$1500 Wells Fargo Bank Bonus Offer

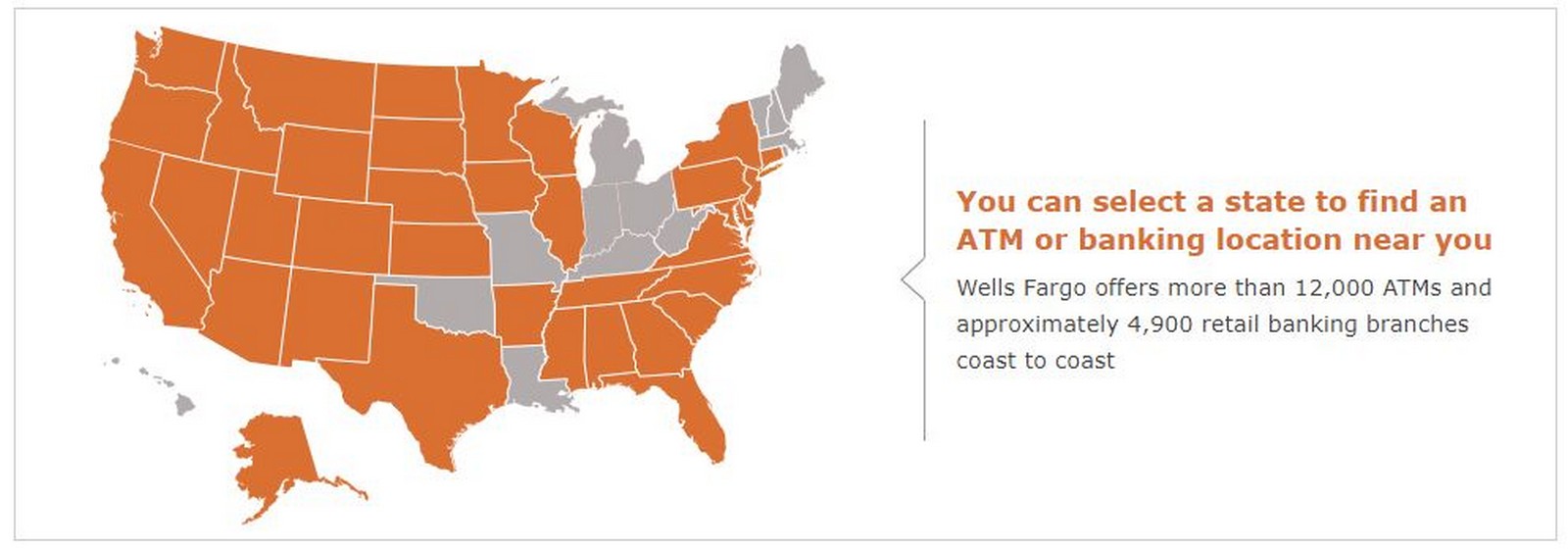

You all know I love myself some bank bonuses. They are an easy way to rack up some serious profit pretty quickly, and without much effort, most of the time at least. Bank bonuses played a role in me earning almost $14K in the first quarter of this year. Well, this $1500 Wells Fargo bank bonus appears to be one of the best offers I have seen out there. It does require you to have a business to get so that limits it for some. I am not sure if it requires an EIN to apply or not yet (as many business checking accounts do). Hopefully someone can chime in below if they try to apply as a sole proprietor. It also requires you to sign up in branch which will limit this for some, but they have branches in a vast majority of states. Remember that you will also need to pay taxes on this bonus offer since it is considered interest income.

Update 6/13/22: We got a few reports in our Diamond Lounge that the bonus has posted on people’s accounts on the 60th day. Faster then expected!

Update 4/22/22: So far all of the reports we have seen are that any codes printed before the offer was pulled are being honored. Most, but not all, bankers are allowing sole proprietor applications too. Time will tell if the bonus posts without issue but it looks good so far.

Update 4/15/22: The links to this offer have been pulled. What we don’t know yet is if the people that already have codes will have their offer honored. The terms have a we can cancel at any time clause in them. Hopefully there are some data points over the next few days letting us know what the results are out there.

Wells Fargo Business Checking Bonus Offer Details

Here are the details on what you need to do for your $1500 Wells Fargo bank bonus offer:

- Open a new, eligible business checking account at a Wells Fargo branch with a minimum opening deposit of $25 by 05/13/2022.

- You must provide the bonus offer code to the banker at the time of account opening.

- Have at least $5,000 ending daily balance in your new business checking account on the 30th calendar day and the 60th calendar day after account opening.

- We will deposit the bonus into your new business checking account within 30 days after meeting all offer requirements.

You will likely want to sign up for the Initiate Business Checking account that has a $10 monthly fee. You can get it waived by

- Having a $500 minimum daily balance, OR

- Having a $1000 ledger balance

Since the offers requires a $5000 deposit this shouldn’t be a problem. There also doesn’t appear to be an early account closure fee.

Wells Fargo Checking Account Bonus Terms

Eligibility Requirements:

You must open a new Initiate Business Checking®, Navigate Business Checking®, Optimize Business Checking® or Analyzed Business Checking account in order to be eligible for this bonus offer.

- This offer is intended for new business checking customers only. You must use your bonus offer code at account opening when you apply for a new eligible Wells Fargo business checking account. For this offer, a new business checking customer is identified by the U.S. Taxpayer Identification Number for the business used to open the new business checking account.

- You are not eligible for this offer if:

- You are a current owner of a Wells Fargo business checking account.

- You received a bonus for opening a Wells Fargo business checking account within the past 12 months.

- You are a Wells Fargo employee.

- Bonus offer code can only be used once.

Bonus Requirements:

- Open a new Wells Fargo Initiate Business Checking, Navigate Business Checking, Optimize Business Checking or Analyzed Business Checking account with a minimum opening deposit of $25 by May 13, 2022. All account applications are subject to approval.

- Have at least $5,000 ending daily balance in your new business checking account on the 30th calendar day and the 60th calendar day after account opening.

Ending daily balance for Optimize Business Checking and Analyzed Business Checking accounts may be reflected as daily ledger balance or closing ledger balance.

Bonus Payment:

- We will deposit the bonus into your new business checking account within 30 days after meeting all offer requirements.

- The new business checking account must remain open until the time we attempt to deposit any earned bonus payment. Please note that an account with a zero balance may be closed by us without prior notice, as further described in the Deposit Account Agreement.

- You are responsible for any federal, state, or local taxes due on your bonus. As required by law, the bonus amount may be reported on IRS form 1099. Consult your tax advisor.

Additional Terms and Conditions:

- Interest on the Navigate Business Checking account is compounded daily and paid monthly. The amount of interest earned is based on the daily collected balances in the account. The following Annual Percentage Yield (APY) is accurate as of December 1, 2021. The account pays an APY of 0.01% if the balance is $0 or more. Rates are variable and subject to change without notice. Fees could reduce earnings on this account.

- Offer valid from March 14, 2022 through May 13, 2022. However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Offer cannot be:

- Paid without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien). Non-resident aliens, signing Form W-8 are not eligible for the offer.

- Combined with any other business deposit offer.

- Reproduced, purchased, sold, transferred, or traded.

- The actions required to earn this bonus are separate and distinct from the options available to you to avoid any applicable monthly service or maintenance fee for the checking account you opened.

Final Thoughts

Hopefully if you are interested in this $1500 business checking bonus offer you are near a Wells Fargo branch to make it happen. I am considering a trip to Chicago to get this done. Of course Michigan is one of like 10 states without a branch…just my luck!

If you are even slightly considering it I would fill out the info and get the email in case they pull the offer early.

Are you going after this massive $1,500 Wells Fargo business checking account bonus? Let me know in the comments.

HT: Doctor of Credit

I made an appointment and did the Wells deal. I have been in business for 30+ years and have never seen the nonsense to get a business account opened. For one of my companies, they said both partners would need to be there. Really no reason for that and my business partner is not sitting there for an hour as he is busy. So instead I signed up for one of my other companies. These are real businesses. What went on could blow my mind. Took more than 90 mins to open, possibly 2 hours. The rep made phone calls all sorts crap. Asked me 100 questions most of which none of their business really. Nobody on the planet would go through this nonsense unless they were hoping to get 1500. Then I merely went to deposit cash to open the account and I would ACH the money in from another bank. They checked my ID to deposit two $20.00 bills. Yep. They need ID for cash. Another funny part is that my wife has an ancient acct here used for one damn bill autopay a month. She wont close it. So I am considered a known person to the bank. In any case I had to post this. What a bunch over there.

Far from a well oiled machine for sure. I have an article today about my craziness for the credit card offer.

If anyone have an extra CODE _Can someone email me a code ? thanks so much elleny76@yahoo.com

For those who applied, did they require a credit check? I know usually opening bank accounts shouldn’t but double checking since I have it locked for all 3 credit agencies. Thanks

I missed this one. I have been so busy I forgot to get the code. If anyone has an extra which I doubt let me know. Its also unknown if the banks will accept it now around here.

Grabbed a code on 4/14, just in time apparently, and they honored it for my husband’s appt today 4/22 with no problem, thankfully live just a couple miles away from the nearest branch so it was pretty risk-free

Excellent – easy $ 🙂

Had appt last week with code in hand. Smooth. Printed the offer details for me upon completion. Also approved for credit card. No HP

Nice double dip Paulie

hey, if anyone can share their extra bonus?

samsimonusa at gmail dot com

thanks a lot

Man. Missed getting a code. If anyone has an extra or isn’t going to use theirs. Lmk!

Got my code the first day, just had my appointment this morning. Everything went smoothly. I got a call yesterday asking me to send over documentation. At that point the banker sounded a little bit like she assumed I didn’t have a real business but after I sent over my info she was a lot friendlier. I’m a sole prop Amazon seller but I have an EIN and 5 years history, and a decent amount of revenue. I wasn’t super clear about what docs she wanted that applied to my business as I don’t have a DBA, but I sent over a Schedule C, 1099k, and my resale certificate. I also listed my D&B # for good measure. I’ve had a personal checking with wells for years and have previously had a mortgage and credit card. I also got pre-approved for their business platinum during opening but it was nothing exciting.

DP: Code obtained 4/12. Appointment was today 4/20 at local branch in PA. Took my two forms of ID, EIN paperwork that I already had since last year, business card and a couple of checks to deposit along with the email with the code. And no issues. I am a 1099’ed travel consultant. Bank rep was floored when he saw the offer. I have my mortgage and some other financial things with WF. I was also pre-approved for their business platinum card as well which I politely declined. I was in the market for a business checking account and for once my timing was spot on!

Thanks for the DP Dawn

Data Point – My code obtained on ~ day 1, April 11, worked without issue in branch yesterday April 19th. The banker appeared to be having his first exposure to the offer, his words were, “wow, great offer….” as if he’d not had anyone else come in with it. Had EIN, showed him IRS paperwork, but still the account made reference to using SSN; seemed as if the EIN was being used in lieu of having any state-level business registration paperwork (which I don’t have, but the rules ask for some similar type of evidence).

Thanks for the info – good DP!

Also looking for an extra code if possible experimentalascent @ gmail

Anyone have any unused codes? So upset that it was pulled so early!

Anyone with an extra code to spare? Happy to pay with gift card. Went to the bank, and in the middle of opening the account it said code invalid. The banker saved my record, and I have to get back soon

I had the same issue with my code coming up as invalid. Two bankers were super nice and helpful and kept trying to enter it, then they went to speak to the manager to research it and confirmed it should work. Then they called corporate who also said it was valid and just some kind of glitch in their system. One banker said there is a way to manually apply the code and she was going to work on it for me the next day (4/22), but they tried entering it once more for like the 5th time and thank god it worked! I was 2 hours into the appt at that point and was going to be so upset if this didn’t work out! I would go back and try again with your same code, they mentioned their system has been getting lots of updates and having glitches and that was probably the issue. Don’t give up on this if you already have a valid code!

I signed up online Wednesday afternoon and received a code by email. Set up an appointment for this morning and met with the banker. I opened up a new business checking account. I’m a sole proprietor and my “business” is a very new website and podcast (neither yet monetized). She read through the fine print, said everything should be good and entered the code. When she printed out my paperwork, the details of the offer printed with it, suggesting it was entered correctly in the system and should be honored.

Nice – we have been hearing people were still able to do it with a code. Thanks for the DP Dustin

Hi! Will you be able to update if those with codes who were unable to make an appointment in time can still receive the bonus?

Looks good so far from DPs I have seen. That could change a week or two down the road. My appointment is in 2 weeks so I hope not at least.

If one resides in a state without a Wells Fargo branch, I assume there are no issues driving to another state to open a Wells Fargo business account and qualify for this bonus?

I just skimmed the terms but didn’t see any notation of that. That is my plan at least.

I went to a branch in a different state and successfully applied as Sole Prop. Everything is a green light so far. Did you try to apply in a different state? Good luck!!!

My small LLC has an EIN. I made an appointment yesterday for an appointment this afternoon, but this morning received an email stating that the appointment was Cancelled. No explanation given. Bummer!

May have just had the business banker call in sick etc. Hopefully you can get it to work out for a date you have available.

You are probably right Mark. I signed up for another appointment the next day and was able to meet and open an account.

So if I currently have a business checking with Wells Fargo, I would not qualify for this bonus if I was to open a new checking account for another business with a separate EIN number?

I don’t believe so but could call a banker to confirm.

My offer was $1.5K for $5K deposit. I walked into a branch this morning, showed the offer code that was emailed to me and was able to open an account. Used my SS# for application and used my name for the name of the business. However, I did had to add something to my name for the actual name of the business – for example, John Doe Transportation or Jane Doe Publishing. Took about 75 minutes to complete. Time well spent!

Addendum: applied as Sole Proprietor without an EIN (used my SS#).

Excellent – thanks for the D.P.

Closest branch over three hours away. I will definitely consider doing this one.

I am thinking of going 5 hours myself 🙂

It is $15k not $5k but still an amazing offer

My bad they had $15k this morning but now I see $5k

Yup a few different offers / links out there

Appointment booked, thank you!

Awesome!

Wow, super offer, and a branch less than a mile away! Thank you!

I’m jealous how close one is to you!

Yes, we are in a sweet spot for pretty much everything in the hobby. But darn, now I have to deal with closing out an account; long overdue to take that one.

Paid without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien)

Can you elaborate on this ?? Can we use SSN for this ?

I am not sure if you can do it as a sole prop with your social or not yet. Hopefully someone can chime in after they go to a branch and talk to a banker.

Sole proprietor without an EIN, fingers crossed someone finds out soon!

It really only takes a few minutes to get an EIN