Barclays Uber Visa Card Relaunched with Big Changes

Barclays Uber Visa Card was launched back in 2017. It has some good earning categories, but the signup bonus is not very competitive. Now there’s some changes coming to the card, with different earning categories, up to 5%, and more. Those who apply will already get the new version of the card, while existing cardholders will be converted in 2020.

What’s Changing

Here’s what the card currently earns:

- 4% back on restaurants, takeout and bars, including UberEATS

- 3% back on airfare, hotels and vacation home rentals

- 2% back on online purchases including Uber, online shopping, and video and music streaming services

- 1% back on all other purchases

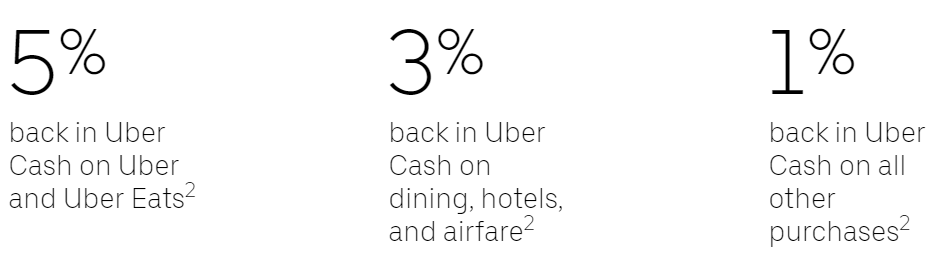

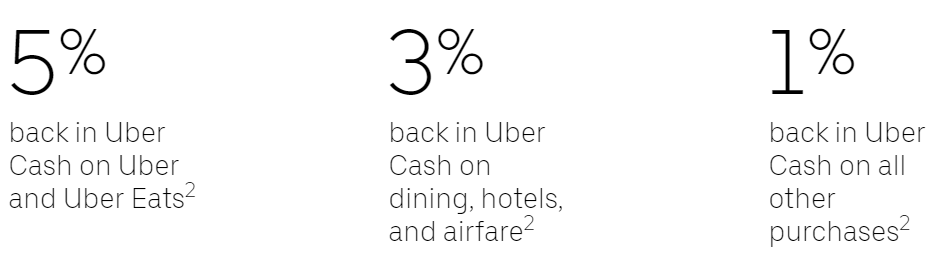

With the upcoming changes, you will earn:

- 5% back on Uber and UberEATS

- 3% back on dining, hotels, and airfare

- 1% back on all other purchases

Another important change is that you will no longer earn cashback. You will earn Uber Cash that can only be used for Uber and Uber Eats. There’s no minimum redemption, but once you accumulate $50 in rewards it will automatically be converted into Uber Cash.

Other Benefits

- Up to $50 credit for online subscription services after spending $5,000 on the card per year

- Up to $600 mobile phone insurance for damage and theft when the card is used to pay the monthly mobile phone bill

- No foreign transaction fee

- No annual fee

Bonus

- Earn $100 Uber Cash after spending $500 on purchases in the first 90 days.

Conclusion

For those who use Uber constantly, this should be great news. You will earn 5% for Uber rides (up from 2%) and Uber Eats orders (up from 4%). Plus the change from cashback to Uber Cash shouldn’t matter.

On the other hand, the card is no longer one of the best cards for restaurants. The rate goes down from 4% to 3%, and it’s no longer straight cashback.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Terrible. Glad I never wasted a hard pull on this card.