Amex Blue Business Plus Approval

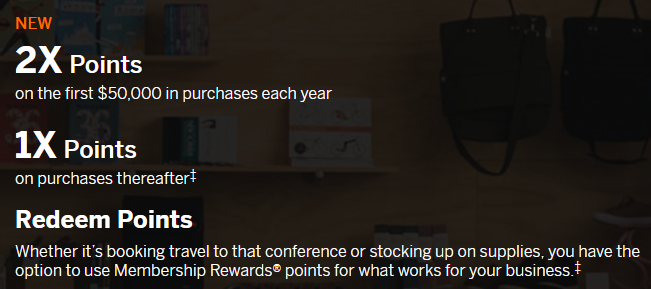

Last week American Express announced the launch of a brand new business credit card. A replacement to their “Blue for Business”, the Blue Business Plus Credit Card is actually a simple product. You pay no annual fee and earn 2X Membership Rewards points on all purchases up to $50,000 per calendar year.

Additionally, the card comes with a 20,000 point bonus after $3K in spend during the first 3 months. As part of my original analysis, I said I wanted to apply for the card, but was holding off due to being close to getting a mortgage.

Offer Link

Why I Applied

As you can tell from the title, I ultimately didn’t end up holding off. In fact I applied on the day it came out and was instantly approved. So why did I change my mind? I saw a few data points indicating that American Express wasn’t doing a hard pull for all new applicants on this card. (I have seen similar data points for other Amex cards as well.)

It seems that for customers with a long relationship with Amex, they may be using your internal profile to determine approvals. I applied and was approved almost a week ago and have confirmed that no hard pull was performed. For the record I am a long time customer with many cards already, so this won’t work for everyone and there is no guarantee they won’t pull your credit.

Why This Card

As I mentioned last week in my detailed analysis, this card really is the king of business spend. It earns 2X Membership Rewards points which can be transferred to travel partners or redeemed in other ways. Since I have a lot of business spend, the ability to earn 2X everywhere without an annual fee was too much to pass up. I also have a few employee cards on the way which will earn cashback via Amex Offers. Bottom line, this card is quite valuable in my opinion.

Conclusion

While it was not guaranteed and certainly isn’t guaranteed for everyone, I was really happy to get this card without a hard credit pull. Since it is a business card it won’t show up on my credit either, so it shouldn’t have an immediate effect on my mortgage. Win win!

Did you apply for the Blue Business Plus Credit Card? Did Amex pull your credit? Share your experiences in the comments!

Does anyone know what the average initial credit limit given ? Has anyone done a balance transfer when applying ? I am wanting to transfer a business credit card balance woth no APR for 12 months. I am hoping it will give me a high enough credit limit to do so.

Thanks for a response in advance

[…] and I love that it is eligible for Amex Offers as well. Additionally I was able to get the card without a credit check and it won’t show on my personal credit report, which is a plus considering things like the […]

Do you know if this card has the ability to transfer MR points to Loyalty Programs like the Amex EveryDay card does? I’ve been looking for a no AF card that has the points-transfer ability and I was going to get the Amex EveryDay card but might get this instead cause of the 2X points…

[…] going on with Blue Business Plus Credit Card applications, which I first read about on Miles To Memories. As noted by Shawn, many people reported not having any sort of a credit pull when applying for […]

[…] Approved: A Strange Amex Blue Business Plus Data Point, Why I Applied & How It Paid Off! […]

[…] Getting the Amex Blue Business Plus credit card without a hard pull? Interesting. This one IS available with my links, no arrows provided […]

No hard pull. Instantly confirmed, but i do gave the black, platinum and gold cards so.I assume they pulled some of the credit from one of those

I applied for the card a week ago, and got it in the mail yesterday. I confirmed via Credit Karma there was no hard pull.

I think I read that this car could be used to transfer MR to partners without any other premium cards.

You might want to double check.

Check one of the free sites. Credit karma. Credit sesame

What is the best way to see if they did a hard pull? I applied a couple of days ago and was instantly approved. Thanks.

Hi Shawn – Thanks for all the good info on your blog. I’m sure I speak for many when I say that I very much appreciate you seeking out data points and being willing to share them with your readers.

Quick note on this post – the 2x cap is $50,000 per *calendar* year, not cardmember year. Here is the excerpt from the AmEx T&Cs on the card:

Blue Business Plus 2X

With your Blue Business Plus Card from American Express, you earn one Membership Rewards® point for each dollar you spend on your Card for eligible purchases. For the first $50,000 in eligible purchases in each calendar year you also earn one additional point (for a total of 2 points). Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, balance transfers, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. Additional terms and restrictions apply.

Hey Craig. You are absolutely correct. Thanks for the correction.

You bet. It strikes me that having it on a calendar year rather than cardmember year could be helpful for those who can hit the spend cap during 2017 and then have the cap reset on 1/1/2018.

Is this card better than Amex gold which does have a membership fee? It is coming up renew for me. I already have Amex Plat.

It really depends on the bonus categories. The Business Gold earns 3X in one of 5 categories and 2X in the other 4. You would have to spend a lot of money in the 3X category to make up for the fee. There are some other minor considerations, but I think for the vast majority of businesses this card will be better.

What do you think Amex considers a long term relationship? I’m thinking of applying, and have had the EveryDay preferred for about 3 years. My very small business being making some income from my gf who lives with me.

I think 3 years is plenty of time. I know a lot of people who have opened a ton of cards after just one year. YMMV of course.

I hope so. They must like me, as they increase my credit limit each year without me asking for a CLI.

I started with the Everyday card in June 2016. Since then I added the Gold, BCE, PRG, SPG personal and SPG Business, personal Platinum. I applied for the Blue business plus a few days ago and was instantly approved. Missed the welcome bonus as I was waiting for the 2/90 to pass and to lower the outstanding balance on the other AMEX cards. The Blue Business Plus is my 5th AMEX credit card.

6/2016 – ED

6/2016 – Gold

7/2016 – BCE

7/2016 – PRG

12/2016 – SPG Business (denied)

2/2017 – SPG Business

3/2017 – SPG Personal

5/2017 – Platinum

7/2017 – Blue Business Plus

You said you have lots of Amex cards. Are they credit cards or charge cards? How does one get around Amex’s limit of 4 credit card accounts?

This was my fifth Amex credit card. As far as I understand it based on data points, if one of your first 4 cards is a Delta or Hilton co-brand, then it seems to be possible to get a fifth. Of course this is all based on data points and there is no official confirmation from Amex. I can say both my wife and I have been able to get 5 credit cards and we both have either Delta or Hilton cards.

Shawn, different DP:

I had 3 Amex credit cards – Everyday, Old Blue Cash and Hilton. Applied for Delta Gold personal and Delta Gold Business on same day 7/6/16. Approved for personal but denied for business due to max number of cards allowed.

Not relevant: Since then approved for Business Gold (charge) card which I know doesn’t count in limit. Also AU on 4 other cards. First 3 cards have open date of year 2000 due to backdating at that time (actual open date 2011 or 2014) since one AU card is indeed 17 yrs old account.