How to Cash Out Membership Rewards via Schwab Platinum Amex

I’ve previously described my love for the American Express Platinum Card for Schwab, particularly for the ability to cash out Membership Rewards points at a maximum value of 1.1 cents per point. Many of you have the card but may not have cashed out yet, and others may not have the card but are interested in what the process looks like. Here’s how to cash out Membership Rewards points with the Schwab Platinum Amex!

Updated 9/9/2021 since the cash out value changed recently.

Step #1

Log in to your American Express account and navigate to the home menu for your Schwab Platinum Amex. Halfway down the page on the right, you will see the following graphic noting your Membership Rewards balance. Click on “Invest With Rewards”.

Step #2

The following introductory page will appear. Click on “Get Started”.

Step #3

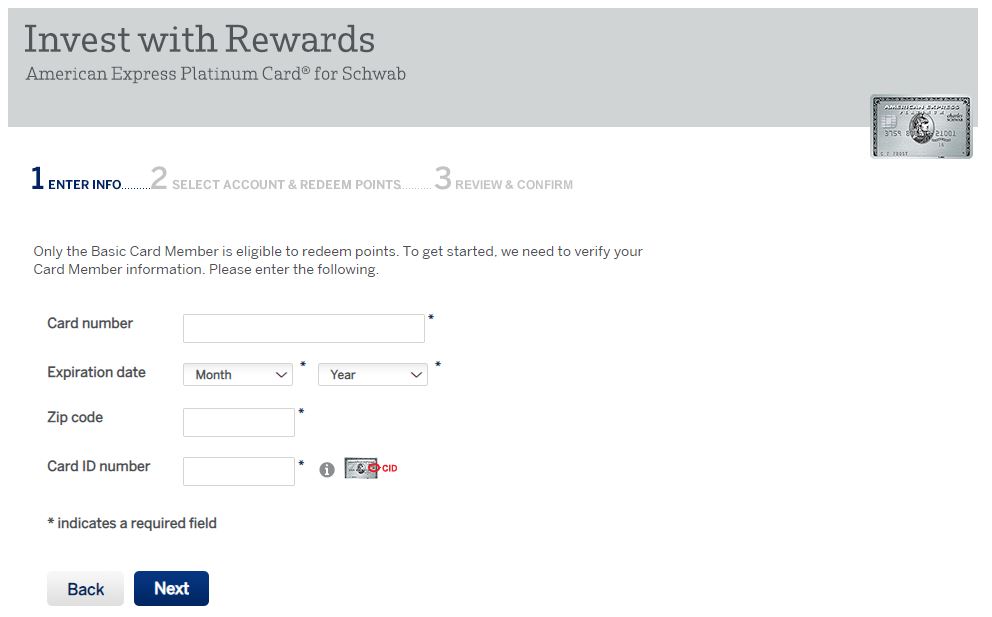

The next page requests your Schwab Platinum Amex card number, expiration date, zip code, and card ID number. Enter all of this required information and click Next. Note: This manual information entry process is required each time you cash out. There is currently no option to save this information for a quicker future process.

Step #4

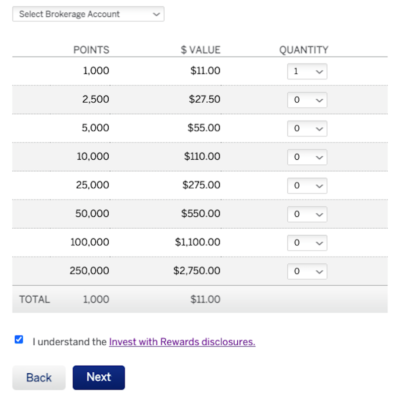

You are then allowed to pick the amount of Membership Rewards you want to transfer to your Schwab brokerage account. You can pick up to nine of each point denomination.

At the top, choose which account to deposit to in the drop-down menu.Pick your preferred quantities, check the “I understand box” at the bottom, and click Next.

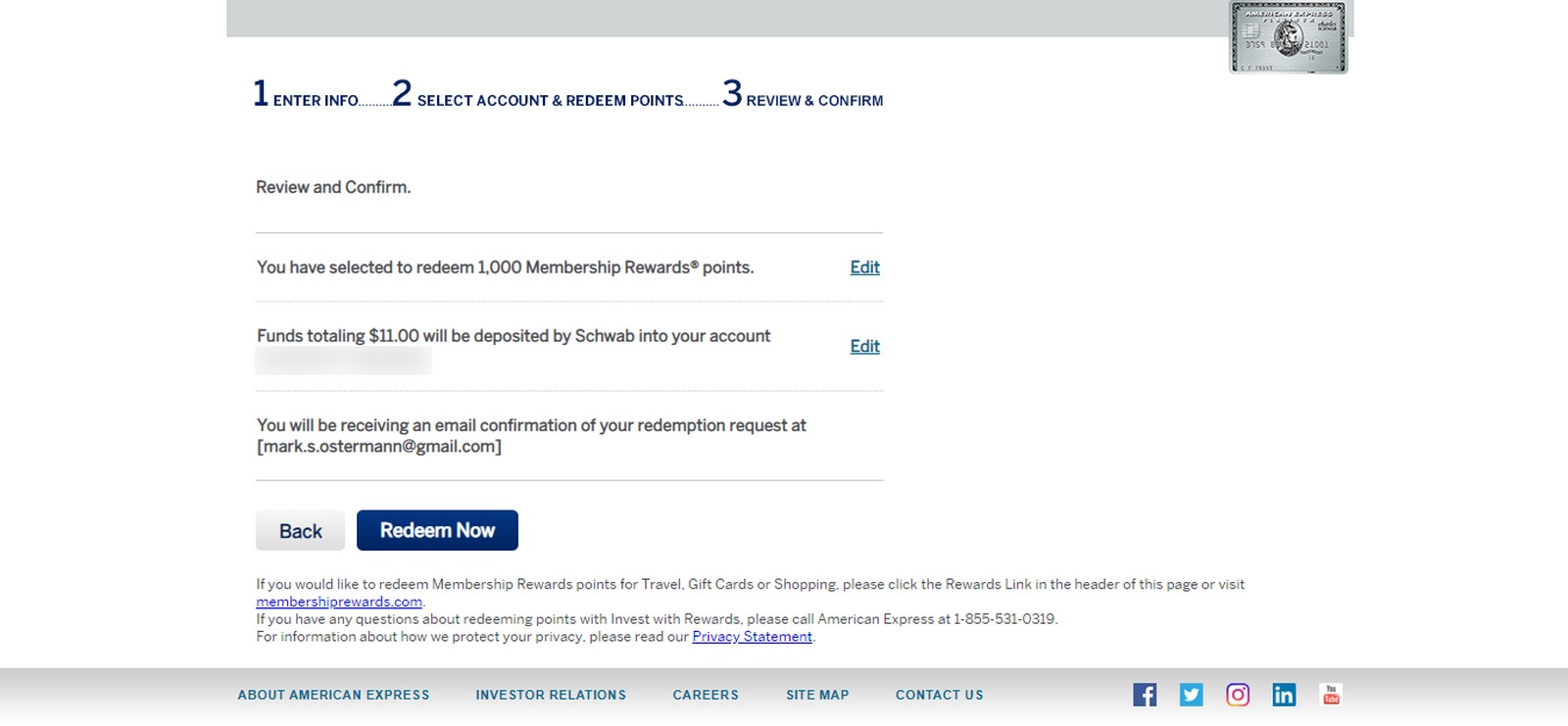

Step #5

The following review page appears. Upon review, choose Edit to make further tweaks or click Redeem Now to proceed.

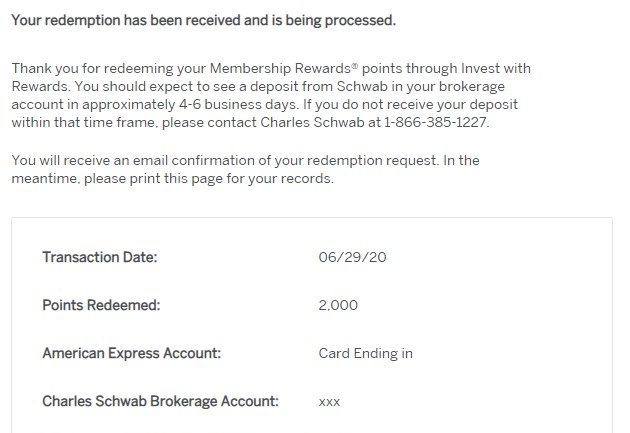

Step #6

The following confirmation page shows up. You will receive an email to the address associated with your Amex account(s) confirming the redemption. Transfers to your Schwab brokerage account are fairly quick, especially if you redeem during bank business hours. A few minutes after this redemption, I checked my Schwab brokerage account. Funds were already in my account!

Step #7

Over on the Schwab site, access your account. The redeemed points will appear as cash in your brokerage account. You can then proceed with investing or transferring to another internal or external account. I don’t leave the funds in my brokerage account once they show up.

Cash Out Membership Rewards – Conclusion

It’s that simple! FYI, once in a while, transfers have been delayed or canceled. This happens relatively infrequently, and Amex brings back the capability fairly quickly. Worst case, you may need to resubmit your redemption request. Overall, though, my experience with the Invest with Rewards redemption method has been predictably smooth. Enjoy!

is there any way to cash out points if you do NOT have the schwab amex plat, but the ‘regular’ amex plat? can you convert the ‘regular’ card to the schwab card and then cash out?

thanks!

Gene,

You can cash out Amex MR’s without the Schwab Platinum, but I don’t recommend it. I recall the rate is 0.6 cents per point. Unfortunately, you cannot product change a regular Platinum card to the Schwab Platinum. Why not earn a new welcome offer, anyway? The Schwab Platinum welcome offer has been 60k MR’s for years.

If I currently have the Amex Business Platinum and got the Amex Schwab Platinum, am I able to move my MR points from the regular one to the schwab in order to redeem at a higher cents per point? Or can I only transfer points earned on the schwab card to the schwab brokerage account?

The points will all be pooled together automatically so you can redeem them from any MR earning card at the higher rate. This includes new card welcome offers etc.

Why would anyone do this when points are worth so much more when leveraged to buy expensive hotel rooms and biz class travel?

You can’t go anywhere now but that will change eventually. 1.25 cents is mediocre when Fidelity and Citi have cards that rebate 2%

Boraxo,

Different strokes for different folks. While many in the hobby are interested in expensive hotel rooms and business class travel, many others aren’t. Also, some savvy Amex cardholders consistently earn at least 2 Membership Rewards per dollar on all of their Amex spend, which easily outweighs the undeniably solid 2% cash back rates you mentioned.