Amex No Lifetime Language Offers Get Around The Amex Pop Up

A few years ago I was in Amex pop up purgatory and shared with you that I was still able to get a Delta no lifetime language offer to go through. Shortly after that I was finally able to slay the Amex pop up by spending on my Hilton Surpass card, or at least I think that is what did it. Last month I broke down my Amex Business Platinum card upgrade offer and why I decided to pass on it. I ended up grabbing the Business Gold expand your membership offer instead (new term for no lifetime language offers I guess). I said that I figured it would get me around the pop up like the Delta card did in the past and that I would update you once I had completed the offer.

First Of All What Is The Amex Pop Up?

Before we get ahead of ourselves I should go over what the Amex pop up is for anyone not quite understanding what I am talking about. A few years ago American Express started a program that would alert people if they were not eligible for a welcome offer. This pop up would appear after you hit apply telling you that you would not receive the welcome offer. You would be offered the chance to cancel the application after they informed you.

It sounded like a pretty customer friendly thing at first. Amex was going to let us know if we had the card in the past and just forgot about it etc. The program quickly morphed into something much more obscene and obscure. Amex had changed their terms that they could pretty much deny anyone for any reason they wanted. That is when the pop up started appearing in large numbers for people in the miles & points hobby. We were labeled as gamers or abusers and we were locked out of Amex applications. That was true for me too.

My Experience With The Amex Business Gold

I had slayed the pop up years ago but it just came back around for myself and my wife. So you could imagine that I was excited to get another one of the no lifetime offers from Amex to test my luck once again.

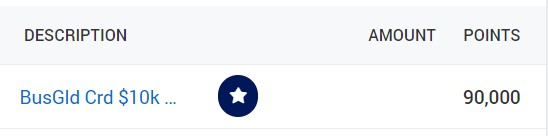

I was immediately approved and finished the spend a few weeks later. Having to pay my yearly taxes helped out there some. A day or two after I finished the required spend the points hit my account.

So it appears that the new “expand your membership” offers work the same as the old no lifetime language offers when it comes to the Amex pop up. It is also believed that sometimes you could have the pop up for personal cards but not the business cards. There are reports of that at least but I did try to apply for the Hilton Business card a few weeks back and still got the pop up so that wasn’t the case for me.

The other way to get around the Amex pop up is an upgrade offer. Since it isn’t a new account the pop up doesn’t play into it. Just remember it is best not to take an upgrade offer until you have already carried the card before because just carrying the card resets your “lifetime” clock. It doesn’t matter if you have ever earned a welcome offer on the card before or not, carrying the card is what Amex cares about.

Final Thoughts

If you are in the Amex pop up purgatory and get one of these no lifetime language offers, or the expand your membership offers, go ahead and grab it. You should still get the welcome offer and avoid the pop up.

I received an upgrade offer on my Amex Green Business card to the Gold Business card as well the other day. It appears it is time for me to carry 3 Business Gold cards 😉😁.

So I should be able to get a 2nd HH card.. ?

If it is the no lifetime type offer then yes you can get a second of the same card and get the bonus.

Me too, I am going to pass on the second card, $15k spend kind of steep and can complete several other sign up bonuses with that spend hopefully and avoid the RAT. I would not be concerned if you have a lot of real business spend.

I had a business platinum card and had an offer via another business card for the 150K business platinum. I was approved for that and now I have another business platinum 150K offer. I’m torn between greed and RAT fear.

To be honest I wouldn’t be worried about that. I know people with quite a few biz platinums and have no issues. They focus more on the 12X or 10X spending offers which makes no sense to me but that is how they roll. The real risk would be triggering the pop up but that seems completely random at this point.