Transfer Southwest Rapid Rewards To Another Member

There are some programs out there that allow you to combine points with others for free to book award stays or flights. Hilton and Hyatt both do this, even British Airways allows you to create a family account to pool points. Southwest is not one of them, well at least not for free. You can send your hard earned Rapid Rewards points to other members, worth around 1.4 cents a piece, for the cost of $10 per 1,000, or 1 cent a piece. That isn’t a great deal. But, did you know there is actually a way to transfer Southwest Rapid Rewards to another member without a fee? It is a credit card perk that you may not have noticed and it is included on the Southwest Rapid Rewards Performance Business and Southwest Rapid Rewards Premier Business cards.

Transfer Southwest Rapid Rewards Perks Details

The two Southwest business cards from chase have a Southwest® $500 Fee Credit for Points Transfers perk listed on their terms page. This means that you can transfer Southwest Rapid Rewards to another member, or charity, and the fees will be wiped off of your statement, for up to $500 per cardmember year.

Here are the full terms of the perk:

- A statement credit will automatically be applied to your account as reimbursement for fees associated with using your Southwest Rapid Rewards® Performance Business Credit Card to transfer points to another Rapid Rewards Member or a pre-selected charity chosen by Southwest with an active Rapid Rewards account, up to an anniversary year maximum accumulation of $500 in reimbursed transfer fees.

- Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that date each year.

- If you switch to this product from another Chase credit card your account open date is the date the switch to the Southwest Rapid Rewards® Performance Business Credit Card is completed.

- Statement credit(s) will post to your account the same day your point transfer fee purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles.

- Account must be open and not in default at the time the statement credit is posted to your account.

- Statement credits will be issued for the anniversary year in which the transaction posts to your account.

- For example, if you transfer points and Southwest does not post the fee transaction until after your current anniversary year ends, the cost of the fee will be allocated towards the following year’s maximum of $500 in reimbursed transfer fees. Points can be transferred with a minimum transfer of 2,000 points and a daily maximum of 60,000 points.

Does Being Able To Transfer Southwest Rapid Rewards Even Matter?

You may be wondering, does this really matter though? You can use Southwest Rapid Rewards to book a flight for any other member already so why would you need to transfer points? Heck, you can even use someone else’s points to book a flight for yourself and then add that person as your companion from the Companion Pass. This is a great way to split up a cost of a flight by the way.

That is all true but there are a few instances where this could come in handy. Do you have a family, every member with their own Southwest Rapid Rewards account, and often have some points stranded in their account? I know I have. This is a way to pad those accounts and unlock those trapped points.

In the past I have transferred Ultimate Rewards points into my wife’s account to unlock her points. That has always annoyed me since Southwest is not the best use of UR points. Not to mention I had the points to cover her in my account, so with this perk I could have avoided the transfer from Ultimate Rewards. I can’t transfer UR points into my kid’s accounts either, since they are not authorized users on my Chase accounts. Because of that their points are trapped till they earn enough. If I had this perk available I could push some points from my account to theirs and unlock those orphaned points.

Another Great Perk Of The Southwest Performance Business Card

Since we are talking about perks of the Southwest business cards I should mention one other pretty cool perk of the Southwest Rapid Rewards Performance Business card. I have covered this in the past but they are worth mentioning again.

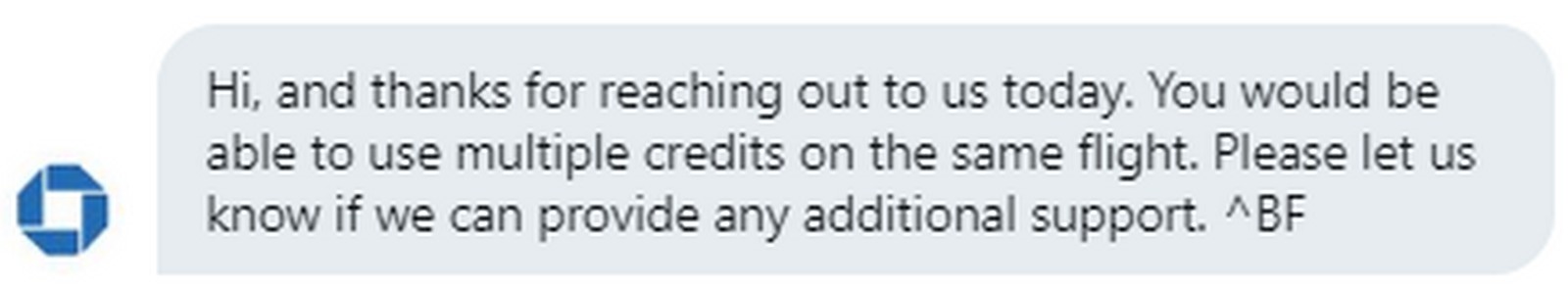

The Southwest Performance Business card comes with 365 in flight WiFi credits every year. That is essentially guaranteed free WiFi since I doubt anyone out there is taking 365 flights each year. But the cool thing is you can use these credits on other people as well. So anytime you are traveling with employees, friends or family they should be covered by your card. Here is a confirmation from the Chase Twitter on it:

Final Thoughts

Granted, being able to transfer Southwest Rapid Rewards points to other members for free is not a huge deal overall. And, it isn’t a reason to get one of these cards either, but it is good to know that it is there should you need it. Especially if you are already carrying the Southwest Rapid Rewards Performance Business or Southwest Rapid Rewards Premier Business card in your wallet. It could just end up saving you thousands in stranded points each and every cardmember year.

Were you aware of this credit card perk? Have you ever used it before, or do you think it could be helpful at all? Let me know in the comments.

HT: Brian M from MtM Diamond for pointing this out.

If I transfer my wife’s points to me, but charge the fee on my SWA Biz card, will I get reimbursed?

I am not sure about that. The terms made it seem like not but I am not sure how they would be able to tell.

I would maybe try a small transfer to test it.

I’ll answer this since there was no follow up. Last week I transferred points from my wife’s account to mine and paid the fee with my SWA Biz card. A couple of days later, I had a credit for the same amount as the transfer fee.