The Unheralded Perks of the Wyndham Card

The bonus on the Wyndham card was recently increased to match the all time high of 45,000 points. That is enough points for 3 nights in one of their hotels. That is a great bonus that can bring you $750 plus in value in big cities like NYC etc. But that isn’t why I think the card is undervalued. It is their partnership with Total Rewards that makes this card compelling to me.

Total Rewards Partnership

I applied for this card for myself – (denied) – and my wife (approved!) earlier this week. It isn’t because I love Wyndham hotels, I haven’t stayed in one in over 10 years (RIP Crystal Palace Nassau). It is because I love their partnership with Total Rewards.

Wyndham recently announced a partnership with Total Rewards where you can match status and transfer points between the programs. The point transfers are maxed out at 30,000 per year.

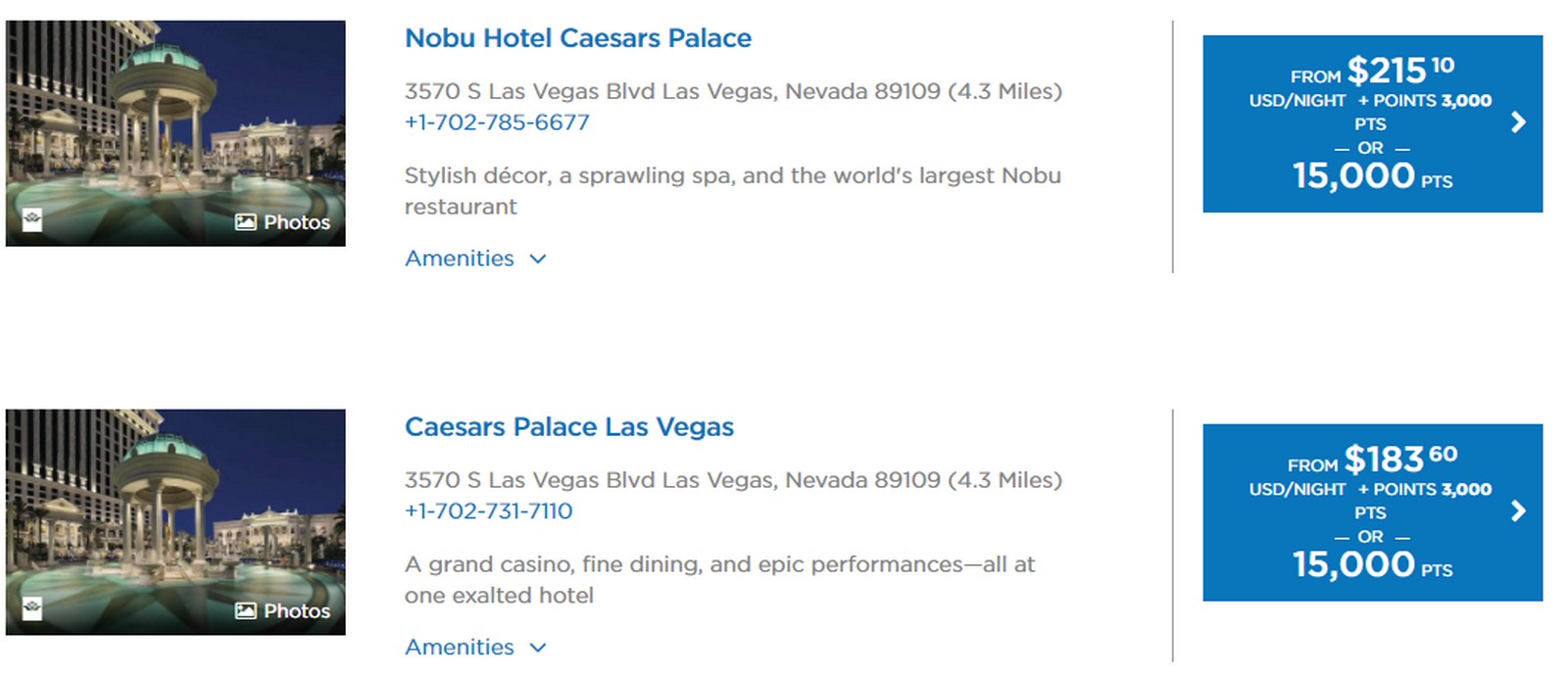

That is $300 in food and drinks at any Total Rewards casino per year. So you are able to get at least 1 cent per point out of Wyndham points. You can also book Total Rewards hotels, including Caesars Palace and Caesars Nobu! That is amazing!!!

Perks Of Total Rewards

The card comes with Wyndham Platinum status which you can then status match to Total Rewards Platinum status. This comes with some nice perks:

- 15% discount in gift shops

- Complimentary parking in Las Vegas and Atlantic City

- Complimentary stay at the Atlantis (2 nights, does not include resort or maid fees)

- 10% discount on Norwegian cruises

- Buy one get one free shows (select shows only)

Those are some big perks and would offset the annual fee after one trip to Vegas if you maxed out the value. The card would also pay for itself if you take a trip to the Atlantis!

Conclusion

This is a solid bonus that I think anyone who goes to Vegas, Atlantis, or any other Total Rewards casino should consider. The perks you get from the partnership are pretty great.

Even if you loathe Wyndham hotels this partnership makes it worth considering.

[…] has two co-branded credit cards issued by BarclayCard. In December we covered some of the lesser known perks of Wyndham Rewards and why it’s co-branded cards are underrated. Current card offers […]

Since we got this cards, both Wife and I have had the AF waived twice. We also each get 15K every year on our anniversary. As stated previously, we’re staying in A.C. next weekend. Originally each booked a room @ Bally’s. We wanted Caesar’s but nothing available. Looked last night and Caesar’s had openings which I booked and cancelled the Bally’s reservations. Cash prices is about $300 w/ tax so nice redemption w/ points.

Awesome David….I know Barclaycard has been cracking down on the AF waiver for the AA card so I wonder if they will get sticker on that this time around. Although with you having the old 15k yearly bonus it is worth paying the annual fee anyway!

The magic # is $20K spend

Interesting. I don’t see myself ever putting that much spend on the card but that is good info to have. Thanks!

This card is a lot like the IHG card – more than worth the moderate AF for road trippers looking for a clean, safe place to crash for the night, but with extra surprise benefits. My intro offer was 45K points, which is enough for THREE free nights (quickly used up on a road trip to Oregon). Going forward, there is a 9K points bonus every year, which is about enough to offset the $75 AF, so I was planning to keep the card. But then they rolled out a weird little promo – earn 5K points by spending $1500/month on the card for each of the next 3 months. Since this is the only card I have ever heard of that gives 2x points for utility payments, I just paid up my gas, electric and water bills in advance. This will earn me 14K points in total: almost enough for another free room night. Cool.

Ink cash gives you 5x UR for utilities but this may be the only personal card that does. I can’t really think of another off of the top of my head.

Thanks for the info Sharon!

mark, there’s additional benefit for new cardmember as follows (so the 1st yr fee is only $25?):

Earn a $50 statement credit when you use your card.

Cardmembers will receive a one-time $50 statement credit on their Account if a Purchase or Balance Transfer posts to their Account (provided the transaction is not later rescinded or returned) within the first 30 days after the Account is opened.

Awesome – thanks Dan!

I have been to Atlantis twice in recent years. The 1st time my wife and I (60 years old) went alone and used Marriott points. We enjoyed ourselves, gambled a bunch (and won on the slots nicely). However, we found the resort to be getting a bit tired and old. We were then offered incentives to come back and gamble some more which included free rooms for us and nearly free rooms for friends. So, we went back for 3 nights and took our adult daughter and her husband and our two young grand kids. This is a wonderful resort for the grand a great time was had by all. We gambled, but not as much and the resort did not like this and did not give us as much in rebates when we checked out. Now, when they send offers they have small print that if you don’t gamble to the levels they expect, they can charge you for the rooms at the end of your stay. IF YOU HAVE THE WYNDHAM CARD AND TOTAL REWARDS, you can get the room and stay without the gambling “minimum spend” restriction wording. One final bit of advice…..if you plan to go. Do not get sucked into the Atlantis dining plans. Way expensive. Lots of good places to eat on the property that you just pay for as you go. And, if you put it on a points earning card like Arrival or Venture, you can pay for it at the end on those and get your money back.

Thanks for the info Jeff!

Booked 2 rooms next Saturday @ Bally’s A.C. w/ Wyndham pts.. I’m TR Diamond (via status match from Black Label/MGM/Hyatt/Hilton/IHG from a few years ago), so will probably get two suite upgrades. Love the flexibility of Wyndham pts., especially condos using pts.. Also have 2% card which makes very easy to accumulate boatloads of pts.. Wife also has same card and status. I like the fact that I can transfer Wyndham pts. to TR to use in the Diamond lounges (1K pts.) which are excellent in A.C., especially Bally’s oceanfront lounge. Overall, I value the card highly and it’s a keeper for us. Looking forward to January when my Wyndham Diamond expires and see if I’ll be able to match again from TR.

well, I still have the old earning as 2 points per dollar, therefore, I dont have the Platinum Status. Is there any way I could upgrade to Platinum status but still earning 2 points per dollar?

Your card is currently the version with the annual fee?

FYI, those with military/veteran status get Total Rewards platinum status (free of charge) and qualify for reciprocal Wyndham platinum status (also free of charge).

Do you know anything about the quality of the “free” Atlantis rooms. Just read something pretty negative.

It is their base rooms. Not the best but you aren’t there to hang in the rooms I guess. Shawn did a write up about his experience not too long ago.

https://milestomemories.boardingarea.com/atlantis-beach-towers-initial-review/