Toys R Us Mastercard Converted

With the recent announcement that Bon-Ton may be liquidating and the impending closure of about 800 Toys ‘R Us stores, it isn’t the best of times for retail. One of the drivers of profit for retailers is store branded credit cards and actually Toys ‘R Us had a lot of success with theirs.

I opened a Toys ‘R Us credit card after I found myself shopping in their stores quite a lot for reselling. At the time I opened it I was given 20% off my entire (HUGE) purchase plus they had an ongoing 10% discount for cardholders on Thursday. It wasn’t a card I used a ton but I got some value out of it.

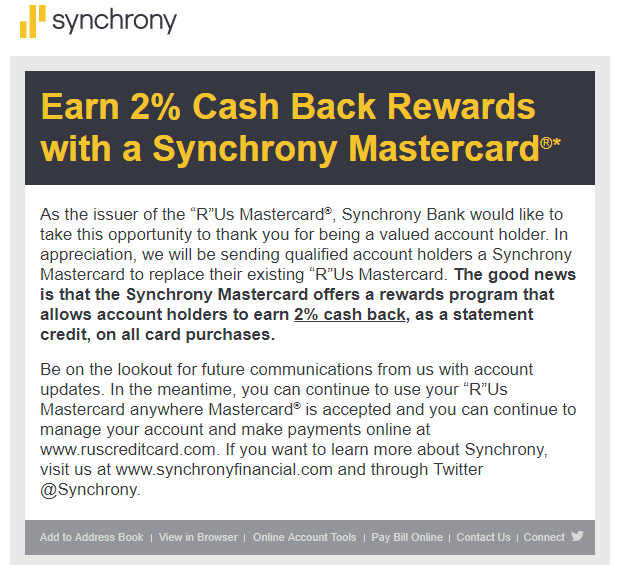

Of course Toys ‘R Us is going away and thus the card is going away. Synchrony issues the Toys ‘R Us credit card and has announced what will happen to this card. I just received this email:

2% Cash Back & No Annual Fee

The Synchrony Mastercard is not a publicly available product as far as I know, but I believe it comes with no annual fee. 2% cashback with no annual fee isn’t unique, but its still a decent deal for most. I am assuming Synchrony wants to keep this large customer base and offering 2% back is a good way to get them to use the product. Their card portfolio is heavily linked to retailers, so the bank needs to keep customers as companies die.

RELATED: Cards That Will Earn You Over 2% Back On Every Purchase.

Conclusion

While 2% cash back isn’t the best you can do (I earn 2.625% back as a BofA Platinum Honors member and Alliant CU and Discover it Miles are offering 3% back for a year), I suspect many Toys ‘R Us cardmembers will see it as an attractive product. As for me, I’ll probably keep it open to age but won’t be using it all too often.

Why if we already have a synchrony bank credit card , but it’s not toys r us

Is there gonna b any monthly charge if card is not in use? And what is the rate when in use?

[…] at Milestomemories reports today getting an email about his Toys R Us credit card, indicating that it’ll automatically change […]