All information about American Express cards in this post has been collected independently by Miles to Memories.

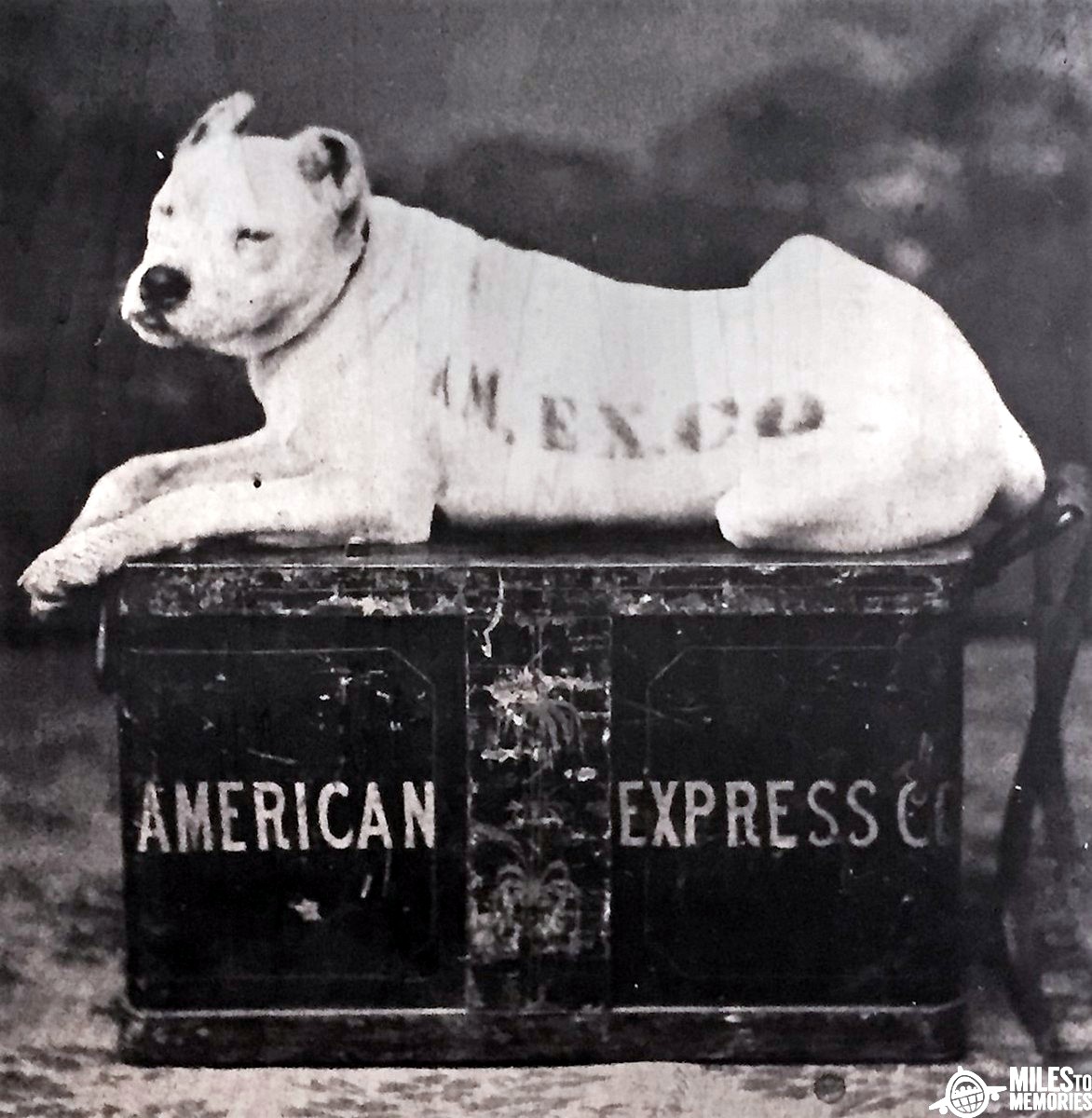

American Express: Entertaining, Unpredictable, and Never Boring

When American Express implemented their once per lifetime welcome bonus rule to personal cards in 2014 and then to business cards in 2016, it was, in my opinion, the most draconian of all application rules. In believe Chase’s 5/24 rule, while stringent, was painless compared to American Express’s rule. I continued my American Express relationship then, primarily by adding new card accounts when the right welcome offers came along. But I did not put much effort into American Express beyond that. However, as the years passed, American Express slowly but surely became more intriguing to me. Now, I consider American Express to be the most entertaining, unpredictable card issuer today. Here’s why!

RELATED: Credit Card Application Rules By Bank – Complete Guide

Dynamic Welcome Offers

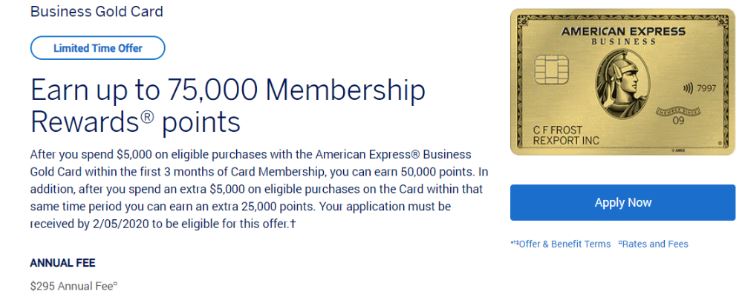

While the once per lifetime rule still applies, I await outsized welcome bonuses offers applying for Amex cards. Fortunately, Amex routinely offers elevated welcome offers. For instance, their Delta cards have higher offers due to the recent card refresh they received. In January, I applied for the Amex Business Gold card when I received an increased welcome offer. Hilton cards also periodically have higher welcome offers, as well. Given how often these offers change, keep up with what offers are available in your online account at any given time. Also, you may receive an elevated welcome offer when you are referred by someone else to a particular card. And speaking of referrals….

Generous Referral Bonuses

Amex referral offers are widely available across their cards. When you refer someone (spouse, extended family, another points enthusiast, for instance) to an Amex card and they are approved for any Amex card, you get a referral bonus. These bonuses vary and can be quite lucrative. For instance, fresh off of my Amex Business Gold approval, I referred my wife for a 25,000 Membership Rewards referral bonus.

Amex has improved the flexibility of referrals recently. The individual you are referring the card to does not have to apply for the same card you are referring from in order for you to get the bonus. Using the above example, I referred my wife to the Amex Business Gold, and she applied for the Amex Blue Cash Preferred. I still received the Amex Business Gold 25,000 Membership Rewards referral bonus. While each card has annual referral bonus limit (Amex Business Gold is 55,000 Membership Rewards), you can build up referral capacity by opening and referring from additional Amex credit card accounts.

Finally, these referral bonuses fluctuate often, even by the day. Consequently, make logging into your Amex account a routine activity to see what good stuff is available! Also remember that these referrals can trigger a pop up when the person goes to apply, so be aware of that.

Upgrade Offers Abound

Speaking of routinely logging into your Amex account, another benefit of doing so is finding card upgrade offers. For instance, I have upgraded my Hilton Amex to the Hilton Amex Surpass and received a bonus similar in value to a new card welcome offer. And you can receive these upgrade offers on card products you have already held! For instance, I received an upgrade offer from the regular Hilton Honors card to the Surpass even though I previously had the Hilton Amex Surpass. If you haven’t previously held the card, I recommend applying for a new card welcome offer first rather than an upgrade offer. Once you hold an American Express card you are then ineligible for the the welcome offer.

Taking Amex upgrade offers into account, Amex’s once per lifetime welcome offer rule isn’t a huge concern for me (other than ensuring I apply for an elevated welcome offer). Why isn’t the rule a big concern? Because I can repetitively receive offers from the same product, albeit welcome offers then upgrade offers.

As a reminder, you can call in to request an Amex upgrade offer in addition to viewing options in your online account. This is how I recently received an upgrade offer for the Amex Everyday Preferred.

Authorized User Bonuses

I admit I have been slow to take advantage of authorized user bonuses. When I previously opened Amex accounts, I added my wife as an authorized user to assist in meeting minimum spend for welcome offers. Now, I no longer do so and meet minimum spend just with my card. Why the change? Because Amex periodically sends out authorized user bonus offers. For instance, I recently received and accepted a 5,000 Membership Rewards bonus for adding my wife as an authorized user to my Amex Gold card account after she spent $500 on the card. That’s a pretty easy 5,000 Membership Rewards! Other Amex card flavors, such as the Hilton and cash back cards, offer authorized user bonuses, as well.

Pay Over Time Bonus

By enrolling in Amex’s Pay Over Time program, you can easily obtain 10,000 Membership Rewards. While any cardholder can sign up for this program, Amex must target you in order to receive the bonus. Mark has written a great summary of this program here.

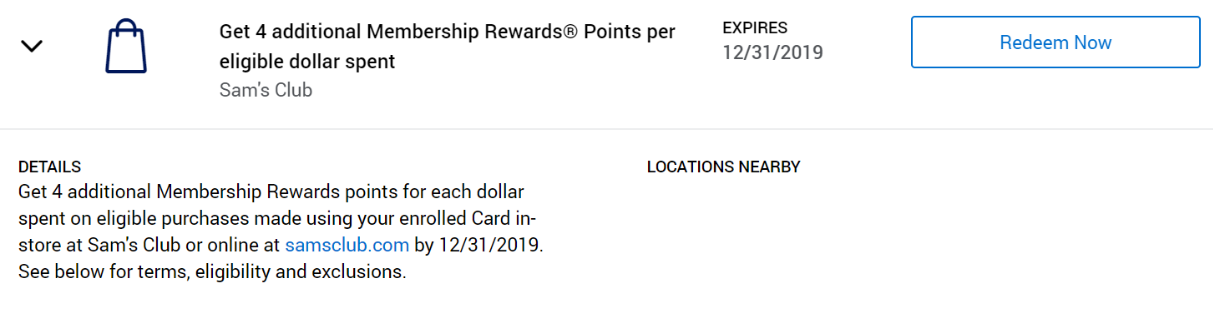

Amex Offers

Last, but certainly not least, I want to mention the ongoing, practical utility of Amex Offers. They’ve been around for years, but while they are now more limited in some aspects, they continue to offer solid value. For instance, Amex targeted my wife for the 10% off insurance (up to $60 back) offer. This is free money, considering we are going to pay our auto insurance, anyway. After logging in, ensure to click all of your card accounts and check offers, as they can differ.

Evolving Fine Print

Along with these great offers come changing Amex terms. For instance, the Amex Bonvoy Brilliant now includes the following anti-gaming terms:

Statement credit(s) may be reversed if the eligible purchase is returned/cancelled or if we, in our sole discretion, determine that you have engaged in abuse or misuse in connection with the benefit or that you intend to do so (for example, if you do not maintain an eligible Card Account for the duration of the reward year). Card Members remain responsible for timely payment of all charges

When I recently upgraded to the Amex Everyday Preferred card over the phone, I was told the following:

Membership Rewards could be removed from my account or my Amex accounts could be closed if I downgrade or cancel the card within 12 months.

In my view, staying updated on Amex’s changing terms and behaving accordingly is an acceptable step. Especially considering the outsized value we can achieve from all of their card products.

Final Thoughts

These are just a few reasons I consider American Express to be the most entertaining, unpredictable credit card issuer today. I actually enjoy logging into my Amex account and seeing what random, unexpected offers of all sorts are available. I bet I’m not the only one! What has made Amex fun for you?

All information about American Express cards in this post has been collected independently by Miles to Memories.