ThankYou Premier 50K Match Bonus

The public bonus on the Citi ThankYou Premier card has been a big fat “0” for quite awhile now. This is almost shocking in my opinion considering that this card is Citi’s flagship travel rewards product, a competitor to the Sapphire Preferred.

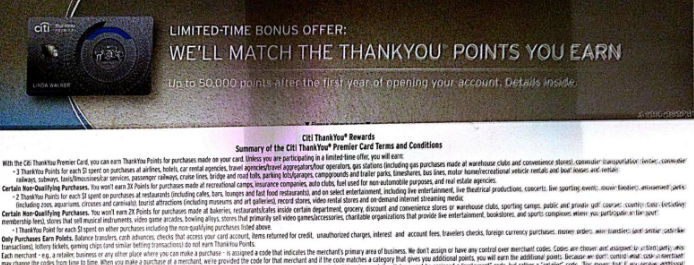

Following their huge rules change to restrict churning and bonuses, the company may be trying out some new bonus strategies. One Reddit member has reported receiving a new offer for the card giving up to 50K ThankYou points as a bonus, but there is a catch. It is a match of all of the points earned in the first year without anything up front.

This isn’t the first time Citi has offered a non-traditional bonus on the ThankYou Premier card. A couple of years ago their offer on the card gave 20K points after $2K spend as the sign-up bonus plus another 30K after $3K spend in the second year. At least those were true bonuses, but this time you have to spend with the card to get anything.

While this offer is targeted, it does have one thing going for it. Apparently it doesn’t contain any of that new restrictive “one product per family” bonus language. Based on what I have seen from the scan and what the original poster on Reddit said, it appears anyone should be able to get this offer if they receive it. But is it worth it?

Offer Analysis

To start, let’s look at how the ThankYou Premier earns points. It earns in the following categories:

- 3 ThankYou Points per $1 spent on travel including gas, airfare, hotels, cruises, car rental agencies, travel agencies, railways, public transportation, tolls, taxis, parking and much more.

- 2 ThankYou Points per $1 spent on dining out and entertainment.

- 1 ThankYou Points on other purchases.

Since the bonus is a match on points earned the first year, you can basically double the earnings in each of those categories. For example, you would earn 3X up front in the travel/gas categories and 3X as a match at the end of the year. Your return thus is 6X overall. In the dining and entertainment categories the return is 4X. Pretty good.

Of course for most people, spending $50K per year on travel, dining and gas probably isn’t the easiest thing to do and thus this offer won’t be good for most. There are a couple of exceptions of course, including people who can generate spend quite easily at gas stations.

Disqualifies You For Other ThankYou Bonuses

Remember, while this particular offer doesn’t have the “one product per family” language, the ThankYou Preferred and Prestige cards do. That means if you open this card, you won’t be eligible for a bonus on those cards for 24 months.

Final Thoughts

It is interesting to see banks continue to experiment with different bonus opportunities to entice customers to get and use their cards. For example this week we saw Amex offer a three tiered bonus on the Blue for Business card which rewards spending in the first year and now Citi appears to be trying this strategy as well. For now this isn’t a public offer, but I wouldn’t be surprised to see more bonuses like this sooner rather than later.

What are your thoughts on these new “spending” bonuses? Are they a fad or will the banks roll them out more widely?

HT: @IadIsGr8 on Twitter

My wife actually got a straight 30,000 on I think $3000 spend first year annual fee waived Friday. Probably going to do it to be able to transfer ty points I earn pating my mortgage on plastiq with the att access and more. Based on Shawns blog I PCed into the att card in September from an old citi Expedia.

Citi is trying to get signups while not giving up huge signup bonuses? Not in my book. The only way to teach Citi a lesson is to not sign up for their cards until they bring back the bonuses like they used to. In the meantime it’s Chase all the way (and to a lesser extent, Amex)

Got it a few days ago …. Not interested! If they had a supermarket bonus, would have jumped.