How to Avoid Lost Money with Financial Apps, Tools & Accounts

When it comes to phones this past year has been a bit of a roller coaster for me. After finally ditching the iPhone to return to Android with the OnePlus 6, I then moved to a Pixel 3 XL with a brief stop at Samsung along the way. I had thought I would upgrade from the Pixel 3 back to the iPhone 11 Pro, but then I swerved and settled on the Note 10+.

So why all of this phone talk? Well, today there are so many apps and other services that live on our phones it can be so easy to forget about them. How many times have you opened an account or signed up for a service because of a bonus offer or promo? If you’re like me the answer is A LOT!

So Many Portals

One realm where we can all “chase” deals is when it comes to shopping portals. To start, portals all have different rates depending on the day and/or store, so it is often beneficial to have accounts with many of them. Also, portals often offer sign-up bonuses for joining, giving us crazies another excuse to sign-up whether we need another account or not.

How to Maximize Online Cashback and Rewards Shopping Portals in 2019

Sad Samsung Story

Which brings me to my story. Last year Samsung Pay had some amazing portal promotions through their app paying up to 30% back at Walmart. As a reseller I was naturally able to take advantage of this deal, but in my moves between phones I forgot about Samsung Pay and my pending cashback.

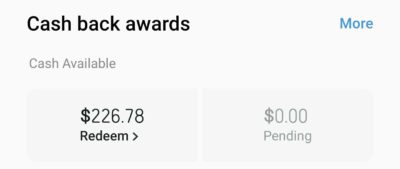

That is until yesterday. After activating my Note 10+ and playing around with it a bit I headed into Samsung Pay and discovered this little tidbit of information.

Even after seeing the cashback I had no idea what it was for, so I dug a little deeper. Eventually I found the history of the account and discovered those Walmart purchases plus a couple of virtual trips to Home Depot were the legitimate source of my cashback. What a nice surprise, but one that I would rather not have experienced.

How to Avoid Lost Money

Organization is the key in this game, so the best thing to do is to keep track of your portal purchases. I do this, however I get sloppy sometimes and I simply forgot to log these due to the fact that I was buying from a phone instead of at a computer. A lesson learned for sure, but one that is easily avoidable.

To avoid forgetting or losing out on portal cashback:

- Create a spreadsheet with every portal purchase

- Track the day and time plus the store, purchase amount, order number and expected cashback percentage and amount

- Track whether or not the purchase registers on the portal or whether you have to follow up

- Finally, track that you have received payment so you can close out that entry

If I had done any of this then I would have not forgotten about my Samsung Pay portal cashback and my wallet would have been $226.78 fatter! I could have used that money to invest or at least earned some interest on it. Thankfully I can still claim my balance, but it was just sitting there all of this time.

Tips for Organizing Money Accounts & Financial Tools

As I mentioned before, money accounts and various financial tools and programs are everywhere. From accounts we use and recommend like SoFi to free investment tools we also use like Personal Capital (both of which have sign-up bonuses), I seem to be opening a lot more of these things. Unfortunately that means I am also forgetting about some of the less compelling ones.

For this reason I suggest the following tricks to stay organized:

- Create a log of each financial product you sign up for

- Track any bonuses or offers you are supposed to receive in your log

- Close accounts actively once you are done with them and have no more interest

Not every service will be for everyone. If you try something and know that you have no use for it, then shut it down. If it is a tool then I generally will keep the account open, but if it is an account I shut it down. I also track any bonus details to ensure I have done what is required to cash out any money I have coming my way. As you can see from my story I am not perfect, but this stuff helps a lot.

Bottom Line

For me there are a couple of takeaways from this discovery. First, I need to take human error out of my tracking process even more! I also need to create a better system for tracking when I buy from my phone. Finally, I had forgotten some of the crazy rates Samsung Pay had last year and I am excited for the upcoming holiday season to see if they return. Let’s just hope I don’t forget again?

What is the most amount of money you have forgotten about somewhere? Share you story in the comments!

Good article. I almost lost money from when I used to shop through UPromise. I received a letter in the mail that my inactive account was going to be turned over to unclaimed property. I was able to complete the enclosed paperwork and have them mail me the check. It wasn’t as much as you received, but I did get a little over $100 that I had completely forgotten about.