The Better United MileagePlus Explorer Offer

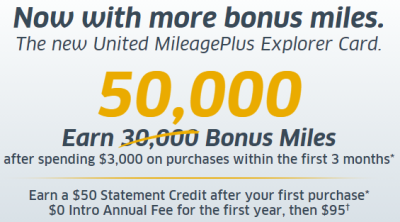

Yesterday there was a lot of coverage about the United MileagePlus Explorer card. The normal bonus on this card is 30k miles, but for a limited time they have upped the bonus to 50k miles plus you can still get another 5k for adding an authorized user and having them use the card. The annual fee is waived the first year.

There have been targeted 50k offers on and off for awhile, but this is no doubt a fantastic deal. Even though United has really lost a lot of value on international premium class redemptions, 50k miles still can get you quite far (especially in economy), plus you can always supplement United miles with Ultimate Rewards.

The Better Offer

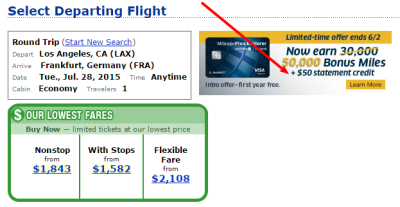

So yes 50k miles is a great bonus offer, but you can do even better. All you have to do is search for a flight on the United website. On the top of the search results you should see a banner advertising the 50k offer. Look closely and you will notice it also comes with a $50 statement credit. Why would you apply for this card without the $50 credit?

Card Benefits

Here is a quick run down of the card benefits:

- Free first checked bag

- Priority boarding

- No fees on foreign transactions

- 2 United ClubSM passes per year

- 10,000 Bonus Miles when you spend $25,000 in net purchases on your Card each year

- 5,000 Bonus Miles when you add an authorized user and make a purchase in the first three months

- Earn 2 miles per dollar spent on tickets purchased from United

- Earn 1 mile per dollar spent on all other purchases

My Take

I have had this card in the past and it is great if you are flying on United since you do get the free checked bag and priority boarding. The Mileage Plus Explorer also comes with primary rental car insurance which is pretty rare (although the Sapphire Preferred has it now).

Beyond the card benefits, this card is high on my list because of the bonus. The last time I had the MileagePlus Explorer was just over two years ago, so I am highly considering this offer. (I wonder how many cards Chase will let me get!)

Conclusion

We are living in the golden age of credit card offers. With that said, you should always be looking for something better. In this case don’t settle for just 55k miles, make sure to get your $50 too!

HT: Doctor of Credit

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

|---|

Hey Shawn,

I’ve never thought of applying the $50 statement credit! Thanks for the hint. A question for you. You mentioned you’ve had the credit card. Do you notice any credit score change when you cancelled that card later on? I mostly fly UA but the MP programme is getting “unfriendly”. I don’t intend to keep this card too long because I am using LH M&M. Thank you.

I kept this card for a year since I didn’t want to pay the annual fee. While I do have a few cards that I keep since I have had them forever, I do cancel cards where I don’t feel the annual fee is worth it and haven’t seen a noticeable drop in my credit score. Everyone’s situation is different, but my score did not drop.

Hats off for you who always post the best offer, regardless of receiving commission or not! That’s why I always put your blog on my top must read list!

Thanks David!

Hey Shawn,

What kind of FICO do I need to get this card? Also about 2 months ago I got the Chase Hyatt–should I wait longer to apply?

Thanks!

Walt in general it is ideal to have at least a 700 credit score to apply for rewards cards, Credit Karma reports some people have been approved below that with the average score being 708. https://www.creditkarma.com/creditcard/chaseUnitedMileagePlusExplorer

As for how long to apply after getting the Chase Hyatt, it really depends on a number of other factors. Shoot me an email at shawn@milestomemories.com with some more details about your situation and I can try to help you out a little more.

https://www.creditkarma.com/creditcard/chaseUnitedMileagePlusExplorer