Amex Schwab Platinum

I recently wrote about how my wife had decided the time had come to finally cancel her Amex Schwab Platinum account. Years – or even months – ago, we would have never considered this course of action. But given the current state of things, the decision was surprisingly easy. Over the weekend, though, it was time to do the deed via Amex chat. While we were confident in the outcome, we were curious to see how the conversation would go. Before I get into the highlights, I’d like to set the stage with our more recent chat experiences.

Closing Time

My wife’s Amex Schwab Platinum was the last of four Pay Over Time cards we cancelled over the weekend. The others closed were one of my Business Platinums and two other “vanilla” personal Platinums. We were able to take care of all of those very efficiently, as we had no interest in retention offers, anyway. We requested in the initial chat messages to close those without being transferred to other reps. (I’ve also found it much easier to close Amex business cards over the weekends for another reason.) But as longtime Amex Schwab Platinum cardholders, my wife and I were each intrigued and budgeted a bit more time for this conversation.

The Chat Conversation

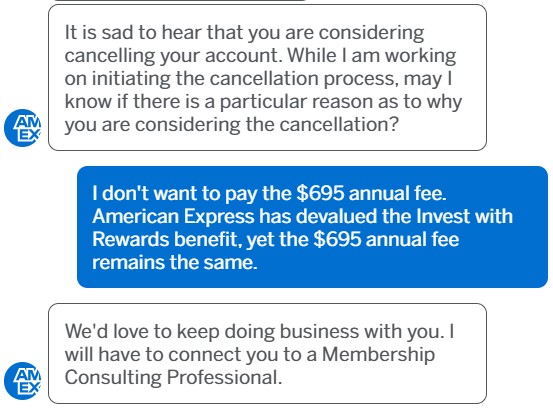

The Sunday evening chat started how most others do. After some pleasantries and a rep query, my wife matter-of-factly mentioned why she decided to cancel her Amex Schwab Platinum account:

Unsurprisingly, the rep then transferred my wife to a retention agent to discuss her situation further. We mentioned the same reasoning to this second rep. The conversation continued.

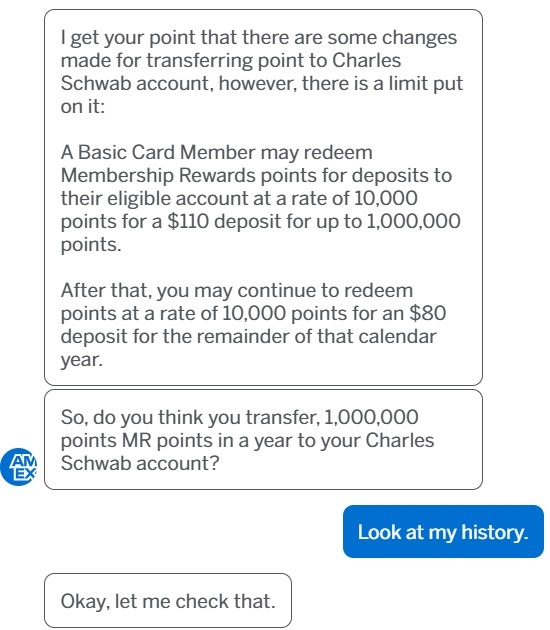

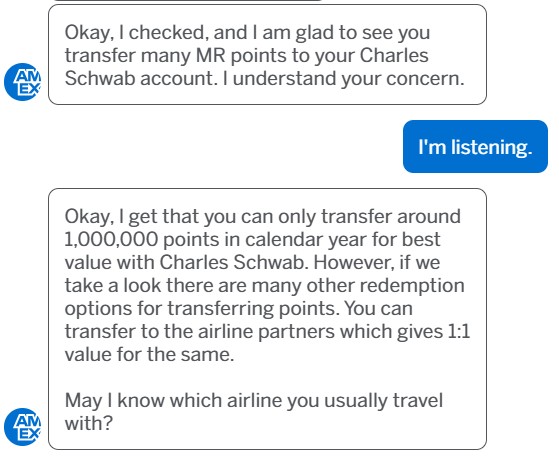

While our response above may seem terse, we wanted to encourage the rep to better understand the situation. After a few minutes or so, the rep responded again.

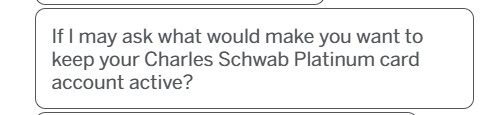

Many avid Amex cardholders have been here. The rep attempts to change the conversation into one dealing with alternative redemptions, ones which are consistently less attractive in our situation. My wife reiterated that based on our previous redemption history, she didn’t find points transfers to travel partners interesting. Based on the conversation up to this point, we were not sure why the rep asked the next question, but hey, she asked it:

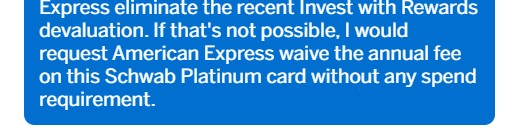

My wife responded with a truthful, unrealistic answer:

We know that first request was indeed comical, but it was the most genuine answer to the rep’s question. She would keep her account if Amex hadn’t instituted the annual 1.1 cents per point redemption cap for Invest with Rewards. My wife knew the retention offer she asked for wasn’t likely, either, but it’s the only other way she’d agree to keeping her card open.

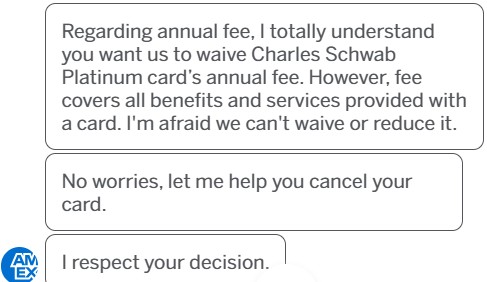

Shocker, the rep didn’t have the capability to eliminate the Amex Schwab Platinum’s Invest with Rewards devaluation. And we weren’t surprised in her answer on our annual fee request, either. Once she got to the last line below, we knew the conversation was wrapping up.

Amex Schwab Platinum – Conclusion

As we predicted, the conversation was entertaining on the way to the expected outcome. I’m confident many Amex Schwab Platinum cardholders are in the same position as us. We have zero interest in paying the same annual fee for an inferior product year-over-year. I encourage all Amex cardholders to clearly convey their specific reasons for card closure. I’m sure many of you already are, but please focus more on being heard. Perhaps with numbers, Amex will get the message. But I’m not naive – I don’t expect Amex to revert back to previous benefits based on any collective outcries. Bigger picture, remember that you’re in control of the cards you open and close, and how they relate to annual fees.

It would be interesting to see if anyone is calling them regarding Mr. Schwab’s appearance in the Oval Office last week at just the right time to see the market take off after Trump postponed the tariffs and market shot up and Trump says “Charles Schwab just made 2.5 billion dollars.” And then we find out Schwab has engaged the Trump Organization in a major deal. https://riabiz.com/a/2025/1/31/charles-schwab-corp-ties-brand-to-trump-after-becoming-custodian-consultant-and-investment-advisor-to-trump-media-discount-brokerage-startup

That’s more than enough to cut ties for me.

This makes zero sense. One should always determine if there is a retention offer and then determine if the value exceeds the AF.

I can understand not wanting to play the coupon book game and thus valuing those perks at $0 (though the $200 airline fee credit is relatively easy to complete). I can understand cancelling a Plat card if you have others that are a different flavor.

But again, this makes zero sense the way it is written up with zero context

Boraxo,

Here’s some context, and then more. Enjoy!

I have been an Amex member since 1994. In January I decided not to renew my Gold card. I called and spoke to an agent. She responded without even asking me if there was anyway I would change my mind. I even asked her, after 30 years you don’t want to keep me as a member? Her response was, well you called to cancel!

Calvin,

Sad, but true, I guess. You were perfectly correct in your moves, but I’m not surprised at Amex’s shrug. Hang in there!

This is very interesting. I’ve been considering closing my AMEX Business Platinum because the benefits aren’t what they used to be. And, I could save $695. I’m not sure if any card is worth it at this point.

You’re not alone, Susan!

Great article.

A lot of us are going to be in the same boat once we hit the 1M redemption annual cap.

It’s unfortunate since we’ve had this card for almost a decade and it had been a no brainer to keep the card.

Surely, Amex knew this would happen, right? Or maybe another refresh will keep everyone in the fold. 😉

I’m surprised the rep admitted that they couldn’t waive the AF because that’s how Amex pays for the services and benefits they offer. So you are paying $695.00 that they’re charging you to use those benefits. If you don’t use them you lose them. If you don’t use them, AMEX doesn’t have to pay out.

Schwab was the only Platinum card I never had. Because of the Annual Fee and a few decreases in card benefits, is a card I will probably never acquire.

Hopefully, Amex will give you a reason to pick up the Schwab Platinum eventually, Bill. But I won’t hold my breath!