American Express Once Per Lifetime Rule, What Does It Really Mean?

We love talking about the application rules that each bank has, and each bank’s rules are unique. There is the Citi Premier 3/6 rule, the Chase 5/24 rule and the American Express once per lifetime rule to name a few. There have always been theories on what was really consider a “lifetime” by American Express. It was long believed that 7 years was a lifetime in their eyes. That doesn’t seem to be the case any longer, if it ever was.

Okay, so we had thought it was 7 years for the longest time…probably for like 7 years or so. Then Greg at Frequent Miler decided to test out the theory with the awesome new Platinum offer that is available right now. He was able to get a welcome offer at the 5 1/2 – 6 years range. That was awesome news, and because of it I decided to push the envelope a little bit further.

Background On The American Express One Per Lifetime Rule

Here is a list of the American Express application rules which you can find on our complete bank application rules guide:

- Maximum of 4 credit cards.

- A maximum of 10 cards without a preset limit.

- 2 cards in a rolling 90 day period.

- Welcome offers are once per lifetime.

- 7 years is considered a lifetime with American Express. The 7 year clock starts once you close the account. Upgrades and downgrades will count against you.

- A pop-up will alert you if you are not eligible for a particular welcome offer.

And here is what we have written on the once per lifetime rule:

The other rule is “once in a lifetime”. If you had this card in the past and received a new cardmember welcome offer on the card, and then received the points from that offer, you cannot get a similar offer and the associated bonus again. If you’ve received it once, you cannot have it again on the same card. Targeted offers without lifetime language are semi-frequent, and data points also suggest that “lifetime” is more likely 7 years. Because of this “lifetime” language, holding out for high welcome offers is recommended.

My Actual Experience

Well, it appears we may need to update the guide a bit because my recent experience was quite a bit different. If you read my recent post titled, I Just Can’t Stop: Another Mini Application Spree That Produced Juicy Results, then you know where I am going with this.

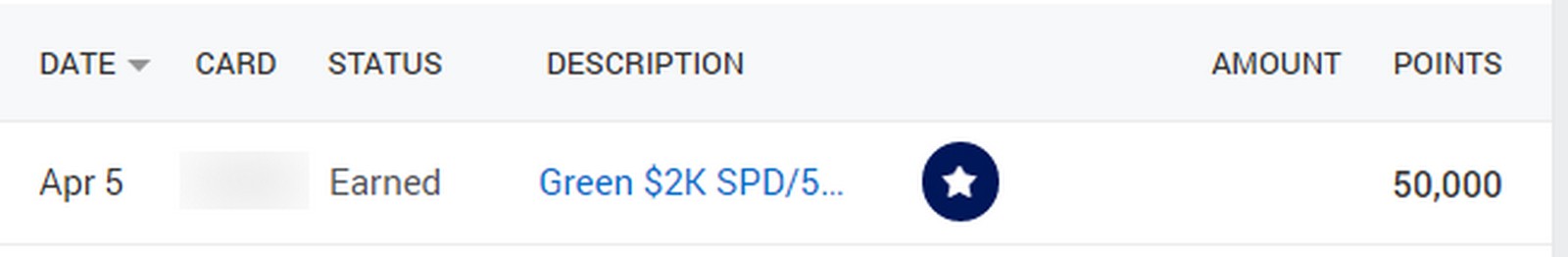

I decided to sign up for the Amex Green card with the current offer available via referral. By signing up I received a $200 statement credit at home improvement stores and my wife received a 25,000 Membership Rewards referral bonus. There was also a 50,000 Membership Rewards welcome offer attached that I could earn after spending $2,000 within 3 months.

The catch was that I had already had the old version of the Green Amex card which would exclude me from getting this offer. It hadn’t been 7 years since I carried it yet. It hadn’t even been 6 years or 5 and a half or even 5 years since I had the card. I had closed my Green card in September of 2016. That was only a short 4 and a half years ago, I surely wouldn’t get the welcome offer.

I explained in my previous post that I was okay with not getting the offer because of the 25K referral bonus and the $200 statement credit. That alone covered the $149 annual fee and gave me a bonus equal to what I got for the card 4 1/2 years ago.

So I went ahead an applied, fully expecting the Amex Pop-Up warning me I was not eligible for the offer. But, the pop-up never came. I figured this gave me a good chance of getting the offer. And lo and behold this is what showed up in my account yesterday, before the final charge even settled of course.

Final Thoughts

So what is the American Express once per lifetime rule? I really have no idea anymore. Is it now 4 years? Is it simply the fact that your mileage may vary based on the card and the account? Maybe. Is the Green card somewhat exempt because they massively changed the set up of it? Possibly, but that didn’t change anything when they did the same thing with the Amex Gold card a few years back.

If you have any similar data points share them in the comments below. I am guessing the 7 years limit is somewhat a thing of the past. Maybe it is now 4 years? Only data points will give us a clearer picture though.

You can always ask Amex on a Live Chat to tell you what cards you’ve had, and they’ll promptly list out every card that shows in their system. I’ve been tracking my cards since I started the miles game in 2013 and a November 2014 Delta Gold personal card has dropped out of Amex’s list of cards I’ve had, per Amex in chat. October 2020 was when I asked them for a list of cards in my history and it no longer appeared. August 2018 had been the previous time I’d asked Amex for a list of cards in my history and it did still show at that point. Don’t know the exact time that card dropped off but it was technically less than 7 years, but more than 4.

What about Amex business cards… subject to one in a litfetime?

Hello, back in 2016 I opened up the hilton, after a year I received a upgrade offer to surpass with 100k bonus but never knew much about credit cards during the time and I had an offer to upgrade for 2 years but overlooked it. Now, I haven’t had an upgrade with bonus in years after 2018… I never closed the hilton card cause I had no reason to, it’s a no AF. It’s been 6 years now, what should I do? Thanks.

You can always just apply for the Surpass card since it is considered a different product (assuming you have never had it). There is also an article coming out later today about the no fee card you may find interesting 🙂

I did the upgrade to surpass then downgraded again and after 5 years was told on the phone no bonus when I tried to reapply. So it’s still there for now, maybe I’ll try again

Mark, My DP just came in. I applied for Amex Green for the same reasons on 3/30/2021 and my bonus posted 4/12/2021. My original Green dates are further out than yours. Approved 10/2015, Bonus 11/2015, Closed 10/2016.

Awesome – thanks Jason!

So the PRG and current Gold are different products, why not old Green and new Green?

(I have experience; had PRG and Platinum, got SUB for new Gold, pop up for Platinum.)

The terms on the offer page do specify if you have had this card or any version of the Green card so I don’t think that is it. Tried same thing for my wife (had old Green card) and she got the pop up which she wouldn’t have if they thought of them as different products.

One word: clawback.

Doubtful, but we shall see.

It could also be how long the IRS requires banks to hold onto data. Data storage is pricey.

What do you mean, “Upgrades and downgrades will count against you” ??

Somewhere there is probably a beady eyed greedy little AMEX rat scheming to claw back your sign on bonus offer.

Upgrades and downgrades restart the “lifetime” clock since it is based on when you last held the card, not when you last got the bonus.

I have also had the Amex Bus. Plat. within 3-4 years. Got nice bonus both times.

Excellent – thanks for sharing John.

I also got the upgrade offer credited even though the upgrade offer I got from green to gold included the life time language. It was weird having the language on an upgrade offer. Hopefully Amex is not making “mistakes” with these things right now and then a year or two later they’re clawing them back.

Yeah I have never seen that on an upgrade offer. I hope that doesn’t become a thing 🙂

I really think it might be as simple as amex changing their IT systems within the last few years. It’s probably not worth their while to transfer all available data from the beginning of time so they probably just pick data from the last few years and move it over. Essentially it’s once per lifetime or until amex changes their IT system.

Could be something to do with their data for sure

I got the Amex Platinum in 2016 when they had that short window of 100k points. Closed it in 2018. Applied for it again last November and got the 75k bonus after hitting the minimum spend. So 4 years.

Awesome – thanks Steve

Got that same offer and closed in 2017, but just tried the other day for the new 100k offer and got the pop up saying I had the card before.

That’s 2 years from date of close and according to what’s written in the article, that’s what matters. That would be great news!

One concern would always be that Amex might put the Rewards Abuse Team on this and claw back the sign up bonus at some point in the future. But you would probably have a pretty strong case as to why you should be able to keep it.

Nice! Getting close to Chase’s 48 month rule, even thought it’s once per “lifetime!”