U.S. Bank Altitude Reserve Shutdown Letter

Last week I covered the news that U.S. Bank has been shutting down new Altitude Reserve accounts for gift card purchases. One of our readers shared their story about getting shutdown for purchasing gift cards at a Simon Mall. When that reader was talking to the U.S. Bank Investigator they weren’t given much information either.

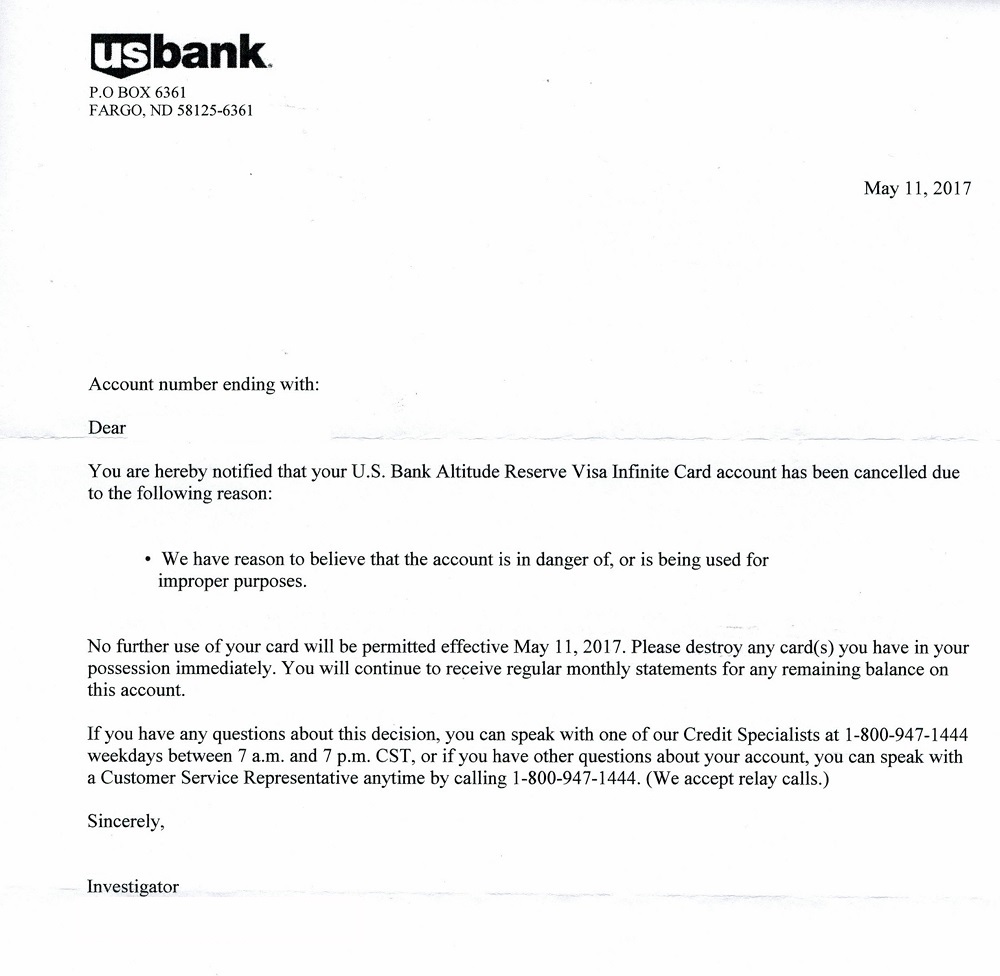

Well, now we know a bit more. The reader followed up with me and shared the letter they received in the mail. The reason for the shutdown? “We have reason to believe that the account is in danger of, or is being used for improper purposes.” Of course the bank is probably protected by the terms in their cardmember agreement which most likely explains the use of this language.

This reader also noticed that their statement printed and despite it saying that the reader earned points for their purchases, none were awarded. Not surprising of course.

Conclusion

So U.S. Bank is shutting down accounts for purchasing gift cards and is calling that an improper use. As I suspected they seem to be looking to catch this behavior quickly and thus are targeting accounts that are “in danger of” being bad for them. What do you think?

It would have been preferable had the bank notified cardholders in advance, in promotional materials and/or its terms and conditions, that GC purchases are not allowable and make the account(s) subject to shutdown.

I got an American Express from US Bank. They never did get it activated properly. I could use it some places but not others. I finally shut it down in frustration. I have a Visa with them. Their customer service is poor and they never do what they promise to do. I have it as a backup card only anymore.

[…] U.S. Bank Altitude Reserve Shutdown Letter: How They Justify Shutting Down an Account for Buying Gif… by Miles to Memories. Shut down letter for those that wanted to see it! […]

I have said in earlier posts that US Bank is a weird operation. I still believe that. However they offer a new product and start shutting down new cardholders. This is really unusual. They can be tough on underwriting yet they will shut down new accounts on a premium product like this does not make sense. –

Do we have any idea of gift cards getting 3x via wallet versus non-bonused gift cards? I assumed that it was the former getting shut down

In this reader’s case the gift card spend was 1X.

Are shut downs coming mostly from vcg purchases? I buy Amazon gift cards at the supermarket for gas points and they accept mobile wallet, but I don’t want my account closed over it.

US Bank is not interested in having customers whose main purpose is to game/hack/maximize the benefits offered. I’m sure this type of user does net cost them – but the hope is to get so many normal customers that the small loss is immaterial.

We’re lucky the larger banks don’t behave the same. US Bank wants only normal customers and they are weeding out the customers who might represent a loss. It’s really very typical of them. They survived the financial crisis very well due to this conservative attitude but I don’t like being their customer.

The bank probably saw money laundering issues with the purchases of gift cards and to prevent issues from the US Treasury’s FinCEN bureau and its primary regulator decided to end the issues with termination of the card. The Feds are leaning hard on financial institutions about use of bank accounts for money laundering and hiding of transactions. Gift cards are prima facie evidence used to cancel such relationships.

Gift cards purchased with credit cards create a huge paper trail and thus aren’t generally an issue. Buying gift cards with cash is a different story.

I find it funny that one of my local stores allows you to buy 8k/day in gift cards – no id required – with cash, yet restricts you to 2k/day with credit card (and id), citing money laundering purposes.

Not really. Cash is cash even if it is dirty. Credit card transactions can be reversed, causing losses to the merchant.

“Improper use”. Love the silly excuses they give. Just say you’re closing the card as a business decision instead of insulting your customer. What morons.

USBank is incapable of making this so-called premium card be a success. No buzz, only a series of shut down reports for chicken-shit reasons.

That’s a bit ballsy calling a couple of days of charges enough to determine improper use.

Credit card issuers are given broad ability to terminate your card if they suspect improper activity. Buying gift cards can be used to launder money, so they are well within those rights here.

Yeah, buying gift cards with cash could be laundering money, buying gift cards with your credit card is most certainly not money laundering unless you are the worst money launderer in history.

No buying them with a CC can be money laundering, if you buy a gift card with a CC and use it to buy drugs that is money laundering and also is illegal activity which can be included in Improper Transactions.

that is not money laundering. You are clueless. Learn a definition before coming here and spouting fake news please

There was a recent case of a stolen CC being used to launder money, http://www.forbes.com/sites/laurengensler/2017/01/11/gift-cards-money-laundering/

So please don’t call me clueless nor calling it fake news, I stand by my prior comments and the Card Issuer has braid rights to close your account for any reason, if they have a sniff that you might be doing something improper, illegal, or just something they don’t like they can shut you off.

Money laundering is the act of “cleaning” money – an activity that will introduce “dirty” money (money gained illegally) into the financial system with a legitimate basis thereby making it “clean”.

So the act of stealing the credit card is obviously a crime. Buying gift cards with those stolen credit cards is also a crime. Theft, fraud…whatever else goes into that. But let’s look at the money laundering aspect of that article’s scenario: the criminal bought gift cards with a stolen credit card. Gift cards, basically cash equivalents, are now “dirty money”. The criminal is selling those gift cards at a loss (well, it is all still a gain since they didn’t pay but stole instead) on Raise. While the origin of the gift card is unknown, the sale of the gift card creates a paper trail for introducing the money into the financial system as “clean”: goods exchanged for cash.

But, gift cards bought with a credit card are traceable so basically trying to launder them when you have to provide information about yourself to get the money is really being a dumb criminal.

This is why many criminals create shell companies and sell stuff in a storefront, hiring employees, but don’t care about real business being profitable or not They may buy real items to sell, mark up those items to create “profit” and slowly inject the dirty money in a legitimate way to make it clean. They also can create separate books: no matter the transaction, the second set of books always has a much higher price that it is sold at to introduce that dirty money into the system and clean it.

The criminal really was dumb. They should have just sold the gift cards in person thereby remaining anonymous to the financial system. It doesn’t clean the dirty money they have by selling it for cash, but it keeps them out of the financial system. The dirty money they have will just have to be stuffed under the mattress to avoid detection. Surely you have seen the pictures of the drug lord whose home was raided and the “insulation” in the walls behind the sheetrock were bags and bags of dollar bills? (not to mention the bedroom just stuffed with wads of dollar bills like they were paper reams.)

You are clueless

Received my Altitude Card over a week ago and been holding off activation. I only purchase a handful of GCs each month for legitimate spend reasons. But with the uncertainty of any GC purchases shutting down my account, I’ve kind of lost enthusiasm for the product now. Really a shame since I’m a long standing USB customer and considered moving much of my primary spend to this product. If the blogs start turning against this card, watch out!

they wont turn on it. Bloggers make too much money pumping Credit Cards

Your reader should file a complaint with Federal reserve bank which regulates nationally chartered banks .

Just a thought. When people are buying gift cards for MS (or even more questionable purposes from the banks POV) they are likely doing pretty heavy card use. Even if not exceeding the credit limit is it understandable to see monthly charges that makes no sense in relation to income would raise red flags? Do they monitor that? If I make $100,000 a year and am charging $10,000 a month doesn’t it look strange, and look unsustainable under normal circumstances.

It would be interesting to see numbers on those being shut down, such as monthly use, income, and credit limit. And heavy spending right after open may also look strange/risky.

I’m not saying I like it, but it may well be reasonable business decisions.

These gift card restrictions are really becoming tiresome.

Can anyone explain what the difference in gross revenue is for a credit card issuer (US Bank or AMEX) if a retail store customer spends $1000 for regular merchandise versus $1000 in gift cards? i.e., if I buy a $1000 laptop versus $1000 in Visa gift cards?

The gift card buying purchases probably consist of a much higher percentage of purchases that maximize bonus categories, where the issuer loses money after paying out the rewards.

yes, but what if there are no bonus categories, shouldn’t it all be the same?

Yes. Not an expert but from the reading I’ve done the rate depends on the payment network, the card type (they charge even a little more for premium tiers like the Infinite), the category of merchant, and I think even the security features of the card, but nothing to do with the line-item products of what you are actually buying.

It is just for lack of a better alternative that I’m guessing that people that buy a lot of gift cards are a segment that mostly cost the issuer money (by being strategic maximizers). Besides earning bonus spend on these purchases they probably also segment spend in general and don’t use the card for unbonused spend that would make up for the loss leader categories.

But then again, if that’s why, why do they axe someone after a couple purchases? Why not wait longer to see what the pattern is?

Tro,

I agree. Thanks for taking the time to respond to my question.

Tro you are mostly correct, on top of interchange (IC) rates which are dependant on card network, card present/not present, and merchant type (you can find Visa’s here http://bit.ly/2roLIek), there are also fees that are paid to the issuing bank (in this case US Bank) and there are also processor fees which is the entity that the merchant enters into a relationship with to process the transaction with the card networks.

I completely understand why they don’t want people to take advantage of the 3x bonus. The problem is that they’re going about it in a way that’s giving them a load of bad press for a card that had been getting some positive mentions prior to that.

IMO they’d have been better off placing a limit on the bonus for mobile wallet transactions, similar to how the Ink Plus has the $50k limit on office supply spending. They’d have been able to limit their exposure to MSers and maintain all the good will that the card had gained.

US Bank has always been very conservatively managed. This behavior is consistent with their reputation.

So, buying stuff with your card is improper?