Amex Blue for Business Bonus Offer

Update: This offer has been extended through 2/22/17.

American Express has a confusing lineup of products. There are their Everyday personal cards which earn Membership Rewards and their Blue Cash personal cards which earn cash back. Then, just to confuse things there is the Blue for Business card which earns stripped down basic Membership Rewards. WTH?!?

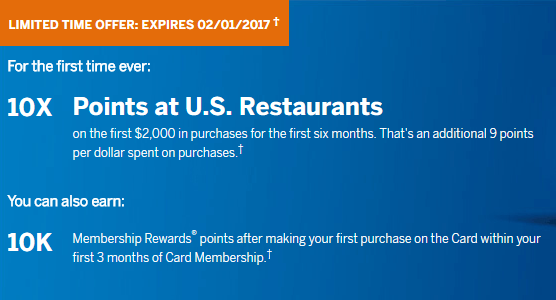

While the Blue for Business may not be as well known, it is actually an interesting product and today American Express made it a tad more compelling with the launch of a new limited time bonus offer through 2/1/17 2/22/17. Let’s take a look.

The Offer

- 10,000 Membership Rewards® points after making your first purchase on the Card within your first 3 months of Card Membership.

- 10X points at U.S. restaurants for the first six months, on up to $2,000 in purchases.

- 2X points on all qualifying purchases on the first $50,000 for the first year. That’s an additional 1 point per dollar spent on purchases.

Offer Link

Card Features

- 1X Membership Rewards® point for each dollar you spend on eligible purchases.

- Get a 30% annual points bonus based on the past year’s purchases on your Blue for Business Card.

- No annual fee

Points Earned

As I mentioned above, Blue for Business is a Membership Rewards card, but it only earns basic MR points. What does that mean? Well, essentially you earn points that cannot be transferred to their mileage program partners. Thankfully there is an easy workaround. If you have any other Membership Rewards card that has the ability to transfer (Platinum, Gold, Everyday, etc.) then your points are pooled and you can transfer them. This makes the bonus here potentially very valuable.

Previous Best Offer

The previous best offer on this card was offered last October:

- 10,000 Membership Rewards points after making your first purchase on the card within your first three months of Card Membership

- Plus an additional 10,000 Membership Rewards points after spending $5,000 on purchases within the first six months of Card Membership.

Offer Analysis

This offer really comes in three parts. The first part is the base bonus. This is the same as the normal bonus which is 10K points. Not great, but not bad for a no annual fee card.

Then, we have the 10X points at restaurants on up to $2K in spend in 6 months. That works out to $333.33 per month. I assume most people can hit that. Given that 10X is better than you will get elsewhere in this category, you will probably want to use the Blue for Business at U.S. restaurants.

Finally, you have the 2X everywhere offer on up to $50K in spend. At first this may seem like a gimmick, but it can be quite valuable. I personally value Membership Rewards at about 1.5 cents each (others value them higher), so that would be like getting 3% cashback everywhere. That is a fantastic return.

Offer Link

Other Considerations

You can’t really take the full value of the 2X everywhere as a bonus, because you can earn 2% or more with a no annual fee cashback card. This means that the bonus portion is only what you receive above that. For example, I can earn 2.625% cashback everywhere with my , so the benefit is only marginal to me.

The 30% bonus is based on your spend throughout the year and not your overall points earned. So for example if you spend $50,000 during the course of the year, you receive 30% of that back in the form of points. In that case then you would receive 15,000 points at the end of the year.

Conclusion

While the Blue for Business card is probably a niche product, for those who are invested in Membership Rewards it can be a great no annual fee business card. With all of these additional kickers and no annual fee, it is definitely worth a look, especially considering the value that Amex Offers add in as well.

What are your thoughts on the Blue for Business? Do you have this card? What do you think of this new three tiered type bonus Amex has been toying with? Let us know in the comments!

[…] have one of the old Blue for Business cards from American Express. I originally got the card a little over a year ago. The offer was for 10,000 Membership Rewards points after your first purchase, 10x points at […]

[…] offer really comes in two parts. The first part is the base bonus. This is the same as the previous bonus which is 10K points. Not great, but not bad for a no annual fee card and it only requires one […]

[…] in October American Express launched an increased bonus offer on their Blue for Business card. The offer was supposed to expire today, however American Express […]

[…] bonus opportunities to entice customers to get and use their cards. For example this week we saw Amex offer a three tiered bonus on the Blue for Business card which rewards spending in the first year and now Citi appears to be trying this strategy as well. […]

I see what you did there. Trying to make us spend more on eating out! Average 19-50 year old male spends $277/mo on food (females are less). To spend $333/mo on just eating out definitely adds up, bonus points or not, regardless of your family size.

About two years ago I realized we were really spending too much money on food. The savings can really add up over the course of a year or three. Sure, there’s definitely situations where you have to spend a lot on eating out (like business) so I’m not getting on anyone who spends that much. If anything, this is a great deal for them. At any rate I know my post was mainly a side tangent to the topic. I think this could be a great deal for anyone who eats out a lot, values MR, spends a lot and has a transferrable card.

@Anthonyjh21 – You don’t have to eat out a lot to get those points! Simply go out less to far more expensive places that charge three time as much! (Snicker).

Does it count towards 5/24?

Amex doesn’t report business cards on your personal credit so it shouldn’t.

Thanks so much for the quick answer!!

Well, what about year 2?

Then it basically earns 1.3X per dollar and thus it wouldn’t be my card of choice. It could be a good card to have long term though since it does have access to Amex Offers and no annual fee. Another one to look at is the SimplyCash Plus since it also doesn’t have an annual fee but gives 5% at office supply stores.