American Express Financial Review Process

If you have been in and around the credit card space for any length of time, then you no doubt have heard of an American Express Financial Review. A Financial Review is when American Express takes a closer look at their relationship with you as a customer in order to determine if they want to keep doing business with you. Many banks do this, but the American Express Financial Review has become legendary.

I’m not quite sure why I have feared the American Express Financial Review for so long. Yes, I have heard of people having all of their accounts shutdown (no more Centurion Lounge 🙁 ) or their credit lines being slashed, but I have been truthful on my applications and can back up my income/spending. Rationally I shouldn’t have anything to worry about, but in reality it made me sick to my stomach. Here is what happened.

Increased Spending

Over the past six weeks or so my spending has ramped up to get ready for the holidays. My reselling business naturally has A LOT of spend, particularly this time of year. While American Express cards are often my go-to anyway, right now I am working on earning my 50K Welcome Bonus on the American Express Gold Card plus spending offers on other cards. It’s a perfect storm.

The other morning after spending about $500 on my Blue Business Plus card, I received two calls from 623-492-4206. If you Google 623-492-4206 you will find that some people have marked this number as fraudulent, but it is indeed American Express. Since I missed both calls I received two voicemails asking me to call back for a “personal business matter”. I immediately had a suspicion it was an American Express Financial Review. A quick swipe of my card at a store confirmed it. My accounts had all been shut off.

The American Express Financial Review Call

At this point my stomach was in knots. American Express has probably been my most reliable bank for large purchases and I do count on the banking relationship I have with them. I quickly returned the caller’s message, but he was on the phone with someone else and it went to voicemail. I went along with my day, but hated the feeling of being in limbo.

About an hour later the American Express Financial Review agent called me back and we began a very intense question and answer session. He asked me about each of my businesses, what I do for a living, why I am spending so much, my income and what I like to eat for breakfast on Tuesdays. It was all VERY thorough.

It’s All About the Spend

During the call it was clear he was honing in on my increased spending over the past month or so, particularly at a certain retailer. I calmly explained it was because of our holiday ramp up and pointed out that I shop at this retailer often and had a similar ramp up last year for the holidays. I wasn’t sure if this would be enough or what other type of verification he would want, but I assumed he was going to ask for tax returns which I am able to provide.

Instead, after about 10 minutes he stopped the call & asked me to hold. My stomach went from sick to sicker as I waited on hold while walking up and down the aisles of a local Target. The upbeat holiday music and bright red hues did nothing to calm me. I kept reminding myself that I had done nothing wrong, but the legend of the American Express Financial Review loomed large in my head. I was DOOMED. Or was I?

Getting the Good News

When he returned to the call I was fully prepared to be asked for a mountain of records to back up my spending, but instead he delighted me with some good news. The agent told me that he was satisfied with my answers and that he could see my pattern of spending from previous months/years and thus had ended the American Express Financial Review. I didn’t need to send in any documentation and all of my cards were turned back on. Boom!

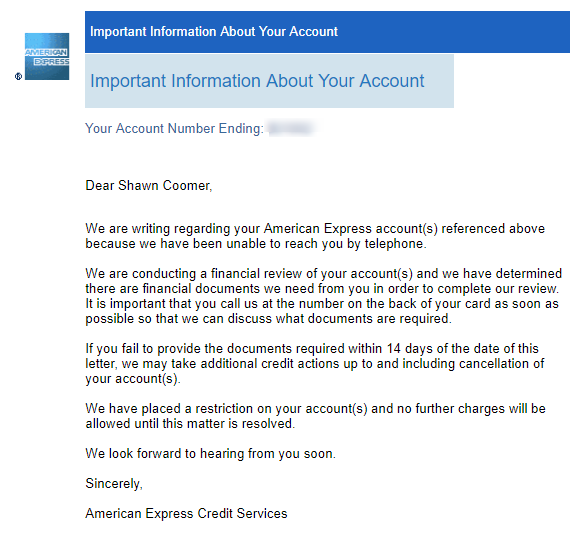

He even warned me that a series of letters had already been generated and that I should ignore them. Indeed I did receive an email later in the day which still gave me a sick feeling despite it all being over.

American Express Financial Review Takeaways

While I didn’t undergo a long drawn out American Express Financial Review, I have a few takeaways from the experience.

Don’t lie – If you are truthful with the bank from the beginning, then you won’t have to worry if you are under review. Because everything I had told the bank on applications was truthful, I was able to explain my spending plus could have backed it up with documentation if requested.

Stay Calm – I did a horrible job of this, but I’m glad it was all over quickly. It is actually normal for a bank to review financial relationships in order to make sure they aren’t at too much risk. Just give them the answers they want and things should be alright.

Be Concise & Confident – It’s evident now that the American Express Financial Review agent who calls you has a lot of power. In my case he was able to end the review based purely on my statements and a closer look at my spending history. That saved me the hassle of sending in financial documents and also the agony of waiting for a result.

Conclusion

I survived an American Express Financial Review and lived to tell the tale. While my American Express Financial Review experience wasn’t nearly as tough as what some others have gone through, it was still nerve wrenching. With that said, I’m sort of happy I went through it because now I know the bank has reaffirmed our relationship and I can continue to grow my business by leveraging their products.

Have you ever gone through an American Express Financial Review? Share your experiences in the comments!

Meaningless FR, They didn’t look at repayment, they look at multiple purchases on the same merchant, If it happens, account triggers to FR. I got FR. They asked me the documents ITR and bank statements in India. I refused to submit. They cancelled the account. I asked them to clear my points before paying the due amount. They cleared all the points and then I paid my bills. Account was cancelled.

If you got this FR, this card is not suitable for you. There are lot other cards which suits to our nature of expenses. Amex is definitely useless card, if we are going with repeated transactions with same merchant.

In India it’s waste of card , 90% merchants doesn’t accept this card at all because of high merchant charges. Visa and mastercard are also providing unlimited air lounges and other membership tie ups with hotels.

This is awful … they have brainwashed the customers into thinking their product is so exceptional and exclusive to bear their card (and there are tons of better cards out there), that one of you had a stomach ache, the other had intense dread, someone else kept wondering if their spending was going to trigger a call.

Isn’t there something wrong with the picture? Regardless of what triggers a financial review, a bank charges excessive interest to protect them from defaults, from the reserve of all the interest they collect.

I stopped sleeping with AmEx in 2010, after they raised me from a 6.24% APR to 29.99% APR on a 100% never late, always below half the limit, in fact they were raising me consistent well over $100K. They rate hike took effect when I had a $38K balance on it. I paid it off within 6 months, and closed my account. I learned at that time that to borrow money for a card for everyday purchases is awful for the consumer. It traps them into a pile of debt.

Let them request the financial review, you aren’t buying a house, only asking for a credit line. Close your accounts before they do (yes, it does make a perception difference to new lenders), and yes, they will close you proactively if you do not provide information. Nobody should have your bank statements, unless it’s a big player for a major transaction.

AmEx hardly qualifies.

Be glad this forum is here and get a different card. AmEx is not the card to have in 2020.

Exactly TRUE

Shawn,

Great to hear you made it through the FR. But you made no mention of what’s seems to be becoming more frequent now…..were you not asked the 4 dreaded questions on whether your businesses (as i assume you have amex biz cards in your wallet) …have anything to do with the purchase or management of western union products, including Money Orders?

Don’t you do any ms with your amex cards?

I have averaged 45K per month for the past 15 years and never an audit on my PLT.

[…] from Miles to Memories underwent an American Express financial review and wrote about his experiences. These reviews are feared because AMEX can shutdown all of your accounts, at their own discretion. […]

Wow! that was such a near miss! Great job shawn. I had a similar experience and was asked to fax the 4506-t. Within a week after that, everything was set right! I had at some point bloated by gross income but they never questioned it.

had one 3 years ago…they needed to pull a 4506-t to validate my income.

I am being FRed right now as I spent only $300 on my business plat from Jan to Oct but in the first week of November I put more than $30k across three amex cards ($15k on the plat) on one merchant. Initially my transaction didn’t go through and I called, immidiately I was told that I was placed on FR and need to be transferred to the dept. I spoke with my case manager and she asked all the questions she could. At the end of the call she told me that Amex will have to request my 2017 tax and I will have to complete a form 4506T so they can request it from it IRS. she told me “I gotta be honest with you, if you miss the deadline more than often this will result in accounts being shut down”. I am still waiting for the result.. fingers crossed

What was the result

off topic, where is that wallet from? I kind of want one!

[…] I’m Spending Too Much?!? How I Survived My American Express Financial Review […]

Shawn – glad the outcome was positive for you. Was curious if the review got into situations where non-business expenses might have been charged on any of your business cards. I know it’s against the T+C for business cards, but not uncommon for that to occur. Was this something that was brought up at all?

No. I was expecting it since they were reviewing all of my cards, but the topic never came up.

How would you explain ms VGC purchases? I can’t image Amex would like those.

I don’t buy those with my Amex cards and the spend they seemed concerned with was legitimate spend. All different amounts and merchandise so it was easily explained.

Wow, I have had credit cards my whole adult life and have never heard of such a thing

Happy you made it through! Any chance you can give us some rough numbers of Amex spend that triggered it?

I’m trying to understand why someone would go through this? I do all of my banking at Chase. I would be incensed if someone called me asking such questions. Why would they care if you are spending a ton of money, as long as you’re paying your bill on time and in full? No way, no how…there are plenty of banks who would love to have you. That almost seems disrespectful. Can someone explain why anyone would tolerate this type of treatment? What’s in it for them?

I am confused…can you please explain in detail why a credit card company would want a financial review if you pay on time and always pay your bill in full. This makes no sense to me

The explanation is easy – AMEX needs to assure that you have the financial resources necessary to pay them when they start clawing back all your rewards.

Shawn, great result. Congrats!

Great article I have been doing the same as I’m trying to put $24k between Oct-Dec on all my card to reach the max bonuses and I also have my favorite place. I have also been sweating wondering if AMEX will shut me down, at least now I am prepared. Thank you!!!

I’m surprised you went all these years without a FR. But anyway, welcome to the club!

I have always dreaded it and expected one day it would happen. I’m glad it all went well and without much hassle.