ATT Access More Application Link

Over the past many months I have often spoken about how much I love the Citi AT&T Access More card. In fact, I love it so much that both my wife and I each have versions of our own. So why do I love it? Well, it earns 3X ThankYou points on almost all online purchases and even comes with a free phone as a sign-up bonus. What a great deal!

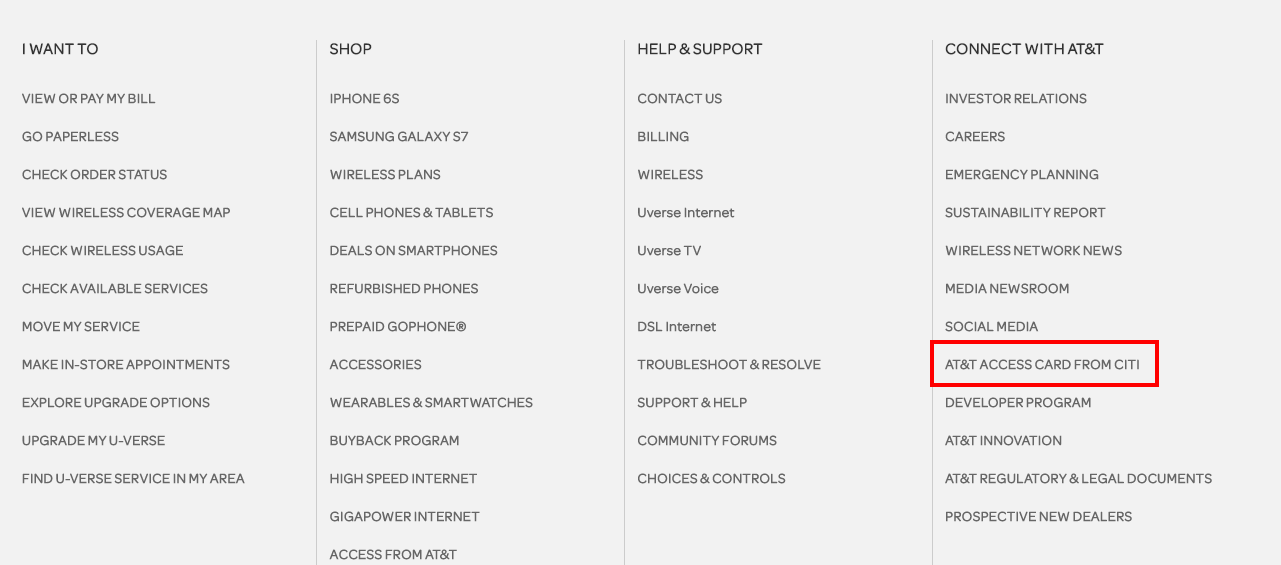

Perhaps it is actually too good of a deal. Many months ago the AT&T Access More card disappeared from Citi’s website never to return. Thankfully there was still a link available on the AT&T website. This link in the bottom menu led to a landing page for both the AT&T Access More and the lesser AT&T Access card. Unfortunately AT&T recently redesigned their site and this is what the menu looks like now.

The new menu lists only the Access card and the link goes directly to the Access card’s application instead of a landing page where you could choose which card to apply for. Additionally the URL of that landing page is now dead as is the AT&T Access More application link that was on that landing page. Thankfully there is still one known working link.

A Working Link….For Now

US Credit Card Guide has found the link and here is what they have to say about it.

I recently did a URL cracking to their application links, and found a working link! My friend gggsssyyygsy has tested the link and it indeed works, and the CSR confirmed that she can see the $650 sign-up bonus! But still, this application link is obtained by URL cracking, do it at your own risk.

So this link is definitely of the zombie variety and the application doesn’t list the bonus, but it appears to be working. I have always had success applying through similar links in the past with Citi and have always received the bonus, but of course that isn’t guaranteed.

If you are interested in applying, here is the direct application link.

Conclusion

Methinks the AT&T Access More card is about to get put down. Its 3X earning is perhaps just a little too generous. Of course, there is a chance it will return to both the Citi and AT&T websites, but I wouldn’t count on it. At least not in its current form. If you are interested in getting the card, now may be the time to apply while this link is working. Now let’s just hope they don’t devalue the card for current cardholders. That would be a sad day.

This link may be helpful as well for application to the Citi AT&T Access More card, https://www.att.com/shop/wireless/attaccesspromo.html

Where did you find the special link to use? I can’t seem to find it.

When I logged in after I hit the minimum spending the link was on the lower left.

I recently got this card. Citi certainly doesn’t make it easy for you to get refunded the $650. There’s a special link you’ll have to use to purchase the phone, which we used and didn’t register according to Citi. Then, they request you to fax (in 2016) receipt verification, which they don’t receive for another few weeks. Finally, we had to pay the $650 balance to avoid getting hit with interest and Citi advised that this would be refunded in 3-4 billing cycles. It’s certainly been a hassle.

I wonder if there is enough time to apply now and still be eligible to buy the iPhone 7 when it comes out. I’ve been eyeing this card for an iPhone upgrade but considering a new iPhone will launch soon, buying the 6s doesn’t seem very smart right now.

You do not have to purchase the phone right away so you should be able to apply now and get it when it comes out.