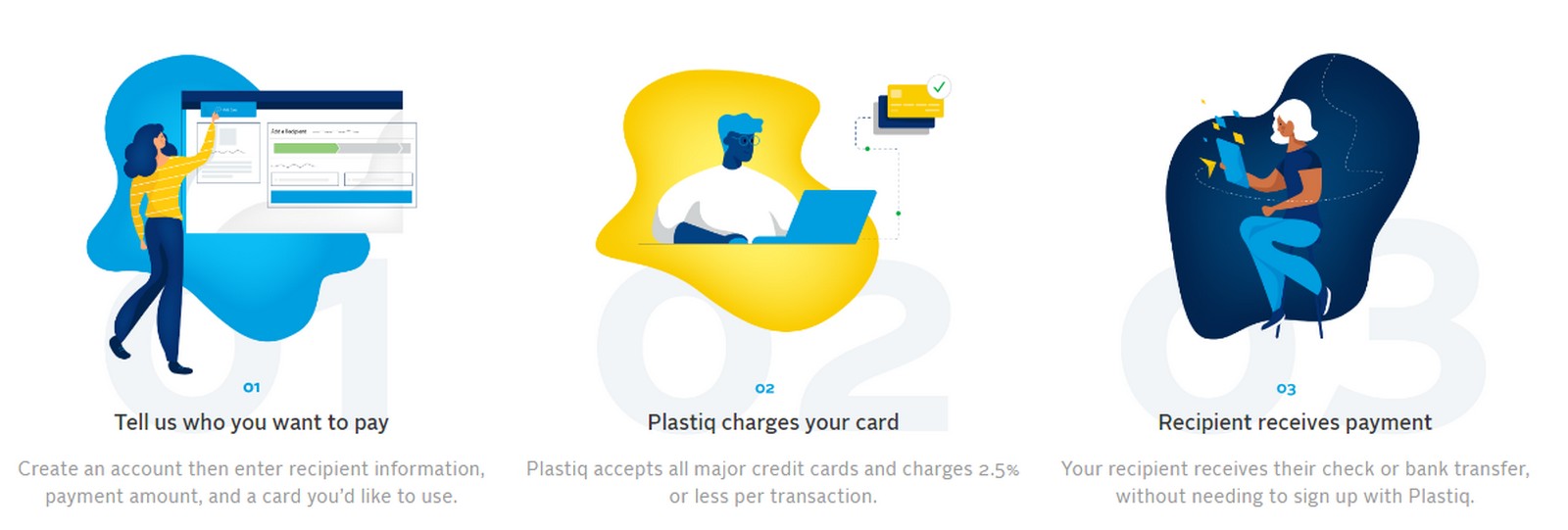

Plastiq is a very easy to use service that allows you to pay vendors/suppliers with a credit card in circumstances where you would normally only be able to pay with cash. You simply set up the payment info for your recipient in your Plastiq account, select which card you want to use for the payment and when you want to send it, Plastiq takes care of the rest! They charge a fee of up to 2.5% per transaction but Plastiq often runs promotions that reduce the fee. The best part is that the recipient doesn’t need to have a Plastiq account to get paid! The vendor will receive your payment via a check or bank transfer without needing to do anything on their end.

Here is An Awesome Chart On Which Cards Work For Each Card Issuer

Ways Using Plastiq Can Help Your Business

Now that we know what Plastiq is and that it can be used for your small business, let’s take a look at how it can be beneficial to you.

Cash Flow Is Your Lifeline

Cash flow is the lifeline of a small business. Many profitable small businesses have to close their doors because of poor cash flow. Especially in industries like construction where it takes longer to recoup your upfront investment for each job. Plastiq will allow you to stretch out your cash flow by up to 60 days if you time it right. It does this by letting you pay with your credit card for things that are normally cash only. That allows you to take advantage of your credit card’s built in grace period.

Rent Payments

Rent costs can be steep and are often one of your largest expenses. Using Plastiq for your rent payment can let you rack up tons of rewards on this huge expense. It also allows you to set it and forget it which means you will never be late on a payment. Because if you don’t have a “roof over your head” then you don’t have a business to begin with!

Discounts for Cash Payments & Early Payments

Some vendors and suppliers will give you a discount for paying in cash. And sometimes that discount may be larger than the fee Plastiq charges. That means you get to earn your credit card rewards for free or maybe even at a small profit.

Vendors and suppliers will also often give discounts for early or on time payments. And if they only accept cash payments it can be hard to be sure you are on time every month with everything else you are juggling. You can set it and forget it with Plastiq!

Credit Card Rewards

I keep hinting at credit card rewards so of course they make the list! These can possibly outweigh the Plastiq processing fee. That means you can come out with a net positive simply for paying your bills. Whether it makes sense will depend on which card you use and the current Plastiq fee, but it is possible to pad your bottom line directly from credit card rewards.

It Can Be Cheaper & Easier Than Getting a Line of Credit

One of the other ways small business owners get access to cash flow is from getting a line of credit. Applying for a line of credit can be time consuming and it might not be set up when you need it most. A line of credit also starts charging interest as soon as you touch the money. When using Plastiq you are charged a small fee up front but you can get up to 60 days interest free (depending on your billing cycle) which adds up to big savings in the long run.

Send Payments in Foreign Currencies

The last thing I wanted to touch on was that it is now possible to make international payments with Plastiq. They have also added the feature that you can make your payments in the vendor’s local currency which streamlines things some for you.

Plastiq Small Business Sign-Up Offer

Right now Plastiq is offering a great deal for small businesses that sign-up by AUGUST 31, 2019. While normal sign-ups only get $500 fee-free dollars after making a $500 payment, small business accounts will actually get their first $5,000 in payments free!

To sign-up your small business & get $5,000 in fee-free bill pay:

- Visit the Plastiq small business promo website (our referral)

- Click “Schedule a Call” and fill out the form.

- Sign-up for Plastiq with the same email address you put on the form.

- Wait 1-2 days for a call from Plastiq.

You can find the full terms of the promo at the bottom of the promo page. This is a great deal that gives businesses a chance to try out the service (and earn rewards) without having to pay. If you don’t want to schedule a call you can just sign-up normally, but you won’t get that $5K in fee-free spend.

Final Thoughts

Plastiq isn’t just for personal use as you can see. Using Plastiq for your small business has many benefits. And those benefits far exceed earning massive amounts of credit card points. If you want to improve cash flow, simplify your life or even add a little bit to your bottom line then be sure to check out Plastiq for your small business.

Thank you for a good summary, Mark. I have been a fan of Plastiq with a non-business account for many years, but the restrictions and fees have worn me down. Use the regular account, just put business expenses on the business credit cards. Unfortunately for them, gradually more & more vendors are accepting credit cards. Also, when I tried to pay my office mortgage, I had to go through hoops to prove I was paying a mortgage on a commercial property.

Tried to open a Business account using the link, but the 5K offer never appeared

Thanks doc – I will see what I can figure out on the 5K link and let you know when I have it for you.

Hi docntx. Follow the directions above just under”Plastiq Small Business Sign-Up Offer”, because there is one link to the offer where you have to fill out a form and then you need to sign-up with the other link using the same email.

Sorry it is a bit confusing and let me know if it doesn’t work.

I’ve learned to adore Plastiq…esp when they have a promo on fees. It’s terrific

It is hard to beat when they have fees.