Disney Cruise Travel Hacks

Everyone knows Disney Cruises are pricey and normally cost a bit more than other cruise lines like Royal Caribbean, Carnival and Norwegian. The verdict is out on whether the higher cost is justified but those that have been on a Disney cruise before gush excessively about their experience.

Besides paying for the Disney name and brand of hospitality, some of the features like Disney Broadway-like shows, fireworks at sea, character meet-and-greets, Castaway Cay (Disney’s private island), a fantastic kids club and red-carpet treatment, is why people set savings goals to pay for and experience Disney Cruise.

A few months ago, I started looking at 4-night Bahamas cruises departing from Miami in April, 2018. You see, Disney Cruise Lines publish their rates, schedules and allow reservations about 1.5 years in advance and the earlier you book, the lower the price. With Disney Cruise Lines dynamic pricing structure, each cabin category has a starting price. As cabins fill up, the prices increase so it pays to book waaaaaay in advance as Disney Cruises usually sail at full capacity.

We are Disney Annual Pass holders and take our twin girls to Disney a few times a year but for a while now, we’ve been toying with idea of taking the girls on a Disney Cruise. As a self-proclaimed “travel hacker”, I’m not content with paying full-price for a Disney Cruise, even if I do book over a year in advance when Disney releases new dates.

Insert, credit cards rewards.

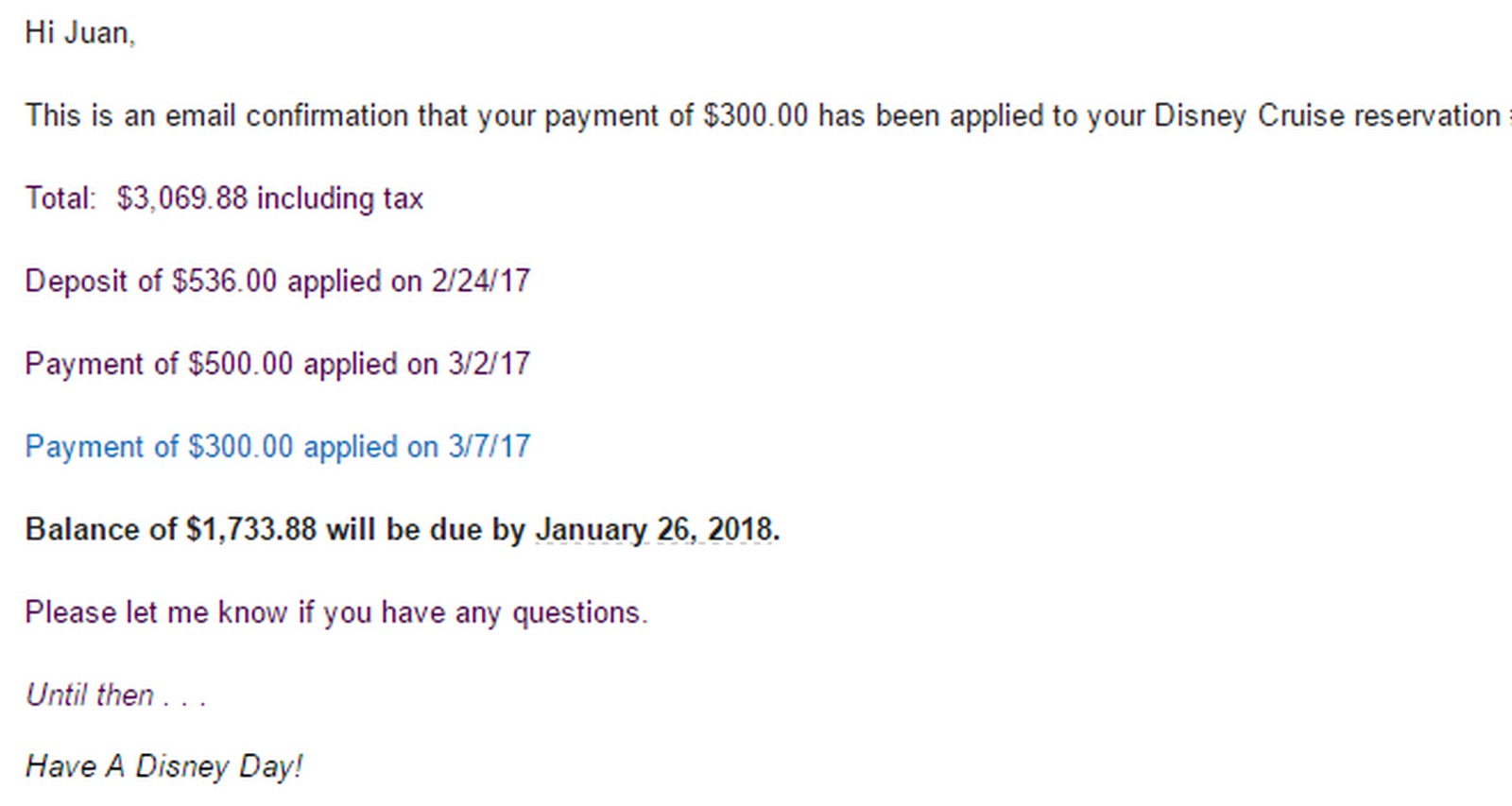

I began on a cost-cutting mission to reduce our 4-day Bahamas Disney Cruise from the original $3,069 to a lesser price. I knew two principle ways to save on a Disney vacation so I began to look into which credit cards offered statement credits as reimbursement for travel-related purchases and discounted Disney gift cards.

Steps to Travel Hacking My Disney Cruise

1) Barclaycard Arrival Plus

My wife had opened this card last year and after spending $3,000 in the first 90 days, she earned the sign-up bonus of 50,000 (plus 3,000 from spend) which equated to $530 towards any qualified travel expense. The $89 annual fee is waived the first year, so you have 12 months to enjoy the sign-up bonus, and evaluate the other card benefits to decide if it’s worth keeping long-term.

Since our goal was to cut down the cost of our Disney Cruise, we used the entire sign-up bonus, which was actually $536, to lower the cost from $3,069 to $2,533, a savings of about 18% the original cost.

2) Bank of America MERRILL+

I was eyeing this card for quite a while as the sign-up bonus of 50,000 points after $3,000 spend within the first 90 days seemed to good to be true for a card with no annual fee. The sign-up bonus could get me $1,000 worth of airfare for 50,000 points or a $500 statement travel credit.

I knew I could get more ‘value’ out of the airfare redemption but I had a set goal and wanted to lower my Disney Cruise cost even further so I opted to reduce the cost by $500 more. My balance now went from $2,533 to $2,033, for a discount of 34% of the original cost.

3) Chase Sapphire Reserve

Ahhhh, the CSR. By now, you’ve probably grown tired of hearing about this card. I was approved for the CSR last year and despite having a $450 annual fee, the whopping sign-up bonus of 100,000 Ultimate Rewards and two $300 travel credits before the second annual fee is due, made it a no-brainer in my book.

Before Chase announced the 100,000 offer would be reduced to 50,000 on March 12th, I had my wife apply in-branch and she was fortunate enough to get approved. Immediately upon getting the card, I called my travel agent (more on this later) and asked her to charge my wife’s CSR for $300 towards the cost of our cruise. Our balance was now down to $1,733 and at this point, I had already reduced my cost by 44%.

4) My next plan of action was to maximize the return on the remaining $1,733 left on my Disney Cruise balance.

I knew the Discover it card was popular among cash back enthusiasts for it’s 5% cash back (similar to the Chase Freedom) in rotating categories such as gas stations, restaurants and wholesale clubs. Discover also matches ALL the cash you’ve earned at the end of your first year as a cardholder so this card can be extremely lucrative.

I signed up for the Discover it card as I had been wanting a Discover credit card product for quite some time. Not a coincidence however was that I knew BJ’s Wholesale Clubs sold $100 discounted Disney gift cards online for $94.99, without the need to be a member. With the Discover it card, I’d be earning 5x per $1 spent at wholesale clubs in Q1 and Q2 of 2017. See where I’m going with this?

Hold on tight, here comes some MATH…..

-

Purchased $1,700 in Disney gift cards from BJ’s for $1,614.83 (saved $85.17).

-

Maxed out Discover it card quarterly spend at wholesale clubs (5% of $1500; 1% of $114.83) and earned $76 cash back.

-

Discover matches your cash back at the end of the year which means the $76 cash back turned into a $152 return.

With the BJ’s/Discover combination, we saved $237 more and our new and final balance was $1495 for a total savings of 51% off the original $3,069 Disney Cruise price. My new cost for our Disney Cruise vacation was now $373 per person for my family of 4!

I’m in total agreement with many of the comments on the savings, but am I the only one that chuckled at this statement?

“Everyone knows Disney Cruises are pricey and normally cost a bit more than other cruise lines…” Yeah, and LeBron James is a bit of a better basketball player than me.

Some math on the opportunity cost. OP spent 4000 on CSR, 3000 Merrill, 3000 Barclay and 1500 Discover. A 2% cashback card will pay you a refund of .02 x total spent. In this case the cash refund would have been .02 x $11500 = $230. The opportunity cost should be subtracted from savings. So if you think you saved $1500 with “The MATH” you actually only saved $1270. Also, like others have said, cash sign up bonuses should be calculated as earning cash for time & spend minus opportunity cost. These are not savings. Savings would be like buying $1250 of Disney giftcards at Sam’s club on an SPG business with a 20% off Amex Offer. Now you saved because your $1250 in GC only cost you $1250(at register) – $250(Amex Offer) + $25(Opportunity cost of spending $1250 not using 2% cashback card) = Total $1025 (costs) for $1250 in Disney Spend. Savings = 18%.

You missed out on a big savings opportunity here: Using a travel agent that rebates some of their commission to you. For example, on a $3000 Disney cruise Costco will give you about $250 back in the form of a gift card, which is as good as cash in my household.

Did you pay with multiple CCs to get the travel credits??

No need to pile on the author. He achieved HIS goal for this cruise and shared his experience which may have helped some people achieve their Disney dream cruise. If you didn’t learn or appreciate their post you can simply move one to the thousands of other posts. If you already see 5+ negative comments, adding your own is only kicking the man while he is down. Thanks for the post Juan…

This has to go down as one of the most shamefully dishonest blogs I’ve read in a long time.

Pathetic and disgusting.

I totally agree with most of the negative comments, in that this post feels like click bait to me.

I am shocked that Miles to Memory would approve this post. The audience here are not the ones that follow the Points Guy or MMS. We seasoned points/miles enthusiasts who discuss MS and resell margins instead of blindly click on affiliate links, so I am truly disappointed when I read the author consider the CSR $300 credit as a trip saving rather than a mere annual fee reimbursement.

I thought I will be reading some creative way to source Disney GC for cheap, or at the very least the mentioning of the $20 GC from every $1k spend using Disney Vacation Account. All I can say is this article is poorly thought out, at best. Might want to stay focus on your niche audience, instead of, you know, Double Duty.

I’m confused on how the CSR is a $300 savings. You still had to pay $450. Even getting two credits, you only saved $150 with that route.

I’m with the others here who say this isn’t really a “savings”. You paid full cost using credits earned. If you get the Sapphire Reserve, pay $450 annual fee, the $300 credit isn’t “free”. It’s like saying a trip was free because you paid for it with your income tax refund.

I’m with the others here who say this isn’t really a “savings”. You paid full cost using credits earned. If you get the Sapphire Reserve, pay $450 annual fee, the $300 credit isn’t “free”. It’s like saying a trip was free because you paid for it with your tax rebate.

You paid retail bro. Don’t delude yourself

We are going on our 6th Disney Cruise in June. Totally worth the price, in my opinion! 🙂

Thanks for wasting readers’ time.

This is not real savings! Your points/cashback is part of your cost!

This is an informative post so don’t get me wrong but….based on the savings logic why didn’t you just apply for 3, 4, 5 other cards with travel credits and cruise for “free”. You could have just as easily applied these travel credits to other cruise lines, air fare, resorts, etc. I guess.

You are right. Wanted to limit my HP’s and simply save a considerable amount. Could have done so and credited total cruise for “free” but that wasn’t my logic here. Wanted to simply save a nice chunk. Thanks for reading.

Not really “savings” when considering the opportunity cost.

@Radster – it’s hard to do better than 5%, like the $1,500 he spent on the Discover credit card. And he maxed out the $300 travel credit on the CSR – that’s an actual savings, too. I guess you are saying he could have transferred his CSR points and used them on international first class, or used his Merrill+ points for airfare to save $1,000 instead of $500? If so, that’s true, but having young kids myself, I could see using the points to save money on a cruise – especially since I might not want to take my squirmy kids on an airplane, so I would consider it a savings.

Acknowledge that some significant mental gymnastics are involved when considering opportunity cost. And each scenario is most certainly person-specific.

If the OP had no other way of ‘cashing out’ his travel reimbursements, then they probably can be considered ‘savings’. I myself, however, consider such CC benefits to be (near to) cash-equivalents, and therefore not savings.

So all that being said, ‘savings’ is probably a reasonable description and I retract my original statement. Apologies the OP. 🙂

Instead of the vacation account, you can also combine gift cards on disneygiftcard.com up to $1,000 per card (just make sure to keep all the drained cards in case of fraud/lost card)