All information about the American Express Schwab Platinum card has been collected independently by Miles to Memories.

Amex Schwab Platinum Cashout

Amex recently announced significant limitations to the Schwab Platinum’s Invest with Rewards benefit, essentially a devaluation for anyone who cashes out over 1 million Membership Rewards points annually. Perhaps you’ve heard. DDG shared the news here, and I’m analyzing the development in another article. But in the days since, we’ve received a new and improved Amex Schwab Platinum cashout experience. Today, I’m covering changes to the interface and why it’s good news for cashout fans.

Amex Schwab Platinum Cashout Process

Whoa, Nice

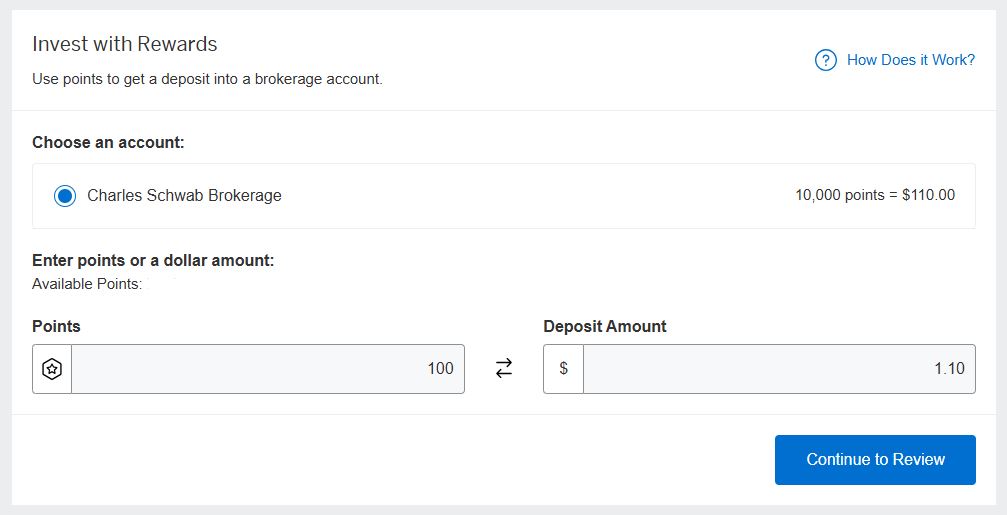

As I do most every Monday (and a few other times weekly), I logged into the Amex site to cash out Membership Rewards. I navigated to my Schwab Platinum card and clicked the Invest with Rewards link under my Membership Rewards point balance. The similarities to the previous Invest with Rewards redemption process end there, though. After clicking this time, the site immediately directed me to the following page:

Instead of entering my Schwab Platinum card details to start the process like before, the Amex site prompted me to enter the amount of Membership Rewards points to transfer to my Schwab Brokerage account (my sole-connected account was already selected). I entered 100 points, since I wanted to confirm the new process with a small test transfer (and for another reason which I’ll get into below). The deposit amount autopopulated based on my points entry. I clicked “Continue to Review.”

That’s It, I’m Done!

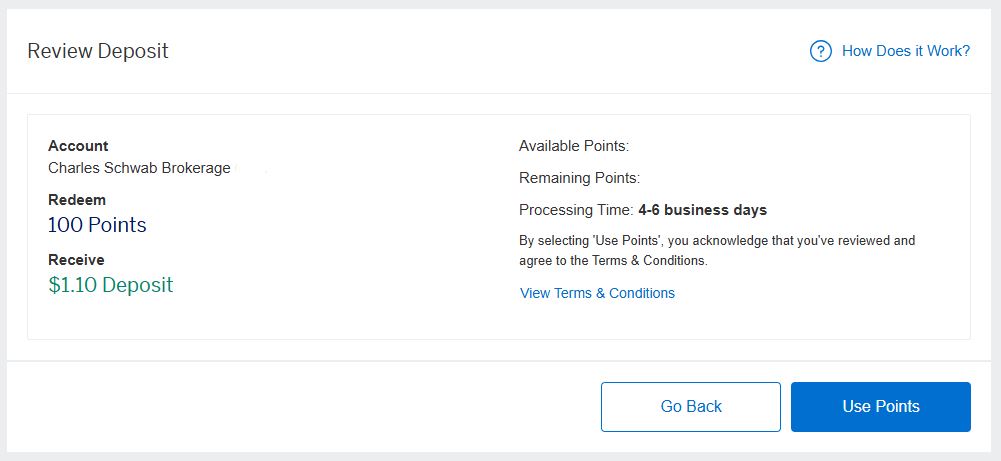

After a quick review of the deposit request, I clicked “Use Points” depicted below:

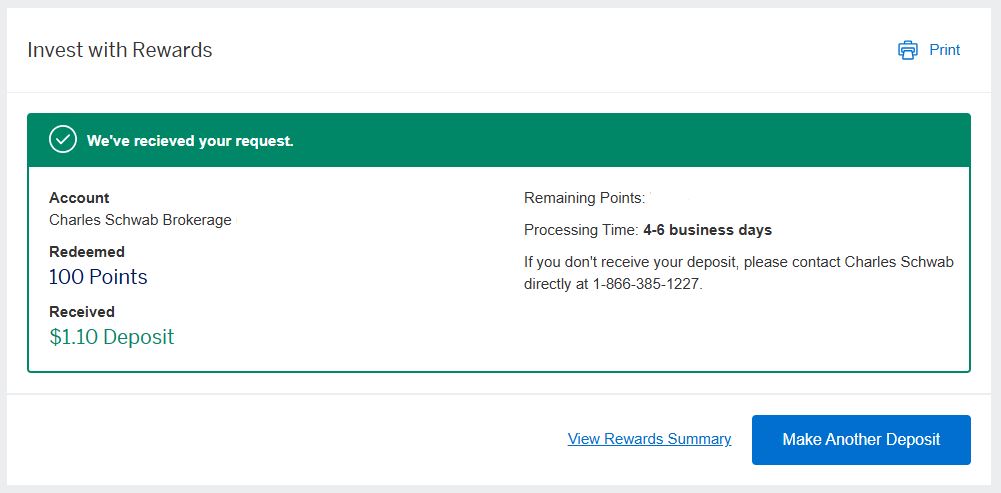

The Amex site immediately confirmed the redemption on the following page:

I found the misspelling of “received” above a bit odd but took this confimation at face value. The last two screens note a processing time of 4 to 6 business days, but I decided to check my Schwab account immediately. I wasn’t surprised to see the deposit already in my Schwab account, similar to how it’s been for most all transfers I’ve made during business hours over the years. For what it’s worth, I created this Invest with Rewards request at about 5:30 pm ET on a weekday.

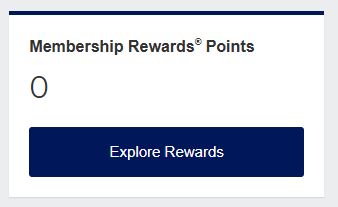

After confirming the deposit on the Schwab side, I went about my usual bulk cashout of Membership Rewards with another Invest with Rewards redemption, this time cashing out all the way to zero. It felt oddly satisfying bottoming out versus being stuck with a balance just under 500. While I’m spinning that positive, let’s get into all of them next.

Good News for Amex Schwab Cashout Fans

This Invest with Rewards redemption update is a welcome development for Amex Schwab Platinum cashout enthusiasts. First off, there’s no need to tediously enter in your full card number, CVV, and zip code anymore. It’s refreshing for the Amex site to immediately take a cardholder to the redemption platform after clicking “Invest with Rewards.”

Secondly, there’s no more drop-down selections to make. We can simply enter any customized denomination of Membership Rewards to redeem. I will no longer go cross-eyed selecting varying increments across multiple drop-down boxes.

Thirdly, and somewhat related to the previous item, Schwab cardholders can now truly cash out any amount of Membership Rewards at a given time. (Remember the 4 million weekly threshold being instituted on 1 Oct, but how many of us will hit that cashout amount that frequently?) Again, I find the ability to cash out down to zero quite fulfilling.

I’ll take these three pieces of good news as a collective small win, especially considering that the speed of deposits during the business day hasn’t slowed, either. Of course, things could change in the future (including spelling corrections), but I’m good for now.

Conclusion

Of course, this is no major improvement compared to the significant negative change we recently experienced. But I know I was able to more easily redeem today than previously. Plus, this is a redemption method I use more than any other. Kudos to Amex for (very slightly) simplifying my life and giving me a few seconds back each time. But I imagine this new interface has something to do with the pending limitations being put in effect on 1 October.

How has the Amex Schwab Platinum cashout process via Invest with Rewards been for you lately?