Today Senior Contributor R.D. Sussman returns with another airline industry editorial. He has previously written fantastic pieces about the modern rise of Delta, the new American Airlines, the History of Low Cost Carriers, United Airlines, the History of Air Shuttles and The Middle East 3. He has been involved with the airline industry for over 20 years and is an active travel consultant and airline analyst. R.D. is also a huge #Avgeek and theme park enthusiast.

Alaska’s Purchase of Virgin America

Yesterday we learned that after some extensive wrangling that Virgin America had certainly found a new owner in Alaska Air Group. While this is somewhat anti-climatic, it does cause some turnaround in the industry – and will have longer-range ramifications for the business as a whole.

In all reality, this is a merger that has so many unanswered questions – more, in fact, than direct answers. What will happen to the Virgin brand, one that has gained a lot of traction in several key city pair markets, as well as Alaska Air operating Airbus aircraft. How will the unique brands & service levels of the two very different airlines be integrated into a single product? And why did Alaska even look at a merger?

As we’ve all seen over the past 20 years, consolidation has been the name of the game. Every major airline was either merged or acquired as part of the industry shake-down of the 00s. We went from having six major carriers to three, and went from having six low cost carriers to four. And now, the niche/specialty carriers are starting to enter play, with today’s merger being part of this.

Why Buy Virgin?

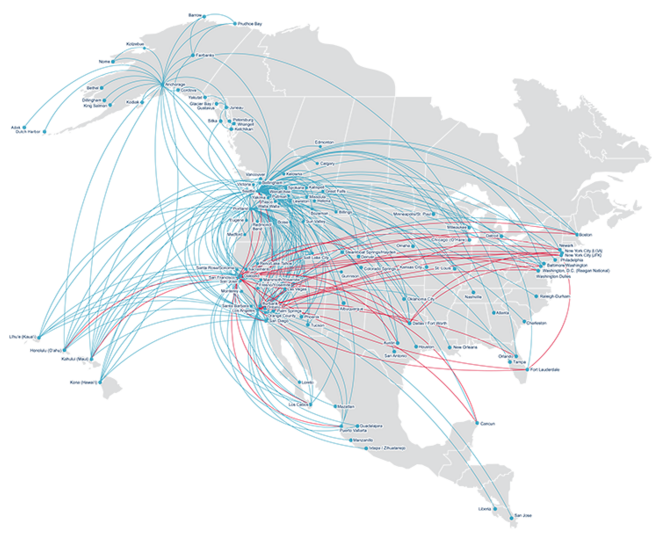

Let’s look first at the WHY of the buyout/acquisition. For the most part, Alaska has chosen to grow organically, developing Seattle, Portland and to a lesser extent Los Angeles & San Jose as large-scale bases. They have a very strong presence in the western states, as well as a very large scale operation to Hawaii, in addition to their homeland markets in Alaska. Alaska’s style of high-quality service and a business atmosphere on board has kept them profitable for the most part and given their style a distinctive Seattle feel, one of a muted, downplayed but quality brand. Virgin on the other hand has developed a primarily mid-to-long haul operations network based upon a vogue, fresh and in some cases ‘naughty’ branding – a hip airline for trendy markets.

In the end, two very opposite brands – but with some very key areas that do generate a potential shift in the brand. Both take noted pride in quality of service, passenger comfort & a better price; both take different views on how the customer sees their product, and both have taken steps to make sure their identity was distinct and almost boutique-like.

So why buy out another carrier? Here is where we find the biggest question – is this to get rid of a competitor, to expand into more cities, or to simply block another player in the game from growing into their backyard. The answer to these is yes – to all of them.

Reasonably speaking, Virgin & Alaska only were competitive on a handful of routes on the West Coast. They had few overlapping markets, less of which were in the key markets that both used well as cash cows. Unlike Southwest & AirTran, this isn’t an issue with the two carriers. Removing Virgin as a competitor isn’t the issue directly.

Is Alaska looking for expansion opportunities? This is a profound yes. While they have grown their home markets quite a bit, they have stumbled at developing more success in other cities, namely Los Angeles & San Francisco. The same can be for any markets west of the Mississippi – where they are primarily a Seattle carrier flying in some smaller niche markets. Here’s where Virgin works beautifully. Having developed – and gained some serious growth – in these key long-haul markets, Alaska can now gain access to the east with some ease – so long as they can continue to grow their brand and keep the traffic Virgin has fought hard for.

The third possibility is to block a competitor from getting bigger – and in this, we see JetBlue – or rather DON’T see JetBlue. JetBlue has been attempting to grow the western markets through several now-failed attempts at focus cities, first at Oakland (Southwest drove them out) then again at Long Beach (Slot constraints kept them from expanding) and again at Salt Lake City (Delta was simply too big). Virgin represented a potentially strong and viable option for them – and when Virgin was placed on the auction block, they were there too. A turn-key west coast operation, a product and plane mix that was nearly identical to their own, and excellent brand recognition in markets they’d not been able to saturate. Unfortunately they lost out. And in this, Alaska effectively has deployed a defensive strategy in one fell swoop – kicking JetBlue hard in the process.

A Huge Price to Pay

So what does Alaska gain for their 2.6 billion dollar price? In essence, this is the big-bucks question. Did Alaska pay too much for Virgin? My best estimates and best numbers say unequivocally yes – and by over a billion dollars no less. Virgin’s tangible assets are very thin to say the least – no owned aircraft, very few physical assets in hand, and mostly rights and accesses such as the Dallas/Love gates, and the slots portfolio on the east coast.

However, these are some substantial assets – if used properly or disposed of properly. In this, we have an even bigger question: What does Alaska do with what they have in Virgin’s portfolio. Here is where keeping the Virgin brand alive & running for a good period of time may come into play. Virgin has had a hard time developing a few of their assets to full potential, namely the LGA & DCA slots, and their gates at DAL. These are some of the most potentially high-yielding markets in the USA, especially if developed properly.

The issue with the LGA & DCA slots is that they are perimeter restricted slots, which makes them difficult to use in cities where the Alaska brand isn’t know. However, the DAL gate access is actually something that could be a very large asset – especially if turned correctly into a focus point for west coast flying. As a scissor hub for Virgin, it hasn’t panned out as well as they’d hoped – but by having a joint operation with Alaska operating to SEA, PDX & LAX, and Virgin to LGA & DCA with higher frequencies, they can get the best use out of both the slots for these cities, but also for the gates at DAL. It would be a mistake to give them up directly – though at the same time, it could bury the hatchet with another long-time nemesis….

The Big “D”

Delta has been pushing hard into both the Transcon market, but also into Seattle – which overlaps both Virgin & Alaska’s territories. At the same time, Delta has wanted but been unable to obtain long-term leases for space at DAL, a city where they wish to grow into a larger & more stable focus point in their network. In one scenario I’ve been looking at, Alaska could offer the DAL gate access to Delta at a reasonable price, along with appropriate code-shares as a way of creating peace in Seattle.

Delta has had some issues with feeding their new Pacific hub there from domestic operations, and Alaska has felt the pinch of Delta growing into their home markets. While both have been making profits, by working together both could come out with even better profitability and less animosity overall. Cooperation, not embattlement could be a huge winner here.

The Product

From the product point of view, both carriers are bringing some very healthy operations to the table. Virgin’s product is regarded as being one of the best in the industry, offering the RED In-flight system to not only watch TV & movies, but also to order food & drinks. Connectivity via WiFi from day one was a huge part of the service aspect to the product, as was a much more friendly & trendy appearance. It has gained them loyalty in many key cities – especially three of the biggest markets in the USA – New York, San Francisco & Los Angeles.

Alaska’s own product is also worthy of note, with customer service being focused on from the top down. A broader selection of Buy On Board combined with customer service focused on a stage-length basis has created an extremely loyal flyer base in their home town of Seattle – a market that is growing at a very rapid pace, and appears to be doing so well into the future. This is a asset which Alaska has capitalized on now for many years, and turned it into a powerhouse hub for Seattle. However, the product offering has only recently begun addressing in-flight entertainment and Wifi on a more industry-related level; indeed, this is an area where they have been a bit behind until recently.

Combining both products will be a challenge – as both have some stellar reputations. Where I see the best mix is introducing RED into the existing Alaska fleet, and crossing the existing Buy On Board products to Virgin’s fleet would be a huge plus.

The Cabins Are A Challenge

However, one BIG challenge in the product is the completely dissimilar front cabin offerings. Alaska, which has a traditional domestic First Class product, now has Virgin – which has a First Class product that is much more akin to International Business. These limited access premium seats are unavailable to upgrade into – and are full nearly 100% of the time. While both will soon have a premium economy product (Alaska is adding theirs in over the next two years; Virgin’s has been in place since 2009) the Virgin First is a bit out of place on many of the markets Alaska currently flies.

Here is where we find a huge challenge – and one where Alaska must tread carefully. It is also where keeping the Virgin brand may be a massive asset. If Alaska were to adapt the Virgin First product into their own longhaul markets (Hawaii, transcon, Central America) and adapted the domestic first product at the same time, it could pay very large dividends. With the Airbus 321NEO coming into the Virgin fleet this year, it is entirely plausible that we could see Alaska combine both products on these planes – Virgin First, a proper domestic first, premium economy & standard economy on one plane – all done easily.

In an ideal scenario – we would see Alaska move into Virgin’s shorthaul & some medium haul areas with their existing product, and using Virgin as a replacement on some of Alaska’s key longhaul markets where a true premium product still has a demand. Much like JetBlue is doing with Mint, Virgin could be used in this method to keep the highest yield passengers on their planes, and to lower the overall costs in some of the shorter market flying.

As the dust settles on this latest round of mergers/acquisitions, there are a LOT of unanswered questions about not only Alaska/Virgin – but also of what happens next. It is clear to me this isn’t the last merger we will see this year in the USA, but rather, the catalyst for some additional changes that will alter our skies once again.

R.D.

4/5/16

[…] Low Cost Carriers, United Airlines, the History of Air Shuttles, The Middle East 3, Alaska’s purchase of Virgin America, United’s Polaris and Slim Line Seats. He has been involved with the airline […]

Bring back SFO -> PHL!!

That is all…

Apparently , ALK stock price goes back up to almost 81. May be Wall street doesnt think it’s as bad as some people think.

Personally, I don’t think it’s a bad idea at all – the systems though different are not completely unlike each other, and in fact compliment each other very well. Hopefully AS will keep this in mind over the next few years as they integrate the networks together into one larger company, Success for them is in how they use their new assets to their best advantage.

R.D.