Airline Lounge Access

Credit card rewards are fun. So it’s natural when travelers are looking for airline lounge access, they set sights on cards first. Why buy an expensive annual lounge pass when you can pick up a credit card bonus and other benefits in addition to lounge access, largely subsidizing the card’s fee? But frequent travelers should start questioning that logic based on Delta’s negative changes last week. American Airlines, Delta, and United each offer credit cards with airline lounge access, but they also sell annual passes. Different travelers are placed in varied dilemmas. Today, I’m sizing up each carrier’s lounge card option against their annual pass alternative.

American Airlines

The Card

Perhaps long overdue from American’s perspective, the Citi AAdvantage Executive World Elite Mastercard was recently refreshed/devalued. While a step down from the previous value (highlight: ten authorized users with no additional fee), the now-$595 annual fee card still offers a slate of solid benefits. The signup bonus now sits at 70k bonus miles on $7k spend.

The primary cardholder and any authorized users each enjoy unlimited visits to Admirals Clubs for themselves, plus immediate family (spouse, domestic partner, and/or children under 18) or two guests. The first three AU’s annual fee is $175 total, and any others are $175 each. The primary cardholder can pick up 10k bonus Loyalty Points twice by reaching the 50k and 90k Loyalty Point milestones. Cardholders earn 4x on AA spend and 5x on additional AA spend over $150k annually, plus 10x on AA portal hotel and car rental bookings and 1x everywhere else. The card comes with a suite of credits, mostly more trouble than their worth: the promiscuous $100 Global Entry/TSA PreCheck benefit, Lyft, Avis/Budget, and GrubHub.

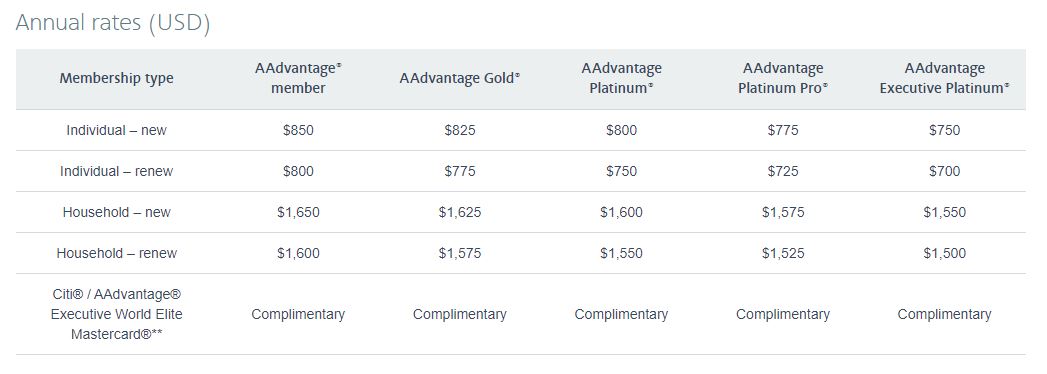

The Pass

American provides a handy table of annual lounge pass prices on their site and pictured above. I found these current prices jarring. The cheapest price is for a top-tier elite renewing a pass ($700). A scrub with no status just looking to buy a pass for the first time must shell out $850 – egads. And that’s just for individuals; household memberships skyrocket above these prices. In their unending thoughtfulness, American also allows individuals to redeem miles for passes – at a rate of 1 cent per point. That should be a no-go for most all of us, as we can easily obtain over 1 cent per point on award flight redemptions.

Delta Air Lines

The Cards

Delta offers two different cards with airline lounge access – personal and business versions. The Delta Reserve’s signup bonus is at a very-meh-currently 60k mile bonus level on $5k spend, while the business version is now elevated to 110k miles with a hefty $12k spend requirement. Each has a $550 annual fee.

Now, for probably the ugliest part. In return for that annual fee, a Reserve cardholder gets a whole ten visits to Sky Clubs for the entire cardmember year. An authorized user ($175 annual fee each) has their own ten visit allotment, as well – what a bargain! Each card version earns 3x on Delta purchases and 1x everywhere else. The business version earns 1.5x on additional everywhere else spending once the $150k threshold is reached.

Perhaps in recognition of these two freshly-crafted turd sandwiches, earning MQD’s via spend at the highest rate (1 MQD per $10 spent) is only available on the two Reserve cards. And that’s far from a slam dunk spend decision for many Delta loyalists, anyway.

The Pass

Meanwhile, Delta’s annual pass option isn’t as expensive as American’s, but there’s one significant catch. An individual membership costs $695, but in order to buy a pass, the traveler must be a Medallion member. And qualifying will get tougher.

At a $1,495 fee, the Executive membership provides access to the primary member and spouse/domestic partner and children under 21 or two guests. Each membership type can purchased with SkyMiles at a one cent per point rate.

United Airlines

The Cards

With a refreshingly simple name and the lowest cost of the three, the $525 annual fee United Club Infinite card currently offers 80k bonus miles on $5k spend. Chase also offers a business version of the card. This one sports a $450 annual fee and 50k miles on $5k spend signup bonus at this time.

The cardholder and two adult guests (or one adult and children under 21) can access all United Club locations worldwide. Unfortunately, card authorized users aren’t entitled to Club access on their own.

United Club Infinite cardholders earn 4x on all United purchases, 2x on dining and travel spend, and 1x everywhere else. Other benefits include: free first and second checked bags, Premier Access, Global Entry/TSA PreCheck credit, upgrades, IHG Platinum status, Avis President’s Club, and a $75 IHG credit. Club Business cardholders earn 2x on all United purchases and 1.5x on all other spend. They also obtain similar Premier Access, upgrade, baggage, and Avis benefits.

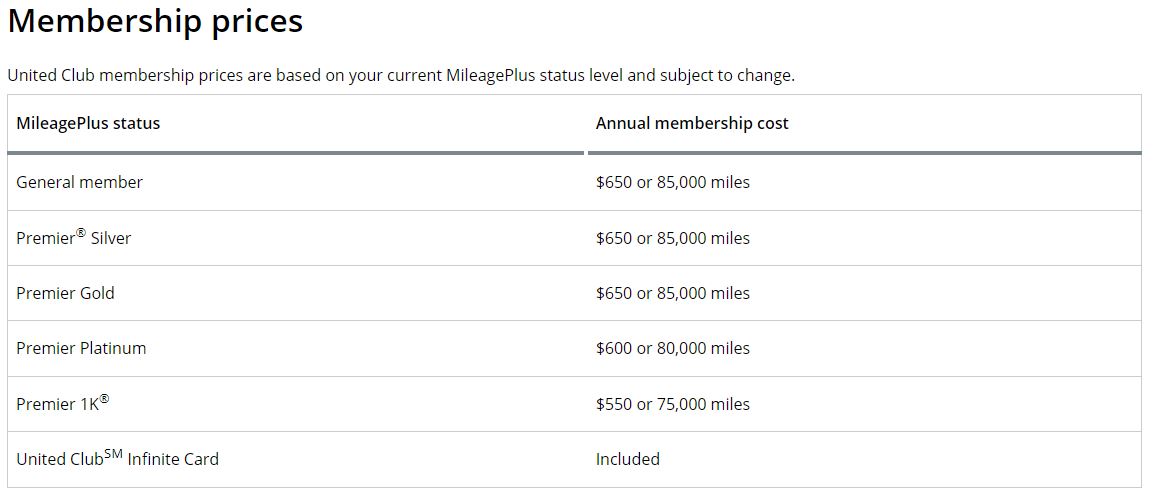

The Pass

Check out United’s fairly straightforward annual pass pricing above. Travelers without United status pay $650, and top-tier elites pay $100 less, somewhat mirroring American’s discount. Note that these are individual pass rates. Most United loyalists will want to avoid paying for memberships in miles, as doing so reflects a return of well under one cent per point. Actually, none are even close to a 0.8 cent per point return!

My Overall Take

Even with the card’s recent devaluations, an American loyalist looking for airline lounge access is generally better off paying the Citi Executive card annual fee than buying an annual pass. The credit card offers more generous guesting privileges at a substantially cheaper yearly rate.

A decision on United Club cards or pass is a more nuanced one. Those without higher Chase priorities (given their stringent 5/24 rule) are probably better off opting for the United Club Infinite card or its business version. It comes in cheaper than all annual pass options, plus they offer a smattering of benefits. But many United travelers may not be eligible for another Chase card and will be stuck paying for a membership if they want access beyond a random single visit.

Not surprisingly, Delta travelers looking for Sky Club access are the worst off. Those who already hit any level of Medallion status and need unlimited Sky Club access should consider buying an annual club membership, especially before Medallion qualification levels increase. Access with credit cards has been significantly throttled, and the best move for non-Medallion members looking for wider access may be an aggressive Amex application strategy (more on that in another article).

Conclusion

Of course, all travelers interested in lounge access should look at additional options, including lounge access options from banks and other entities like Priority Pass. But others who value lounges from the big three domestic carriers should stay up to speed on the credit card and pass choices they have available. I expect things will keep changing, and I look forward to monitoring and considering in future articles. Enjoy the grind!

How are you feeling about airline lounge access options these days? Have you chosen a credit card or pass with any of the big three domestic carriers? Which did you select and why?