Targeted End of Year U.S. Bank Spending Offers

U.S. Bank is sending out targeted spending offers on their Club Carlson and Flexperks credit cards. Let’s take a look at two offers I was personally targeted for. One of them is fantastic and the other is good depending on the type of card you have.

Flexperks Visa Signature Spending Offer

The Offer

Give yourself a gift this holiday season when you use your U.S. BankFlexPerks® Travel Rewards Visa Signature® card between November 1 and December 31, 2015. Earn 3,000 bonus FlexPoints when you use your Card for $500 in net purchases.

Analysis

This is a fantastic offer! By spending only $500, I will earn 3,000 bonus FlexPoints. Better yet, the card pays 2X Flexpoints at grocery stores (as long as you spend more in that category than gas or airlines). The purchase of a $500 Visa for $505.95 will then generate 4,012 points. The cost per point including the bonus ends up being $.0014. Considering Flexpoints are worth at least $.01 and up to $.02 this is a fantastic deal!

What I’ll probably end up doing is using 3,500 of those points to offset the upcoming annual fee on the card. The annual fee is $49, so that gives those points a value of 1.4 cents each. No matter how you look at this deal, it would be stupid not to do it considering the ease and value.

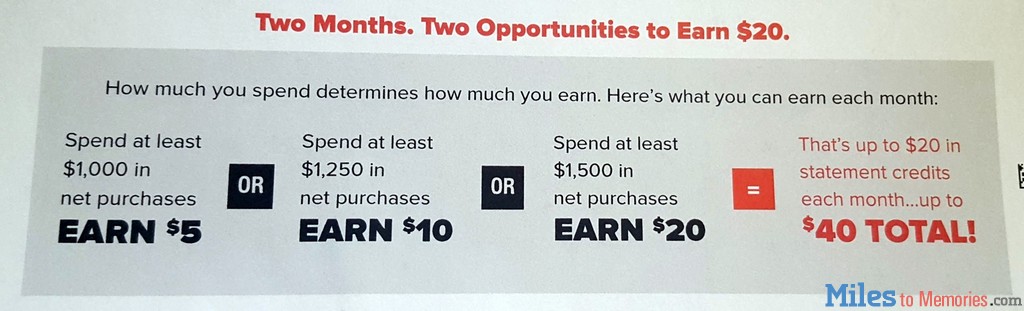

Club Carlson Spending Offer

I also received the following offer on my Club Carlson credit card:

Analysis

To maximize this offer you would need to spend $1,500 to earn $20 cashback. At that level it works out to be 1.33% back in cash on top of the points earned. Since I recently downgraded to the no annual fee Club Carlson card, my normal spend only earns 1 point per dollar, so this isn’t a good deal for me.

If you receive a similar offer for the Premier card which earns 5 points per dollar, then this is something to look into. Getting 5 points plus 1.33% back is pretty darn good in my opinion, even if Club Carlson points aren’t worth nearly what they used to be.

Conclusion

These are two of the better spending offers I have seen from U.S. Bank lately. While the Club Carlson offer doesn’t work for me given the earnings on my version of the card, the Flexperks offer is fantastic. Hopefully U.S. Bank keeps offers like these coming, because they will definitely work to get me to use my cards more often.

How can I check to see what I got??

The Flexperks offers vary too. Mine was 2,500 bonus points after spending $5,500.

The Club Carlson offers vary, I had to spend $2,250/month to earn the $20. While it’s not a bad offer still, I don’t like tying up that much on my MS allocation on Carlson points. For the $1,500 I probably would have done it.