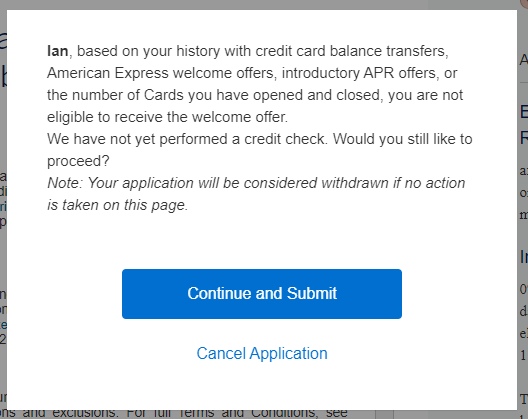

Amex Pop Up

I love Amex. Some readers are probably tired of me saying that, but they reward us in so many ways, new and familiar. The biggest challenge that many have is the dreaded Amex pop up box, though. The Amex pop up boxes prevent individuals from obtaining new card welcome offers. One version of the pop up box is based on an individual holding a card previously or currently. Often, many can obtain an Amex welcome offer on such a card by applying later or obtaining an offer without lifetime language. A more sinister pop up box version exists, though. This Amex pop up prevents an individual from obtaining a welcome offer based on his or her broad “history” with Amex. We’re focusing on this one today. My wife and I have avoided this Amex pop up for several years. Here’s our strategy for doing so.

Note: This Amex pop up box is mysterious. We don’t actually know what behavior absolutely causes one to enter or escape from it. Today, I’m sharing highlights of our Amex behavior while we’ve stayed out of the box.

Apply Before Closing

Some suspect closing a bunch of Amex cards can lead to receiving the dreaded pop up. It’s a reasonable assumption, in my view. But as active hobbyists, we simply can’t follow a “don’t close cards” strategy. In general, Amex allows an individual to hold up to five credit cards and ten pay over time cards. That may seem like a lot, but many get there fairly quickly – especially if they don’t close cards.

Is there a best way to close a card? For what it’s worth, if my wife and I need to close an Amex card, we look to apply for a new one before closing. If the closure contributes to a future pop up, at least we receive another welcome offer before the closure “dings” me or my wife with Amex. Also, by opening a new card, I’m displaying to Amex that I’m continuing my relationship with them beyond the subsequent closure.

Downgrade, Don’t Close

Often, we’re in situations where we’d get more value out of downgrading a card rather than closing it. For instance, a Platinum cardholder may benefit from downgrading to a Gold rather than closing. Similarly, a Hilton Aspire cardholder may enjoy a Surpass or no-fee Hilton card rather than not having a Hilton-earning option. Perhaps Amex positively views users who downgrade rather than close cards.

I have two caveats here. Obviously, the card one is downgrading to must be useful and beneficial to the cardholder. If not, it’s needlessly taking up a card slot. Next, don’t downgrade to a card for which you haven’t yet received a welcome offer. Doing so may preclude you from receiving a future welcome offer on the card.

Stagger Applications and Closures

Hobbyists who incorporate a player two (spouse or domestic partner) have more flexibility in general. In our situation, my wife and I alternate our Amex card applications and closures as much as possible. We try to avoid situations where one of us alone is consecutively applying or closing multiple cards. Instead, I apply for one card, then my wife applies for the next card. I close a card, then my wife closes a card. By doing so, my wife and I are each putting more time between our individual card applications and closures. Of course, this may not matter in Amex’s eyes. But by doing so, our overall aggressive Amex behavior as a team is dampened when our individual Amex relationships with Amex are viewed.

Inevitably, my wife and I make exceptions to the above when an unexpected application opportunity or elevated welcome offer comes along. But in general, we alternate.

Spend, Spend, Spend

A common belief among some Amex enthusiasts is that one can escape (or maybe avoid) the Amex pop up penalty box by increasing spend on Amex cards. If anything, this is the most consistent method I’ve seen for escaping Amex pop up jail. I’ve heard from many individuals over the years that they got out of the pop up box after substantially spending on Amex cards over several months.

If you’re in the Amex pop up box, focus spending in the bonus categories for a given card, when possible. Of course, depending on which card(s) you hold, you may be in the unattractive position of earning 1x or other base rates on spending. Regardless, I’ve seen many escape the pop up with patience and attentive Amex spending in the meantime.

Always Be Applying

When you see an Amex welcome offer that rewards you enough in your situation, seize the day. Don’t avoid ramping up your Amex relationship due to pop up fear. Besides, Amex may look positively at those who pursue elevated relationships with the company. If you end up getting the pop up, at least you know and can make alternative moves. You can’t earn lucrative rewards on the cards you don’t apply for. Put another way, you can’t win if you don’t play.

Pay Annual Fees

It’s possible that Amex looks positively on customers who pay annual fees on an ongoing basis. Based on your situation, identify Amex cards you can benefit from long term. The best cards for any individual to hold indefinitely will vary. Some may not be able to identify an annual fee card worth holding. But for my wife and I, we plan to hold the following cards indefinitely:

- American Express Platinum Card for Schwab (x2)

- American Express Gold Card (multiple)

- Hilton (No-Fee currently, but some version long term)

As usual, we’ll try for retention offers on our Amex cards, but the absence of those won’t prevent us from keeping the ones above. The rewards and benefits from the Schwab Platinum and Gold cards vastly outweigh their annual fees in our situation. While the Hilton card is a no-fee card currently, it’s easily upgradable to versions with substantial annual fees, including the Surpass and Aspire. As a longtime Hilton fan, I plan to upgrade this year to take advantage of their benefits.

Conclusion

These are highlights of our Amex behavior which may have helped my wife and I avoid the Amex pop up box up until now. This could all change tomorrow. Regardless, in the meantime, we’ll aggressively obtain rewards and benefits from Amex where available. Therefore, if or when we ever get the pop up box, we’ll assess that it was worth the effort. And being in Amex pop up jail isn’t the end of the world. You can still benefit from Amex in other ways, and all the other card issuers are at your disposal, as well. How do you think you have avoided or escaped the Amex pop up box?

Hi Benjy,

Any chance you can write an update to this article? Would be interesting to hear if you and your stay out of pop up jail and if strategy changed.

Thanks!

Thanks for the feedback, Daniel! I’ll work on an update which I hope you’ll find useful.

I’ve never been in popup jail despite ~2 Amex cards / year, but then again I put a lot of spend on Amex, especially with the gold being my go-to grocery and dining card, and spending toward the free night cert on the Surpass.

Nathan,

Thanks for sharing your DP!

[…] This was published by Miles to Memories, to read the complete post please visit https://milestomemories.com/amex-pop-up/. […]

I’ve had the type of pop-up you described. Maybe, I’m not sure, for applying for Amex cards I’ve had “too ” recently. In particular for the Amex gold, just received that pop up a few months ago. But knew I didn’t want to pay another $450 for the Hilton aspire, and to my surprise, was approved for the surpass, which I’ve definitely had previously.

Kate,

I’m glad you were pleasantly surprised by your Surpass application. “Why not apply?” probably fits Amex better than any other card issuer.

Some good ideas – I have had the pop up for about a year and no matter what I do I can’t get out. I have renewed cards with decent annual fees and put more spend on all cards. Fortunately my wife does not so she has taken advantage of some of the good offers over the last year. We did do a referral but that was recent and did not cause the original pop up status. That gave her an extra 4x. Ironically I got a huge upgrade offer on my business platinum, which I put very little spend on but I guess overall I have not applied for many cards for the business, but just keep upgrading and downgrading. It seems like the business would be more appropriate to have the pop up than the personal!

JL100,

Stay positive and persistent, and I’m confident you’ll get out of the pop up box eventually. Thanks for reading.