Amex Targeted Credit Card Offer LinkedIn

American Express is growing and evolving as they deal with the hardships of a struggling prepaid card division and the loss of co-brand partnerships like Costco and JetBlue. Their stock is doing so poorly that not only is it trading at near 5 year lows, it is basically trading at the same price it was in the height of the financial crisis of 2008. Not good at all.

As part of their new strategy, we have seen American Express work hard to target “ideal customers” via a number of methods. I have talked about targeted mail offers without the “once per lifetime” language, how some cards will give you higher offers in incognito mode, where to check for prequalified offers on the American Express website and even how some people are being targeted when logging into their accounts.

A Direct Message from Amex

Now, it seems that American Express is branching off into another realm completely with targeted credit card offers. The other day I logged into my LinkedIn account and found that I had a message from American Express OPEN.

When I opened the message it said:

Hello Shawn,

When you’re running a business, having options can make all the difference. The Plum Card® is built to give you options:

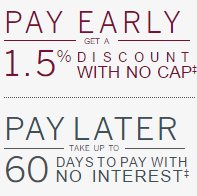

Pay early to get a 1.5% discount¹, which you can use to buy inventory, supplies, and other business necessities.

Or take up to 60 days² to pay with no interest if you need it.

You know your business best. That’s why The Plum Card® lets you decide when to pay each month.

Plus, you can take advantage of a new welcome offer:

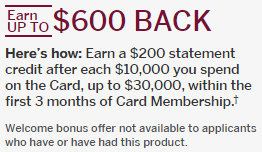

Earn up to $600 back. Here’s how: Earn a $200 statement credit after each $10,000 you spend on the Card, up to $30,000, within the first 3 months of Card Membership.3With the Plum Card, you decide what works best for you. It’s built for your business, with the power to buy big, and the power to choose your payment option.

Sincerely,

Audrey Hendley

Senior Vice President & General Manager, OPEN Product Management

The 1.5% back for paying early is the normal earn on this card, but the $200 cashback for each $10K in spend (2%) is the increased bonus. This offer has been around before, but not for awhile. The way I see it is you earn 3.5% back on the first $30K in spend if you pay your balance off. (And you should be doing that already.)

Is This Offer Worth It

The Plum card is sort of a niche product I think and is probably designed for businesses that need extra time to pay off charges in order to avoid interest. Since this offer requires so much spend and since you can get 3% back with other cards like the Discover It Miles, I don’t think this offer is great for most, but I find the way it was targeted to be interesting. Here is a direct link to the bonus offer if you want to learn more.

Let’s Get Social

My guess is this type of offer will be more frequent on social media as American Express further works to build their customer base in a way that makes sense for them. While I only received an offer on the Plum card, hopefully others will receive better offers on other products via the same means. I guess what I am saying is if you haven’t logged into LinkedIn for awhile, it couldn’t hurt to check. At least one other person has received a 75K Business Platinum offer.

Conclusion

For those interested in the Plum card this bonus equals the best offer we have seen, but the real news here is this new and interesting way of targeting potential customers. Have you been targeted by American Express for a card offer on LinkedIn or another social network? Let us know in the comments.

[…] American Express is known for sending targeted offers via the messages feature on LinedIn. Shawn from Miles to Memories has a great post on this as well. […]