The Amex Once Per Lifetime Rule Snaps Back On My Recent Attempt

A week ago I shared my experience shaving years off of American Express’ once per “lifetime” rule. Since the rule launched we have assumed the lifetime parameters really meant 7 years. That was until recently when people started getting approved at only 5 or 6 years since they last carried the card. I tried pushing the envelope and was able to get an Amex Green card, and the welcome offer, at 4 1/2 years. I decided to push that a little further still with my wife, and it didn’t quite work out.

Update 4/24/21: I recently had my wife attempt signing up for the Amex Gold Business card via my personal referral. She received the pop up for that as well even though it is not a card she has ever had. I am not sure if the Amex Green application put her on the naughty list or if she already was on the list before applying for the Green card and that throws all of my “findings” off a bit. I am inclined to believe the Green card application put her on the pop up list for all cards because she had not been very active with Amex but that is a guess on my part. It could also be the personal referral that is causing the pop up which has been known to happen from time to time. But I figured I would update you on what is going on since more data helps us all out.

Background On The American Express One Per Lifetime Rule

Here is a list of the American Express application rules which you can find on our complete bank application rules guide:

- Maximum of 4 credit cards.

- A maximum of 10 cards without a preset limit.

- 2 cards in a rolling 90 day period.

- Welcome offers are once per lifetime.

- 7 years is considered a lifetime with American Express. The 7 year clock starts once you close the account. Upgrades and downgrades will count against you.

- A pop-up will alert you if you are not eligible for a particular welcome offer.

And here is what we have written on the once per lifetime rule:

The other rule is “once in a lifetime”. From Amex’s terms on applications, “welcome offer not available to applicants who have or have had this card”. This means that holding the card at any point is the important part, not receiving a welcome offer for the card. So upgrading or downgrading to a card you have never had before would eliminate you from being able to get the welcome offer etc.

There are targeted offers without lifetime language are semi-frequent, and data points also suggest that “lifetime” is more likely 4-7 years. Because of this “lifetime” language, holding out for high welcome offers is recommended.

My Experience & Theories On Why It Worked

I don’t want to go into too much detail since you can read last week’s article. But I was able to get the Amex Green card and the bonus at only 4 1/2 years after closing my account. There were some theories thrown out there on why it worked:

- Amex had an IT overhaul 2 years ago that reset the clock for people.

- The newly revamped Green card was considered a new product and not the same as the old Green card.

- Maybe the “lifetime” requirement dropped from 7 years to 4 years.

I decided to test these options out with one application. Remember that this is just one data point so we can’t say anything for sure but I thought it would be interesting nonetheless. And it just so happened to test all of these parameters, which was kind of perfect.

I also couldn’t resist dipping my toe in that referral bonus pool one more time.

My Wife’s Recent Experience

My wife is currently sitting at 4 credit cards with Amex and I am not able to close any of them to free up space. She just got a retention offer on the Aspire card and her Everyday Preferred (even though I had planned to close it). Her Hilton Business card is less than a year old and I am not touching her Blue Business Plus. So that left me with non credit cards as her only options.

She has already carried the Platinum and Green card, plus she currently has the Gold so I didn’t have a ton of options. I didn’t want her to get a business card since the spend requirements are on the higher end (she currently has the lower spend Green Business card). That had me checking her Amex Green personal card closure date to see if I could give that another run. The 50K offer plus $200 in home improvement credit is a great option. Not to mention the 25K referral I would get as well. So I said let’s do it!

Her Application Details

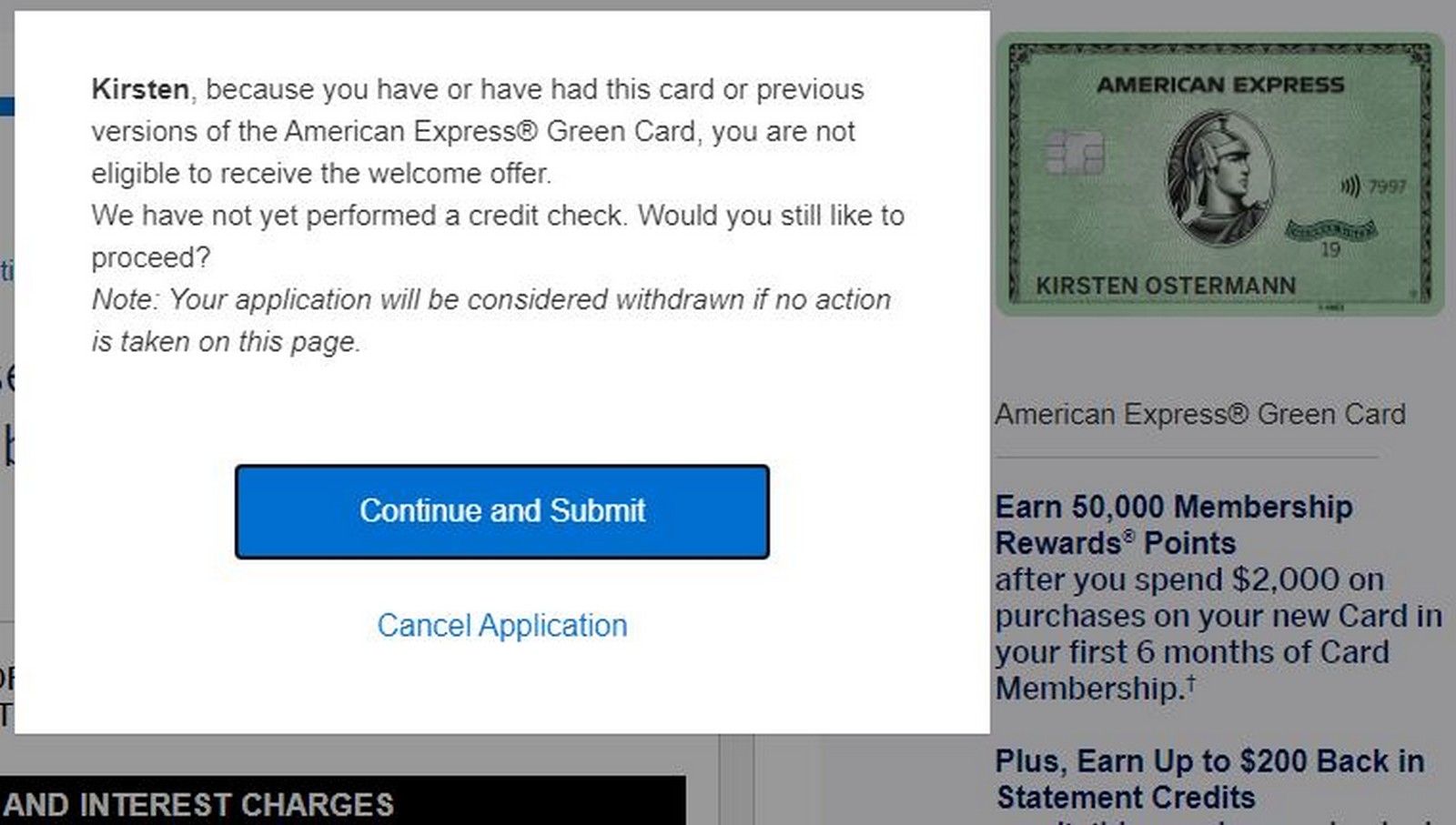

She had last held an Amex Green card in January of 2018. That was less that 3 1/2 years ago which sounded like the perfect time frame for my experiment.

- It was under the theorized 4 year lifetime clock.

- It was later than the IT change over in Amex’s systems.

- She had the old version of the Green card and not the new version.

This would test all 3 Amex once per lifetime rule theories in one shot, that is what I call perfection. So she filled out her info and hit submit and….

Bam! The Amex Pop Up 😥.

What Does This Mean?

What does this mean? Well nothing really since it is just one data point but I will say I think we can rule a few things out:

- The application terms specify that you are ineligible if you had this, or any previous version, of the green card. So I don’t think that the newly revamped card being a new product is a viable explanation.

- The time frame is well past the 2 years ago or so that Amex had their IT revamp so I don’t think that plays a role really.

- The 4 year limit could be a thing although we have seen data points for less than those.

- I will say those data points could have been no lifetime language offers.

- And if they were business cards Amex tends to treat those a little differently (i.e. more loosely).

This could be a totally unrelated pop up as well for her entire account. I won’t know that for sure until I try another application. I would put that at a low chance of probability since she has never had it before, hasn’t had a lot of applications or closures and spends a ton on her cards.

Amex Once Per Lifetime Rule – Final Thoughts

The one good thing about the Amex pop up is that it gives you a chance to cancel the application once you see it. So there isn’t a ton of harm in testing the limits. Plus Amex rarely does hard pulls for current members any way.

I think with this experiment I was able to dispel some of the theories out there. The 4 year theory still has a little bit of meat on its bones but without more data points we just don’t know for sure. Or it could be that the pop up decides everything and we will never know exactly what the criteria is for the Amex once per lifetime rule is. I do look forward to trying to figure it out anyway though 😁.

Haven’t had a new AmEx card in ~3 years, and only 1 new account from other banks. In AOR this week I was insta-approved from Chase, received the “you won’t get a bonus pop-up” for 3 different AmEx cards I’ve never had from AmEx, insta-approved for Barclays and BOA. Was honestly shocked. Had never been turned down for an AmEx card for me or spouse in 10 years where it didn’t make sense. Also got auto-denied from Citi for a card I should have been approved for under their known critera; wonder if Amex & Citi are now looking more at same-day applications regardless of other rules as a “churner” identifer.

Getting after not having had a new Amex in 3 years is pretty crazy. I am not sure if their pop up system looks at outside applications or not. Citi has a rule where you will get denied with 3 hard pulls in the last 6 months so that is what probably got you there.

Citi was my second app after Chase. :-/

Interesting, then I am surprised you had issues.

Blogger writes about Amex loophole rather than keeping quiet; Amex reads blog; loophole gets closed.

Yeah sure Bob haha

Fares would go up as the loyalty programs are a huge source of profitability to airlines, selling their miles to Amex and the other banks!

You don’t think it has anything to do with “hacking” do you? I have been with Amex for over 35 years with various forms of cards. these bonuses are based on securing a new customer for all the right reasons. I have no sympathy for anyone complaining about the qualifications/conditions. As a long time business traveler I would prefer to go back before all these programs airline club rooms were just that private for high mileage passengers. Just think how much airfares would drop!

The companies are making money hand over fist selling their miles to the credit card companies and pumping the sign up bonuses. Prices would have the exact opposite effect if they went back to what you want…not lower.

Most of the airline’s profits come from their frequent flyer programs (ie the credit cards) not from people paying to fly.

The ultimate “get off my lawn” churner comment I’ve read in my 7+ years of being in this community. Well played.