Rakuten Cash Back Visa Destroys Earning for Gift Card Purchases

The Rakuten Cash Back Visa card is an interesting credit card that earns an extra 3% Cash Back on qualifying purchases made through Rakuten.com, in Store Cash Back Offers, Rakuten Hotels and Rakuten travel. Some of those merchants listed on Rakuten sell gift cards, such as GiftCardMall, GiftCards.com and Raise.

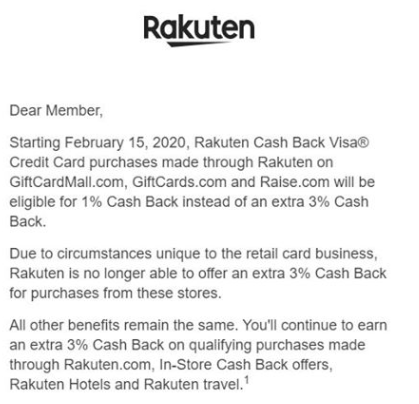

Now Rakuten has sent out notifications to cardholders announcing a change in the earning rate for these specific websites. It goes into effect on February 15th. Here’s what the notice says:

Starting February 15, 2020, Rakuten Cash Back Visa® Credit Card purchases made through Rakuten on GiftCardMall.com, GiftCards.com and Raise.com will be eligible for 1% Cash Back instead of an extra 3% Cash Back.

Due to circumstances unique to the retail card business, Rakuten is no longer able to offer an extra 3% Cash Back for purchases from these stores.

All other benefits remain the same. You’ll continue to earn an extra 3% Cash Back on qualifying purchases made through Rakuten.com, In-Store Cash Back offers, Rakuten Hotels and Rakuten travel.

Conclusion

Big hit for those who were using the card for these types of gift card purchases. There are a few days left though before this change goes into effect.

H/T Patrick and Brett

Yup, terrible news. The hits just keep coming. Where are all the shills who tell us it’s still “MS as usual” and “something else always comes along”?

Never got an email from them. However I paid my Visa in full a week ago and still have not restored my credit line.