Chase Sapphire Preferred Unboxing: Card Art, Welcome Offer & Application Details

I am back! I am finally back in the Sapphire family. Well my wife is back in the Sapphire family and brought me along for the ride. If you remember in my under Chase 5/24, now what piece I said we decided to go the Ultimate Rewards route instead of the Southwest Companion pass route for various reasons. Her Chase Ink Preferred application didn’t go quite as planned but she was able to snag the Chase Sapphire Preferred. Neither one of us has had a Sapphire product since 2014 and it feels good to be back. I thought it would be fun to do a Chase Sapphire Preferred unboxing post for anyone who hasn’t had the card before or in a while like us.

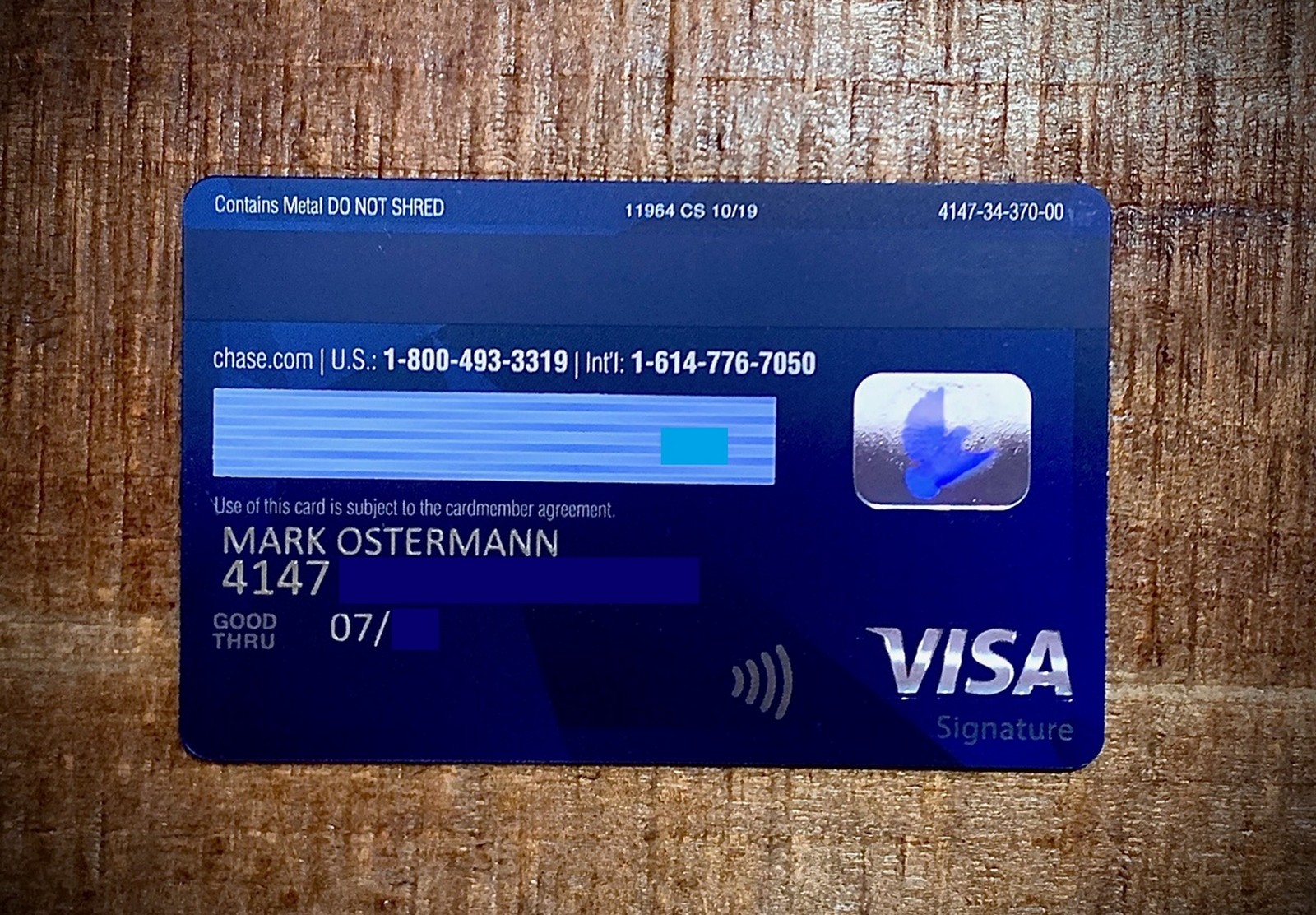

Chase Sapphire Preferred Card Art

I call it an unboxing because a lot of premium cards are sent in a nice box and are presented beautifully. That used to be the case for the Chase Sapphire Preferred when it was the big boy on campus but ever since the launch of the Chase Sapphire Reserve it is now the little brother. That means it comes in a regular paper envelope like most every other card. Even though it looks and feels like a premium card it comes with a non premium $95 annual fee.

Card Design

The card is still beautiful though and I like the tweaks Chase has made since the last time I had one. It is still shiny and beautiful front and back. I like that the card numbers are located on the back of the card which has become more popular these days but I believe started with the Preferred. You will find your name on the front and back of the card which is somewhat unique. But what I like most is that the letters and numbers are raised up and give a nice feel to the card instead of just printing them directly onto the card. Even the American Express Platinum card doesn’t quite pull the feel off.

And yes the card is metal, or at least it has a metal interior. It looks like there is a plastic coating on the front and back and a metal interior. You still get the firm feel in your hand but it doesn’t come with quite the weight of other metal cards. The nice side effect of this is that the card is a bit thinner as well. I have had issues in the past with thicker metal cards, like the Amex Platinum, getting a little stuck in chip readers. I think the Chase Sapphire Preferred is the perfect mix of sturdiness without having too much heft.

Chase Sapphire Preferred Welcome Offer

The Chase Sapphire Preferred has consistently ranked as the most value welcome offer for Chase personal cards. It is consistently one of the best offers in the entire travel space. Here are the current terms of the offer:

- 60,000 Ultimate Rewards points after $4,000 in spend within the first 3 months from account opening.

- The $95 annual fee is not waived

I value Ultimate Rewards at 1.8 cents a piece which puts this offer at a value of $985 after factoring in the annual fee.

I have long said the best way to approach the Sapphire family is to sign up for the Chase Sapphire Preferred and then upgrade to the Chase Sapphire Reserve after the first year. But with the recent changes to the CSR, increased annual fee and new perks I don’t value much, I plan on just holding onto the Sapphire Preferred instead.

Another thing I like about the Preferred, versus the Reserve, is that you can add authorized users for free. It is almost like I got a new card as well with this sign up. I may be just riding my wife’s coattails but I am loving every minute of it :).

Application Process

We haven’t had a Sapphire card in 6 years because Chase changed their application rules, adding Chase 5/24 to the card, right around the time we were eligible to get it again. Here is a quick breakdown of Chase 5/24:

- Chase will automatically deny you if you have opened 5 or more accounts in the last 24 months. These include credit cards from all issuers although most business cards are not included, even Chase business cards. For more info click here.

Chase also installed a Sapphire family rule a few years later as well:

- This product is available to you if you do not currently have any Sapphire card.

- This product is available to you if you have not received a new cardmember bonus for any Sapphire card in the past 48 months.

Those are two pretty big hurdles for anyone that has been in the miles and points game for a while. I am happy that we were finally able to navigate our way to being good on both.

Final Thoughts

I plan on using the Chase Sapphire Preferred for most of our travel going forward. It will be our go to for car rentals for sure since it is one of the few cards with primary rental insurance. And when I am not working on the World of Hyatt card’s $15K free night my flights will go on it too for the trip insurance. Remember that World of Hyatt has some decent trip insurance too.

I plan on making the card a long term keeper for us, even if my annual fees are a bit out of hand. I think the travel insurance, especially the primary car rental insurance will cover the $95 annual fee for us.

Do the math. One has to spend $19000 on travel and dining annually with the Chase Sapphire Preferred accounting for the $95 annual fee to match a nominal 2% no annual fee cash back return using the Chase Travel Portal redeemed point valuation of $0.0125/point. One has to spend $6550 on travel and dining annually with the Chase Sapphire Reserve accounting for the old $450 annual fee minus $300 travel credit (travel credit does not earn points) to match a nominal 2% no annual fee cash back return using the Chase Travel Portal redeemed point valuation of $0.0150/point. One has to spend $10550 on travel and dining annually with the Chase Sapphire Reserve accounting for the new $550 annual fee minus $300 travel credit (travel credit does not earn points) to match a nominal 2% no annual fee cash back return using the Chase Travel Portal redeemed point valuation of $0.0150/point. Thus, there really is no rationale for keeping a Sapphire Preferred unless one has a high value on the primary collision damage waiver and other insurance benefits and little rationale for keeping a Chase Sapphire Reserve with the new annual fee unless Door Dash and Lyft benefits work for you. I have enjoyed the Chase Sapphire Reserve but will not pay the new annual fee. The object of this game is to put the most money in your pocket at year’s end (and not the banks) and that is much more easily accomplished with cash back credit cards.

Not sure where you get $19k from. I value Ult Rewards at .018 a piece that would be under $6k in travel or restaurant spend versus a 2% card to break even. $95/.016 difference. That is with a zero value on primary car rental insurance so it works for me. But everyone has to plug in their own numbers for sure.

Left side of equation is Chase Sapphire Preferred.

Right side of equation is a 2% no annual fee cash back card.

Redeemed point values above $0.0125/point Chase travel portal are possible but require extra work usually from business or first class flight redemptions which may not be achieved by many. Most bloggers do not account for annual fee in net return calculations. Redeemed point value has a very significant impact on return.

How do you get $0.018/point redemption value?

[($19000 annual spend on travel/dining)*(2 point/$)*($0.0125/point)]-$95 = 0.02*$19000

I haven’t used the portal in 8 years of collecting Ult Rewards points. If you are only booking through the portal at 1.25 cents then you leave a lot of value on the table. I often get over 2 cents per point using travel partners and never less than 1.5 but the average has been around .018 cents. It works for me but may not for everyone. I will say pretty much everyone would do better using partners vs the portal.

Hi Mark,

$985 value is bit too high since spending $4000 would get you some bonus from other credit cards too.

Most every welcome offer is $3k-$5k in spend these days so I don’t see a need to discount it much honestly.