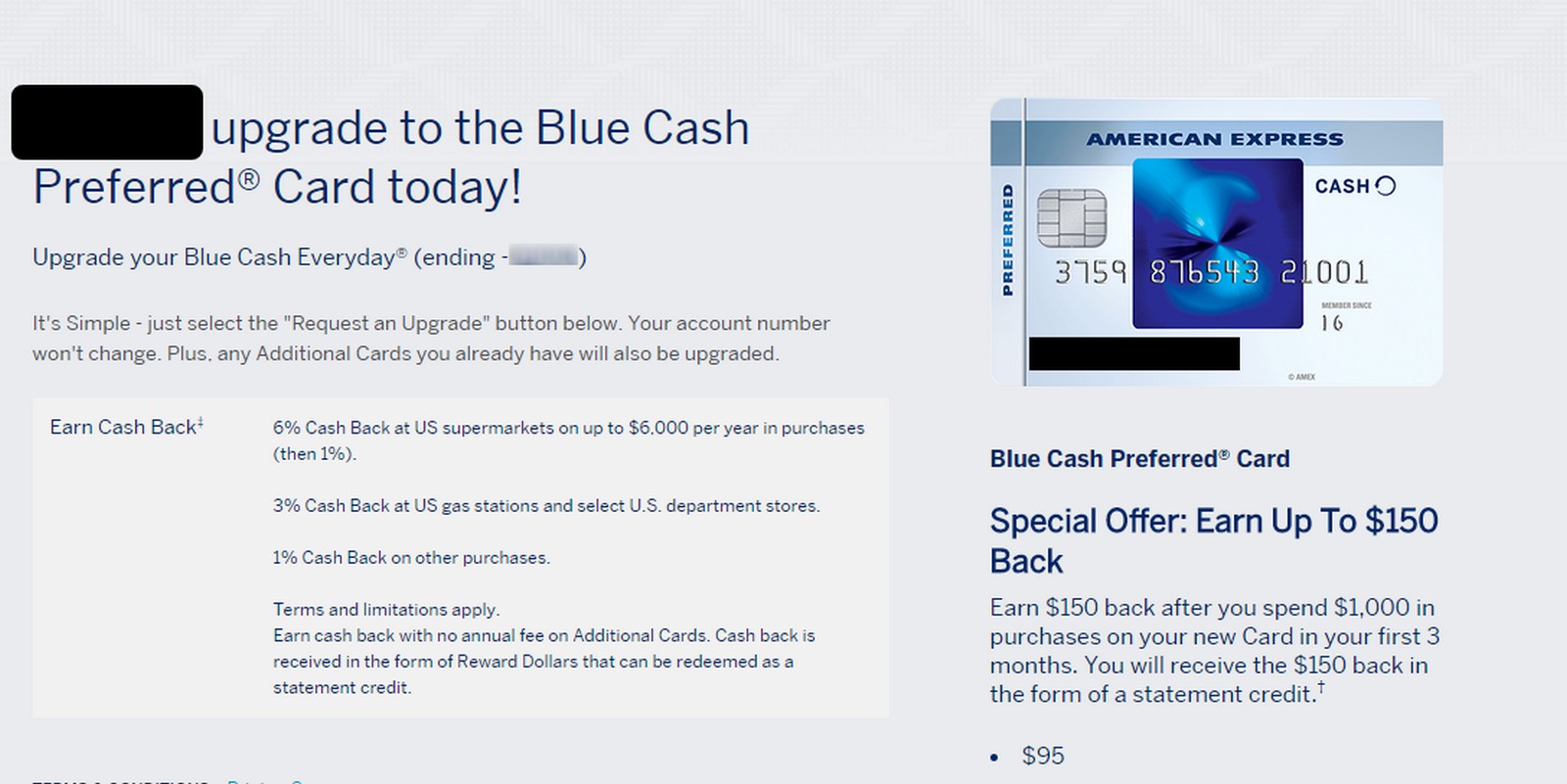

Upgrade Offer for American Express Blue Cash Everyday

When I went to pay my wife’s American Express Blue Cash Everyday card this weekend I noticed something interesting. There was an upgrade offer at the top of the statements and activity page to upgrade the card to the Blue Cash Preferred card. I found it strange that the offer was on that page but not in her Amex Offers. She just recently downgraded back to the Everyday card from the Blue Cash Preferred too (3-4 weeks ago). We downgraded after taking advantage of the same upgrade offer last year.

Details on the Offer & Card

The offer is the standard upgrade offer for the Blue Cash Preferred card:

- $150 statement credit after spending $1000 within the first three months.

- 6% cash back at US supermarkets on up to $6,000 per year

- 3% cash back at US gas stations and select US department stores

- 1% cash back on everything else

- $95 annual fee is not waived

The bonus isn’t astounding in any way but it does cover the annual fee plus it puts a little coin in my pocket. This is one of, if not the, best personal cash back cards on the market. Getting 6% at grocery stores offers a lot of possibilities for increased spend, even if it is capped at $6,000. If you max it out that is $360 in cash back. I could have used this card last week with that Kroger deal.

What I found most interesting is that this is the second time she has received this offer. And it has only been a few weeks since she downgraded to the no fee version. Getting multiple upgrades is possible with the Surpass card but I had not heard of it for any other American Express cards.

A New Authorized User Offer

After seeing the Blue Cash Preferred offer I checked her other cards to see if anything else popped up. The only other offer was to add an authorized user to her Everyday card. The offer was for 1,500 Membership Rewards for $150 in spend.

Conclusion

This was a decent offer that gave us a chance to use a great card for nothing out of pocket, while still profiting $55. It also allows her to get a sign up bonus, and premium card, without having to use a hard pull.

What I found most interesting is that this may be a churnable offer. I plan to downgrade the card again when the year is up and hopefully she gets the offer a third time.

Let us know in the comments if you see any similar offers, or AU offers, on any of your Amex cards.

Am having second thoughts re. this promo, given new round of alarming reports (DOC etc.) about AMEX “RAT teams” going around taking back cardholders earnings…. (e.g., if they determine that you’ve engaged in some nefarious activity…. e.g. ms it seems of any kind, even 3rd party gift cards) What’s your thoughts on these RAT teams Mark? Are they coming after spending even on grocery story gift cards? (before or after the opening promo?)

I think they are focusing on VGC and Simons mall purchases. I have mixed in 3rd party gift cards from Kroger etc. without much of an issue. Who knows if that will change though. 1-2k in min spend shouldn’t be too hard to meet organically though. They don’t care as much once the sign up bonuses are paid out.

Many thanks for the reasoned observations, Mark. Alas, even as we may go forward with the upgrade on my wife’s amex card, our whole outlook on Amex has soured — in spades. That nasty police state style verbiage even applies to this card upgrade:

“If we in our sole discretion (e.g., we’re the corporation, you’re just a pauper) determine that you have engaged in abuse, misuse, or gaming (as we alone define) in connection with the welcome bonus offer in any way or that you intend to do so…. we may not credit $250 statement credit to, we may freeze $250 statement credit credited to, or we may take away $250 statement credit from your account.”

How to alienated long time Amex customers…. How to add amex as a synonym under the wiki entry for, “big brother.”

It is annoying for sure but if you can meet the spend organically then hit them where it hurts them, the wallet. And take their $250 and 6% grocery money and run 🙂

That is my thinking at least!

I have the Amex offer but its for $250 with a $2,000 spend, still with this $95 annual fee. Good deal I assume?

For sure – an even better deal than I got!

Mark, great post! I especially was drawn to the headline, “My wife’s….” as my wife too is the primary name on our longggg held Amex Blue n/f card. 🙂 I’d always thought to leave it alone, avoid the upgrade enticements, as we would lose a “good thing,” pay onerous af’s, and then have to close it…. (and then potentially lose an element in good credit scores, etc. etc.)

Yet upon “getting ideas” from your splendid post, we checked my wife’s amex promos after the login — and happy to see she gets an even better offer. ($250 credit after $2k spend in 3 mos., which we can easily do esp. now that we do more …. spending at grocery stores….. think free gas, free cell minutes, via Kroger, Martin’s Amazon gc’s, etc., etc.) Nice too to learn from your experience that after first year, we can downgrade back to our current card…..

As my favorite “pioneers” in this space (Shawn, Drew, Greg, have long counseled 🙂 — this realm is always changing, and while the basics remain, it’s best not to get too wedded to previous assumptions, lest we blind ourselves to new deals and strategies that might make better sense with new combinations and circumstances. oye.

Awesome! I am jealous of that offer 🙂

Mark – I closed my no-fee AMEX 3 yrs ago. AMEX has a habit of placing new credit lines under old ones with them (my Surpass for instance is actually several years old but shows an open date of a Platinum from many moons ago). I am hoping my “new” no-fee might take the “old” no-fee’s trade line.

I have the Surpass but will definitely upgrade it to the Aspire when I can, hopefully with some sort of bonus (I don’t want to close the Surpass now because of its ongoing activity).

My Citi Reserve will transfer as an Ascend, & I will need to do something with it as well. Sooo I guess I will transfer the no-fee & fee Citi HH cards as you advise & hope for a bonus upgrade later.

My fee on the Reserve was just paid so I can keep as an Ascend for awhile I guess while waiting on a deal or priduct change offer with no further cost.

I didn’t realize AMEX offers up bonuses with product changes…very cool. With that in mind, I am definitely going to transfer my Citi no-fee Hilton card over & hope for something better (bonus) within AMEX.

AMEX states in their cardholder letter to transfer the Citi account & then contact their rep for alternatives, so I will probably do so. Any reason that’s a bad idea? I find it hard to believe they will enforce their 5 card rule on a portfolio buyout? I do wish I knew if AMEX is transferring my Citi account “open” date so that would at least be 1 good definite reason to keep!

If you have never had the fee free hilton amex I would consider canceling the Citi one so it doesn’t negate your chances of getting an amex bonus in the future when they change you over. If you have had it then I would keep it open for a chance to upgrade to the annual fee card. We have each upgraded to the Surpass card twice at 100,000 points each time. But if you have gotten most of the bonuses from Amex already then that would be a good chance to get an upgrade offer in the future.

That is my thinking at least.

Thanks for the post Mark. I actually received upgrade offer as well, $250 credit after 2K spend. But my question is: when did you downgrade the BC Preferred, just before the anniversary or after? Making mental notes in case I take the offer.

With Amex’s new language in their card offers I wait until the fee posts and then downgrade and get the fee credited back. I would take the offer for sure – $250 is about as good as it gets for that card and without having to take a hard pull 🙂

Mine was under Amex Offers & Benefits and was for $250. Everything else was the same as posted above. One click and I was approved. Got the message that I would get the card in 7-10 days. (I have had Preferred card previously and downgraded early this yr)

One thing I noted was that I had the option of requesting a second card, which I did not do. I am hoping that when it arrives it does not include my wife as a second user. I can then use the add a new card user and get the $25 bonus for that. Sweet deal even if it that doesn’t work out for her card.

Thanks for the heads up, I just made $155 and plus (maybe) $25.

Thanks, Sam

Awesome! I am jealous of that offer haha. Good thinking on adding the AU later too 🙂

I failed to mention the required $1000 spend.

Thanks again Mark

Sam

If you close the Delta you would only be using up one spot since the Biz Plat is a charge card. I would close the Citi no fee Hilton card – no reason to have it transfer over. If you are working on the free night on the reserve then you want to keep that open. If not you may want to cancel it before it transfer so you can get the hilton amex version in the future. As for new cards I would suggest:

SPG Business card – although you may wanna wait till it increases to 30 or 35k again

Delta Gold Business – at 60k right now plus $50

Amex Everyday Preferred – this is the best all around card on the market for most people’s spending pattern. Try to get a 25k offer by going incognito.

Those would be my top choices. You could also add in the Surpass with the new 125k offer but I don’t know if you have already had it plus you may want to wait to see what the new card offers.

Mark, I have the SPG Business and closed the other SPG sometime back. I may get the Delta Gold Business and Amex Everyday Preferred for wife and I. I have previously had the Surpass.

I am working the free Reserve night right now, and working on the Diamond status for next year. This will probably also hit the 15K for another free night. I generally keep the no fee cards for helping years on credit report, but do not want it take up a AMEX spot. I appreciate your thoughts on this.

Awesome – sounds like a good plan!

Mark,

Good post. I am concerned that with my two Hilton cards going to Amex I will lose a couple of Amex card spots. I have Delta, SPG, Bus. Plat. now. I am thinking I should feel those other 2 spots with Amex cards. What should those be? I am also thinking of closing the Delta card. I am not sure the companion pass is worth the $195 and Amex gives me the lowest available credit of any card I have.

I appreciate your thoughts on this.