Public Credit Registry Could Replace Credit Bureaus

During his campaign, president Biden floated the idea of transferring consumer credit ratings from major credit bureaus like Equifax, Experian and TransUnion, to a public registry under the Consumer Financial Protection Bureau.

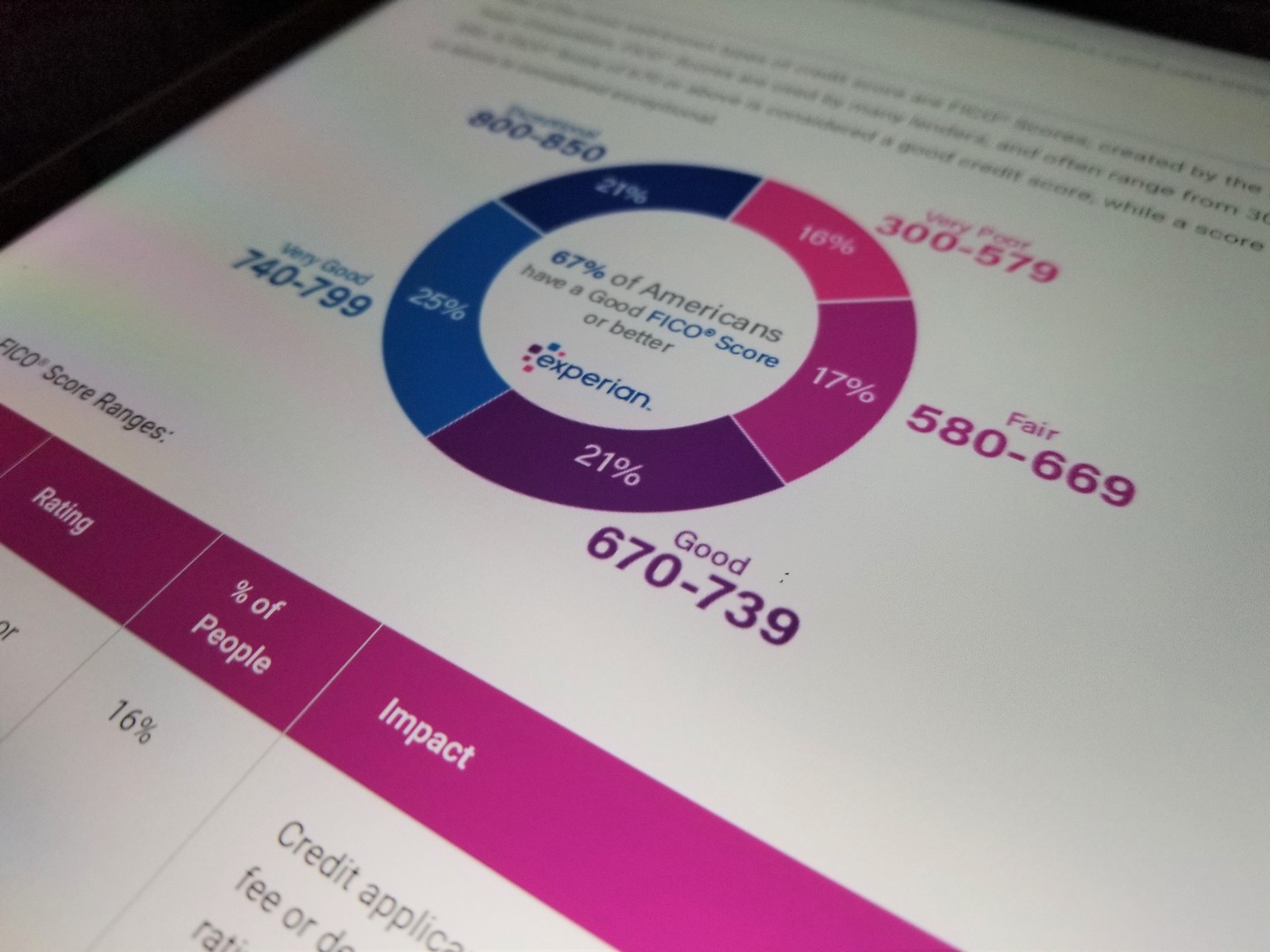

Credit reports and scores are a very important indicator for Americans. They directly impact economic security and opportunity, employment, housing and much more. If you have bad credit or no credit history you will pay more for loans and insurance. Or you could be denied completely.

There are pros and cons to this system. People who focus on improving their scores, pay bills on time, have loans and mortgages, will have an advantage. The cons are that the data is collected without consent, algorithms are not publicly available, errors are common, and there’s claims of racial disparity.

For now there’s no clear indication if a public credit reporting agency will be created. But if it is implemented, the Biden proposal should improve people’s access to their credit reports and will lead to standardized calculations. But on the other hand, if its is the government that controls the agency, it can lead to big volatility every election year if the criteria used changes with every new administration.

My reading of it is that while it may create a public registry (information repository) it may not obsolete credit scoring algorithms (e.g. FICO) which can be applied to the data from that registry, reducing the impact of “big volatility every election year if the criteria used changes with every new administration”. That is, it will store factual data and any recommendation/scoring it may provide may not necessarily be adopted universally (fwiw, FICO is often cited in credit applications, but most big lenders have proprietary risk algorithms based off their knowledge of you, including your credit report information, anyway)

FICO score is total garbage, I hope they revamp the whole system. A credit score only tell you that your currently in debt and how well your able to manage your debt.

Problem is if your great with money and have a debit free life you do not get a FICO credit score if your debt free for 6 or more months. When your debt free without a credit (debt) score then if you ever want to apply for anything credit card, home loan, cell phone etc…it becomes harder to do so as creditors only like to run/check your FICO score before they approve you. If you manage money well they must work harder to manually approve you biased on your wealth/assets Vs the automated way of checking your level of debt (credit score). Total backwards system which encourages people to carry debt Vs loving a debt free life. It would be nice to see a new system called financial score to measure your wealth and/or how well you managed debt in past-present life.

Hey Mike, I agree—and believe a similar system exists with FAFSA, the federal student aid program. When my first daughter was heading to college we completed the form–and were told we would be eligible for—I believe–for $500 in aid. :O I called and talked to someone asking how I could get more aid and was told “go buy a boat.” They noted the more debt, most likely the more money available. SMH

Add in a permanent ban on foreclosures, evictions and forgiveness of all tuition/medical debt and 100% of the population of the US will have perfect credit ratings and no monthly bills. Everybody is a winner!