How to Transfer Citi Cash Back to ThankYou Points

Citi made an awesome change to their Citi Double Cash card by adding the ability to transfer cash back to ThankYou points. The 2% cash back card already held a place in my wallet for general spend outside of bonus categories, but earning 2 ThankYou points per dollar is even better. But you need to know how to transfer Citi cash back to ThankYou points, which I want to walk through in this post.

Citi isn’t known for having excellent IT, and I still frequently run into random errors on their website. However, when I went to transfer my Citi cash back to ThankYou points, things went pretty seamlessly. It was the second step that caused me all the problems.

Transferring Citi Cash Back to ThankYou Points

To transfer your Citi Double Cash card cash back to ThankYou points, first log into your Citi online account. You should be taken to your dashboard, where you’ll see the various accounts you currently have with Citi.

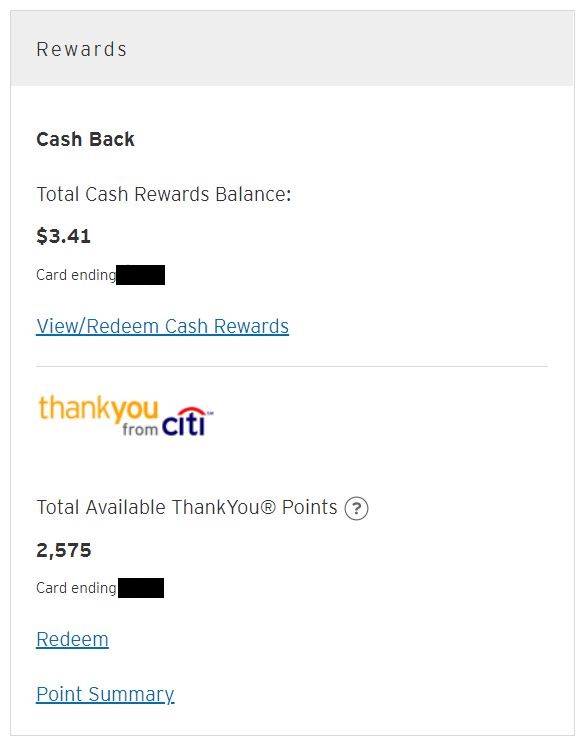

In the sidebar you’ll see a menu with the rewards available on each card. Clicking on ‘View/Redeem Cash Rewards’ for your Double Cash will take you to the screen where you can choose how to redeem your cash back.

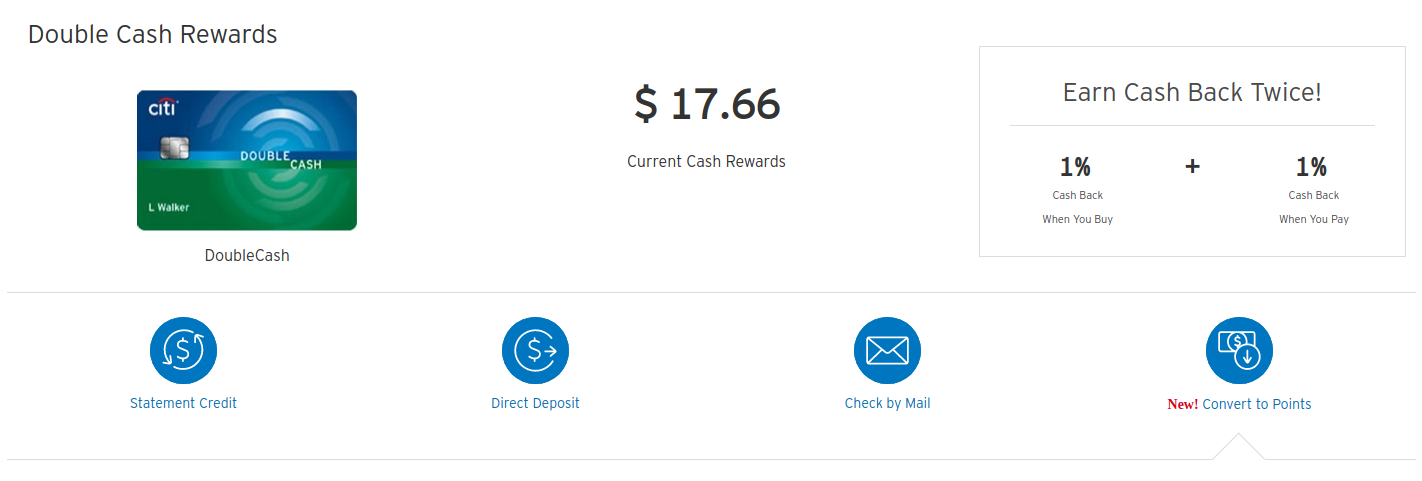

You want to newest option: “Convert to Points”.

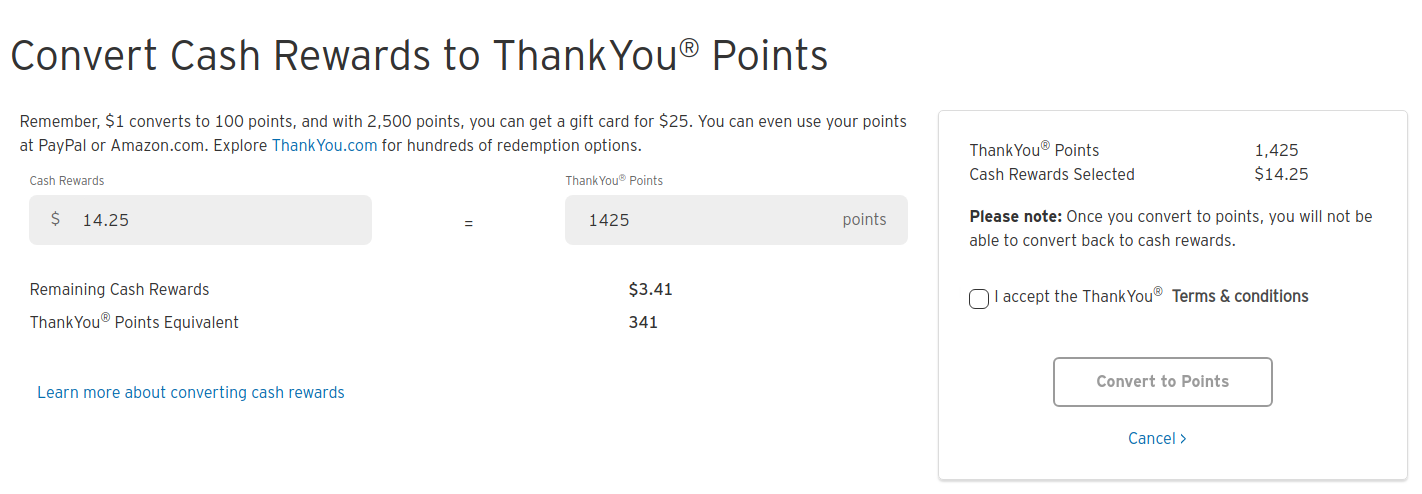

This will open the pane for converting your cash back to ThankYou points. Click convert to points, and you’ll see the following form:

You can decide how much of your your Citi cash back you want to transfer to ThankYou points. The transfer ratio is $0.01 to 1 ThankYou point. You must also convert a minimum of $1.00 cash back to 100 ThankYou points. It can be any oddball number above that. Check the box to accept the terms, and then “Convert to Points”.

Voila. It’s that easy to transfer Citi Double Cash card cash back to ThankYou points.

Transferring and Combining ThankYou Points Between Accounts

While it’s quite easy to transfer Citi cash back to ThankYou points, I found it much harder to do anything useful with them. The ThankYou points that are associated with your Citi Double Cash card account have very limited uses. You can’t transfer them to partners, like you can with a Citi Premier Card or Citi Prestige Card.

Transferring points to an excellent partner like Turkish Airlines, Avianca LifeMiles, Etihad Guest, or any of the other airline programs is really what I want to do. This requires another step: combining or transferring ThankYou points between accounts. My first goal is to combine my ThankYou accounts.

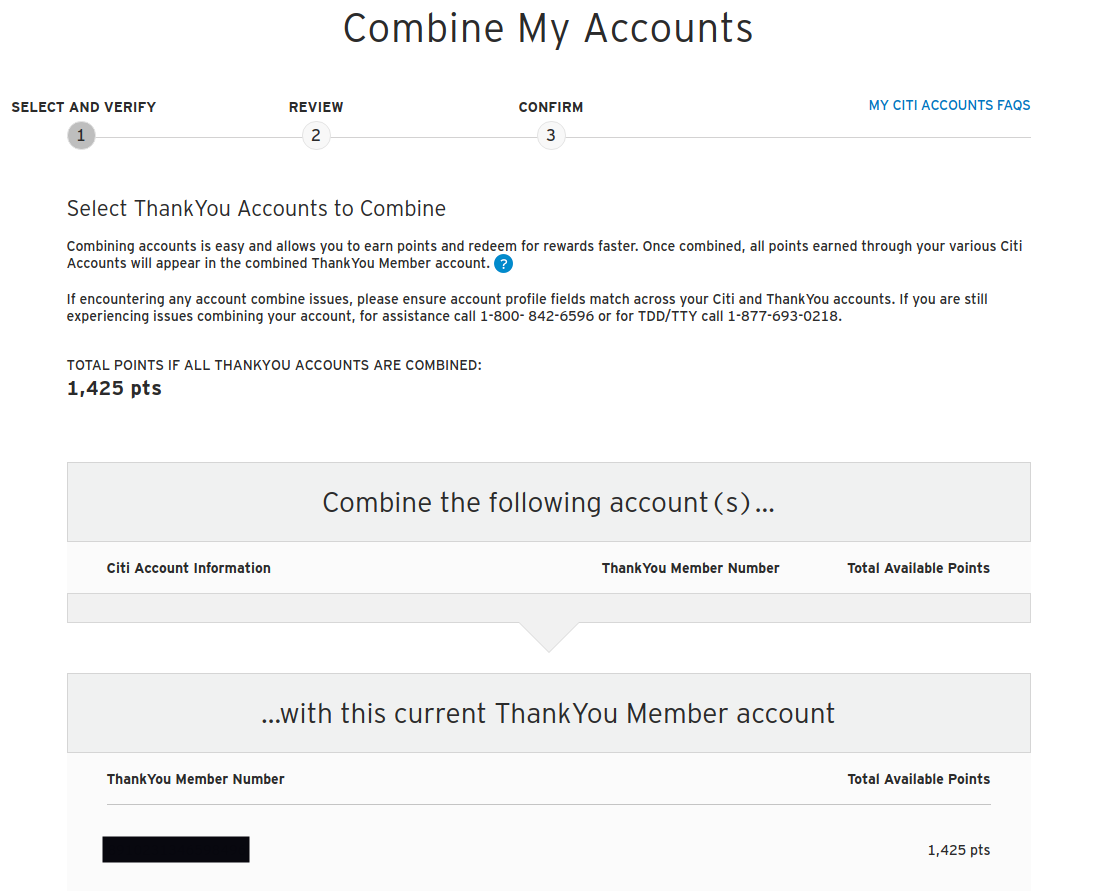

How To Combine Your ThankYou Accounts

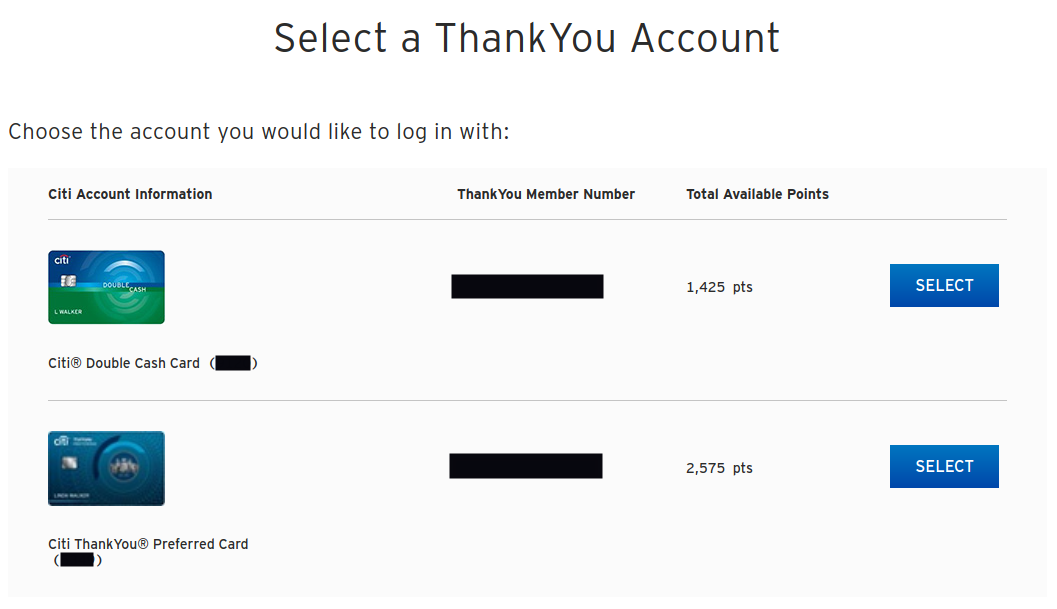

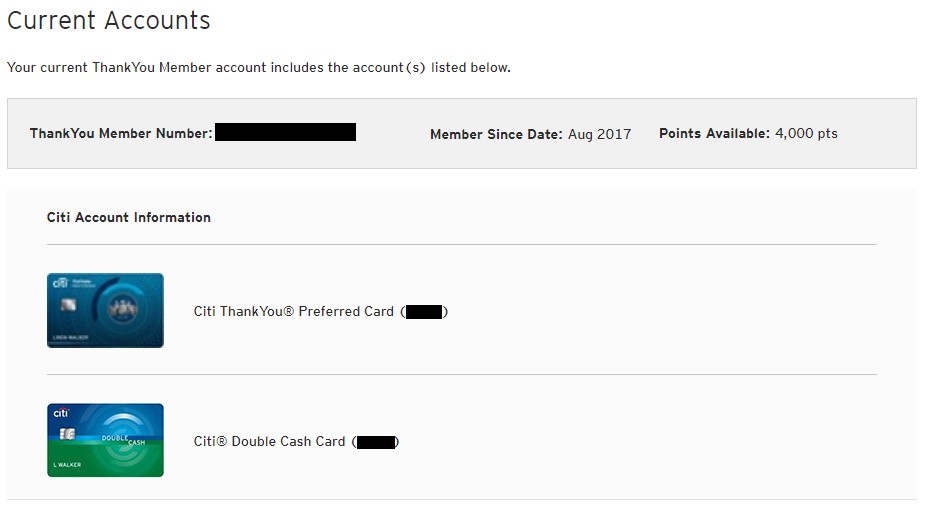

First, you need to head to your ThankYou account summary, which you can reach by clicking “Point Summary” from your credit card account landing page. Here you’ll see each of your ThankYou accounts.

I already find it annoying Citi doesn’t lump rewards together like American Express. From there you need to use the sidebar under “Manage My Account”, where you’ll find “Combine My Accounts”.

Here I’d expected to be able to quickly and easily combine my accounts. However, only one would show up. Following the instructions above the form, I called Citi at 1-800-842-6596.

After verifying some account information, I was quickly connected with a representative who was knowledgeable and able to quickly combine the accounts for me. You’ll need at least one of your credit card numbers, and either the credit card number or ThankYou number on hand to provide to them.

The issue for my accounts is that my phone phone number was different on one of the two accounts, and thus they couldn’t be combined online. Doing it over the phone was fairly painless, and I soon saw that my Citi ThankYou accounts now had a single number.

One important note: once your accounts are combined, apparently Citi has no way of separating them again. They are combined forever. I’m fine with this, and I can’t really foresee a reason why you wouldn’t want this, but I just want to call it out.

Conclusion

Because I’m without a Citi Prestige or Citi Premier card, the final step will actually be to transfer the miles to my wife and then into her Turkish account. However, most of you will probably be done at this point. It’s easy to transfer Citi Double Cash card cash back to ThankYou points, which I will continue to do as I earn them. What’s less easy is combining your ThankYou accounts, but luckily you only need to do this once.

Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers.

[…] Guide To Transfer Cash Back To TY Points: One of the positive changes Citi made was giving the Double Cash card the ability to earn ThankYou points. Here’s how to transfer your Citi cash back to ThankYou points. […]

Jackpot. Was just about to play with it this weekend, and now someone already did the homework 🙂

Haha! Glad it is timely. Just hope your call to Citi goes as smoothly as mine, if you need to combine by phone. Guy actually knew what he was doing.

annoying that second tranche of the 2% you get when paying off statement balance you don’t actually get until the following statement cycle.

If you prepay it should hit the current statement

I had been earning worthless TY points on my ATT More card and that was OK with me for I had plans down the road to get for the 2nd time the Premier card. Got it and then went to combine points. Not wanting to accidentally move my Premier points to the ATT More card, since it is a once and done proposition. The webpage is not absolutely clear. I called Citi and they were glad to do it. I product changed the Preferred card to the Double Cash card, and again called Citi to let them to the linking and combining. The ATT More and Premier have been working together for months without me doing anything. We will have to see how that goes with the Double Cash. Ideally, those Double Cash will always flip to TY points and move over to the Premier account. I will see if that happens or if I have to manually convert and then call.

It is nice to get those Double Cash now earning worthwhile points.

Very good point. The rep was very clear with me on the phone which account I wanted to make the “primary” and that things are irreversible.

There is one useful use for citi thank you points for those who don’t have any other citi cards: it can be used for Amazon promotions like the $15 off when using a citi point.

Great reminder!

The contact info mismatch was the reason mine wouldn’t initially combine, either. One of my TYP accounts was created without a phone number (000-000-0000), so I just changed that to my number – or did I add the 000 number to the other account? Either way, it’s easy enough to change those yourself within each TYP account so that they match. Combining is instant, so you get instant confirmation of whether you did enough. It seems a missing middle initial won’t matter, for those with that discrepancy.

Also worth mentioning – the cash/points will disappea (float in the ether?) for a few days. Don’t fret – just wait 2-3 days and the points should show up. The converted cashback also won’t be added to your “total redeemed,” and a few other totals on the site don’t reflect reality… typical Citi IT, I guess.

As a single account (i.e. before combining), the converted cash back seemed to be added to the points total immediately. I’m curious now about the “lag” you mention. But it is probably typical Citi IT!

Ian,

Once combined with my premier TY account, what is the expiration policy of these TYP earned through the double cash card?

Since everything is combined into one account, there shouldn’t be an expiration date as long as the card account(s) are kept open (my guess is things are linked to the “primary” card TYP account you decided to keep).

It’s only when points are manually transferred between accounts that you’d encounter an expiration date. I actually need to transfer points to my wife’s Premier to be able to use them for partner programs and am going to wait until I know I will transfer them imminently.