Freeze On/Freeze Off

One of the costliest issues our country has to deal with is identity theft. Identity theft and other credit related frauds cost businesses and consumers over $25 billion in 2012 according to Business Insider.

Credit related fraud has become such a large problem that an entire industry of credit monitoring and protection services has sprung up. Every major credit agency along with a number of other companies will monitor your credit and “protect” you for a price!

Freeze Your Credit Profile

In my opinion one of the greatest ways to protect yourself is to freeze your credit profile. When you freeze your profile, no one can access your credit, meaning it is nearly impossible for fraudsters to open up an account in your name.

Unfortunately there are two major obstacles when trying to freeze your credit profile. First, you must contact each of the bureaus and figure out their system for requesting the freeze. Second, unless you have been a victim of identity theft, you must pay $10 (in most states) to have your credit frozen.

A New Easier Way to Freeze

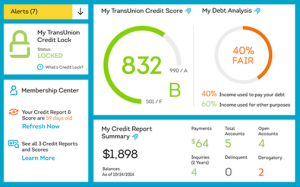

Thankfully Transunion may have just taken the first step towards simplifying the process of freezing your credit. They have now added the ability to instantly freeze and unfreeze your credit profile directly from their mobile app. Awesome right? Well, there is a catch!

Unfortunately the service is only available to customers who pay $9.95 per month or more and subscribe to their TrueIdentity credit monitoring service. Boo!

You Shouldn’t Have to Pay

Transunion and other credit monitoring agencies make money by selling our credit profiles to banks and other institutions. They then try to make even more money by selling us our score and credit monitoring and protections services. There has to be a line at some point.

I have no problem with Transunion and their ancillary services, but freezing your credit profile should be a complimentary service available to everyone. If freezing my profile was as easy as flipping a switch, then I would do it myself. Imagine the amount of fraud that could be prevented!

How to Freeze/Unfreeze Now

If you aren’t a Transunion credit monitoring customer and are looking to freeze/unfreeze your credit, click the following links to find the instructions for each of the three major credit bureaus.

Hopefully Soon

While it isn’t clear which direction this type of functionality will take (free or premium), I am hopeful that the other agencies will adopt it as well. Making the process of freezing/unfreezing your credit reports is an effective tool to prevent identity theft.

Hopefully as the technology progresses, the companies will realize this is a functionality that everyone should have and not just people who pay for advanced services. Of course, I am jumping ahead, but it is still exciting to see something that used to be so laborious turned into a simple five second task.

Do you freeze your credit reports? Would you if it was as easy as clicking a button in a mobile app? Let me know in the comments!

HT: Maximizing Money

I would have no problem with paying $10 per bureau for the freeze. However, in California it costs $10 every time for a temporary thaw…I apply for too much credit to pay $10 every time.

I’ve had my credit frozen since 2010. I only thaw it – temporarily – when I’m doing an AOR. If all done online, both the initial freeze and subsequent thaws are rather easy to implement. I tried the app, but despite being able to log in to Transunion online, it errors out. Even if it worked, I’d probably not use it unless all bureaus’ apps have the feature.

By the way, one minor clarification: the cost to freeze is not $10 for everyone – it varies by state, from $0 to $10. At last count, six states had (at least) free initial freezes for non-ID victim adults. I’m also lucky to be in one of only two states that have fully free freezes and thaws for all adults.

My state rules make it a no-brainer for me to keep my credit frozen. Because, let’s face it, those in the points & miles game are likely those with good credit, and therefore are prime targets of criminals.

Sources:

Credit Freeze and Thaw Guide at

http://www.clarkhoward.com/news/clark-howard/personal-finance-credit/credit-freeze-and-thaw-guide/nFbL/

Credit Freeze and Thaw Costs at

http://www.transunion.com/personal-credit/credit-disputes/credit-freezes.page?tab=freezefees

Cheers.

Good point. I have added the disclaimer that the $10 charge in only in most states. Thanks Joe!