Visa Gift Cards at GiftCardMall Analysis

Last week I covered a Quick Deal over on Frequent Miler about the portal Simply Best Coupons offering .4% cash back on the purchase of Visa Gift Cards from GiftCardMall. This deal hasn’t gotten a lot of attention, but I am going to show you why it is pretty good.

The Old Days

I used to purchase Visa gift cards from GiftCardMall pretty often in the “good old days” of 2013/2014. Back then portals were paying up to 4% cashback for Amex gift card purchases. I then used Amex gift cards to buy Visa gift cards and get another portal bonus. It was a complicated, but nice process.

Then GiftCardMall reacted and banned Amex gift cards and eventually portal payouts for Amex gift cards shrunk and GiftCardMall stopped paying out on Visa gift cards. The system, as nice as it was, died.

.4% (.5%) Cash Back Sucks Right?

Update: Thanks to @tovanhung on Twitter for informing me that Top Cashback is now paying .5% on Visa Gift cards which obviously improves the math.

I’m not going to sit here and argue that .4% (.5%) cash back is amazing. It isn’t. With that said, that rebate amount makes Visa gift cards from GiftCardMall affordable, especially for people looking for an easy way to meet minimum spend requirements.

Note: Simply Best Coupons offers $5 for signing up as well. If you use my link I will earn a 5% bonus up to $50, but the $5 offer applies to anyone signing up.

An Example

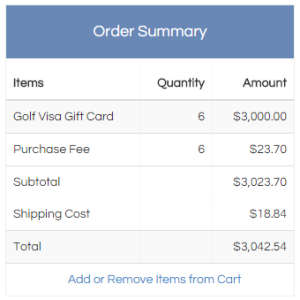

Lets look at a $3,000 Visa gift card purchase from GiftCardMall. This is a very common minimum spend requirement on credit cards, so I think it will help a lot of people.

Here is the math:

- Gift card cost (6 x $500): $3,000

- Gift card fees: $23.70

- Shipping costs: $18.84

- Cashback (.4%): -$12.00

- Final Cost: $3030.54

- Cost per card: $5.09

Update: With TopCashback’s rate of .5% back, the final cost comes to $3027.54 or just $504.59 per card.

Here are a few notes about the math. Portals generally pay out on the face value of the cards not including fees or shipping. That is where I got my $12.00 calculation. ($3000 *.004) As you can probably tell, the math gets better as you purchase more cards.

The shipping method chosen with this order is Critical Mail. When you purchase one card, critical mail is much more than regular mail, but it is about the same cost (within $.20) for 6 cards. Critical Mail is highly recommended as it is trackable.

Analysis

At $5.09 (or $4.59) per $500 card, this works out to be a roughly 1% cost for manufacturing spend. Sure this isn’t mindblowing or anything, but it is perfectly viable for minimum spend requirements. Most cards earn at least 1% on all purchases, so you really aren’t losing money and on the flip side are earning a sign-up bonus.

Remember too that Visa gift cards from GiftCardMall are very easy to load to both Bluebird & Serve. This is a fairly convenient method of manufacturing spend.

Why not REDbird

REDbird is an amazing product and it does generate $5k per month of fee-free manufactured spend. This works great to meet minimum spend requirements as well as category bonuses. I personally have a card that earns 5x on REDbird loads, so I would prefer to use that to maximize my return.

Other Options

You can find gift cards at a lot of places of course. The most popular options are probably $5.95 per $500 at grocery stores or $3.95 per $500 at malls.

For more info see: Where To Buy Pin-Enabled Gift Cards for Manufactured Spend

Conclusion

I am truly excited about this development. While .4% (.5%) certainly isn’t great, it brings down the cost of these cards to a manageable level and hopefully more portals will open their coffers back up in the future.

What do you think? Is purchasing gift cards through GiftCardMall a viable method of manufacturing spend?

I tried buying VGC on Giftcardmall using the topcashback portal. The first thing TCB asked me was for details of my bank account saying that the merchant (GCM) requires that I have bank account info with TCB. Is this normal?

Only purchased once under this scenario. Did not receive any such request from TCB.

Do VGC purchases using an Amex credit card earn points? Amex’s T&Cs state that prepaid gift cards don’t earn points, but how can they really tell if you are purchasing VGCs from GCM, or Walmart?

Yes they do. Those terms and conditions are standard across many cards, but I have always earned points.

Also, has anyone had any data points on using the discover 3% cb card?

Correct me if I’m wrong, but in theory you could make $50/mo per Serve/BB using a 2% cb card and buying in $3k increments, per your breakdown (w/ .005 cb rate)??

If you have two BB/Serve accts you could make $100/mo buying 12 $500 vgc and loading to Kate when using a Fidelity Amex cc, no? If you have a working Kate this seems relatively easy, especially when using the critical mail option.

I meant buying enough vgc to load $5k to each card/mo. It’s late and my mind is mush!

If you purchased $5k at a time on a 2% card you would earn $57.67 per month. Total in fees on a $5k order is $68.70. You would earn $101.37 rewards on the $5068.70 purchase and $25 cashback. So $101.37-68.70+#25=$57.67. I still think a better use of that bandwidth would be to meet minimum spend requirements on credit cards.

Mainstreetshares pays 1.2% for GCM. Much better than .5% from TCB!!

🙂

Simmy

Their terms are vague and many people had issues with this portal in the past. With that said, I have reached out to make sure Visa gift cards are included since every other portal either has a lower Visa gift card rate or excludes them in the terms.

Their terms are clear as day IMO:

Details & Exclusions

Cash back not available on Visa purchase fee, Customization Fee, Shipping Fees on all gift cards.

That means cash back is eligible on the face, which is standard for all portals.

I can’t speak for anyone else, but I have been using them for years with no issues. I have found them to be the most customer friendly portal out there.

Appears MSS Terms have changed:

“Cash back not offered on Visa gift cards, Simon gift cards, Gift Card Mall eGiftcard, Hess Gasoline, Gulf, All Macerich Visas, Arco, Safeway, BP, Best Buy, Target Physical/eGift Cards, Choice Gift Cards, Customization Fee, and Shipping Fees on all gift cards.”

Yes I had contacted them and they finally responded yesterday after checking with GCM. Visa gift cards are excluded and they updated their website terms.

[…] Why GiftCardMall’s New Portal Bonus is Great for Manufactured Spend […]

If you’re using Amex GC’s to buy GCM then loading to Serve you’re looking at an even sweeter deal.

For the sake of simplicity, if we assume a 1% GCM fee and a $5k Serve monthly load limit and a net of 2.5% cb from double dipping w/ portal cb + cc cb from buying AGC, you’re looking at $125/mo.

You can’t use Amex gift cards on GCM anymore unfortunately. I used to do this all of the time though.

[…] seems like a really solid card. If it ends up earning 3x at certain online retailers like say GiftCardMall, this could be a real game changer. We will of course have to wait and see what happens […]

How easy is to redeem cashback earned for travel with WF? If it’s as easy as Barclay arrival I would be interested in signing up for his card..

The 7.5% only works on airfare and you have to purchase it through their site.

I bought them at shopping mall (Simon Mall) cost $503.95

Hello. I am new to a lot of these terms and understanding things. Trying to explain this to why wife is even harder. Can I purchase a card to give to my wife that she could use to pay on her credit card ?

Thanks

PS. Enjoy seeing others with kids doing this.

No these cards can be loaded to Bluebird/Serve at Walmart and you can even purchase money orders with them. After doing that you can pay the credit card, but you can’t pay a credit card directly with them.

[…] For more info on why purchasing Visa gift cards may be a viable option for manufacturing spend, see this Miles to Memories post. […]

How do you get the .4% back when I checkout it doesn’t show anything about the .4% rebate?

You have to go through the portal. The portal pays you back eventually after they confirm the transaction.

Thanks for the info but the risk of $3k from GCM is not work the less than $6 savings if you are in a place where you can get cards for $5.95 or cheaper at $3.95. GCM is a pain as you need to wait for the activation codes or needs to call in to activate their cards. Nice if you do not having access to other options though.

GiftCardMall now sends the activation codes via email when purchasing directly through them. I agree that this isn’t the only solution, but I know a lot of people who don’t have a mall or grocery store who will sell them gift cards.

This is also simpler for people who don’t have a lot of time to go from store to store. As always I like to present options for people and let them decide for themselves, which is why I mention the other options in this post. Thanks RL!

The only grocery store near me for gcs is Safeway. This has been at best a YMMV thing and isn’t exactly smooth when you run into the GC ‘cash only’ police there.

No doubt this offer isn’t going to hold a candle to the grocery store cash back route. However, for those without RB this is a means of utilizing minimum spend. Even with a RB, if you have a 5 % cb card and a $5k/mo cap, you’re better served finding other ways to meet minimum spend (assuming this card doesn’t have 5% cb).

Funny how all previous comments are based on that one small piece of information (5x) embedded in the post, rather than the majority content of the post. 🙂

Yo Shawn,

Would you mind sharing which CCs give 5x on el pajaro rojo.

Thanks.

Wait. Which card gets 5x at Target? Besides Club Carlson?

Which card earns 5x on REDbird loads? I just got REDBird and am meeting some minimum spends, but would love to maximize points as well.

Wait. Which card gets 5 percent at Target?

Some Target stores are coded by Visa as a grocery store. I have the Wells Fargo Visa Signature which earns 5x at grocery stores the first 6 months. I talked about it here: https://milestomemories.boardingarea.com/credit-card-application-strategy-jan15/

Couple of thoughts.

The link (on my phone) is grey in color. It might look better in the traditional blue to stand out more. Not sure if it’s possible and definitely not trying to be picky, I just know you’re looking for feedback!

It would be awesome to read your experiences with RB and the WF card in a new post 🙂

There’s a lot of talk about this card for grocery purchases, but not a ton about RB. Perhaps it’s by design to keep it from blowing up, who knows. $250/mo (theoretical) is pretty insane for one RB account.

Thanks Anthony. I will look into getting this changed.

Shawn

What do use the visa rewards points for? Is it like having a Capital One card where you can use points to pay for travel and/or airfare? Could I use points to pay for a cruise?

Thanks

Nancy

The points are worth $.01 in cash. You only get the $.015 for airfare booked on their website.